By Avik Chattopadhyay

We finally exited a traumatic year, especially for the Indian automobile industry, on a high note. The December 2020 numbers are out with promising silver lines. Both the passenger vehicles and two-wheelers showed signs of revival, growing by 13.6% and 7.4% respectively over December 2019 as per wholesale data released by Society of Indian Automobile Manufacturers (SIAM) on January 14, 2021.

The October-December quarter, the Q3, also saw an increase of 14.4% and 13.4% in both the categories over last year. The Federation of Automobile Dealers Associations (FADA) data on registrations, released three days before SIAM, also showed an increase of 24% and 11.8%, respectively over December 2019.

However, both the press releases by SIAM and FADA tempered the data with words of measured caution. Statements made by the presidents of both the industry bodies attributed the performance to factors like unfulfilled demand of the April-June quarter, a late festive season spilling over into December and the price increase announced for January 2021.

The tone of voice was anxious as the last quarter (January-March) would be the final challenge. Would the industry ‘crack it’ just as the Indian cricket team did on the last day of the Brisbane test on January 19, 2021?

Why the anxiety? Why the deliberate caution? Is the December performance a temporary blip or a signal for the days ahead? I decided to dive into the numbers over the last 21 months to see the patterns if any. Also, I spoke with a couple of development economists for their opinion on whether the industry is over the bend finally after a gradual slump that started way back in October 2018.

So, here is my take on the current situation. The ‘revival’ is not sustainable, and the ‘green shoots’ are that of a prickly thicket and not a large tree. Am I fashionably contrarian, or do I have logic behind my assessment? I do not have the solutions to get out of where we are but certainly, have some specific observations that might help arrive at a few.

My observations are based on the way the ‘Mini car’ segment of passenger vehicles is performing through this pandemic. SIAM defines the segment as “Seats up to five, length – normally

This is the first step into the world of 4-wheeled mobility in India. This is the base. This typically carries the weight of the entire market on its shoulders. This is the beginning of a long pipeline. This is where sustainable revival gets ignited. So, let’s take a look at how this segment has performed during the pandemic vis-à-vis a few other key segments like ‘compact car’ and ‘compact UV’, (UVC as per SIAM classification).

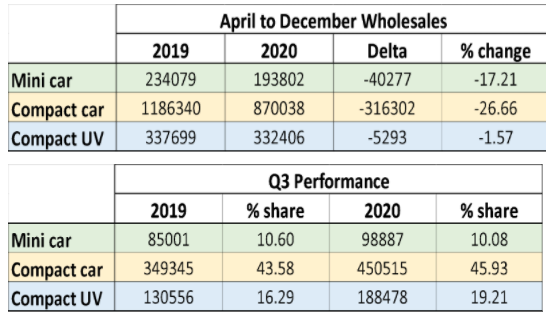

Source – SIAM

The comparison is among the top 3 PV segments. UVs have had a terrific run during this time, leading this ‘revival’, but cannibalising into compact cars and mini cars. What is worrisome is that minicars’ share in total sales has actually gone down vis-à-vis compact cars and UVs. In a critical revival such as now, one would typically expect the entry-level to lead the charge, but it has not. This has two clear implications – either the base is not growing, meaning there is actually no revival or, the base itself has shifted to a different price band, meaning the current entry-level/mini car has lost relevance in the Indian market.

So, what is happening? And why does it happen?

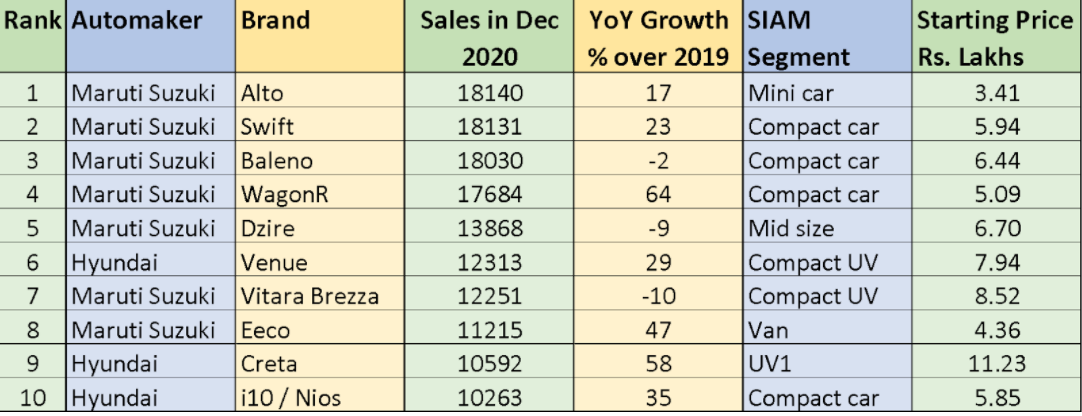

Here is a snapshot of the top 10 PVs sold in December 2020.

Source – SIAM

Simply put, the well-off have restarted buying vehicles, albeit scaled down a price band but the economic segment that makes up the bulk of mini car buyers have not overcome the shock of jobs lost or salaries slashed. One who had decided to upgrade to a Hyundai Creta in 2020 scaled-down into buying a Venue but did not cancel the purchase. One who had planned to upgrade from a 2-wheeler into the first 4-wheeler has had to postpone the purchase altogether.

Armed with this hypothesis, I share a few observations.

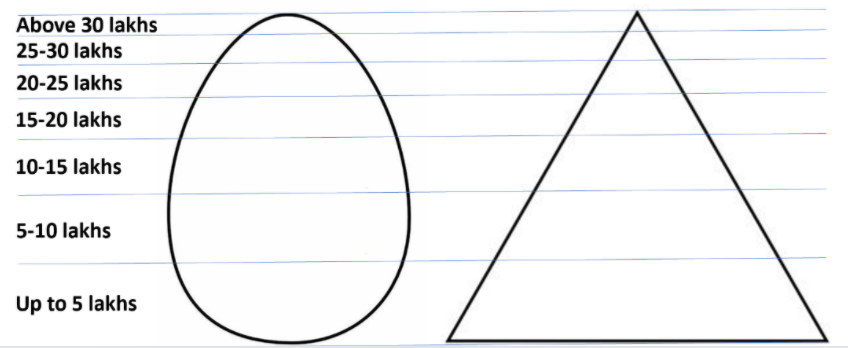

The egg versus the samosa

I present this comparison, thanks to the chats with the development economists. The way the market has developed over the last decade is not sustainable. India is not a mature market. It is a maturing one. The market is not 1.3 billion. Only around 400 million Indians can afford to buy a mode of transport starting with a bicycle. So, the base needs to be broadened to ensure a higher car penetration than the current 23 per 1,000 people. The entry-level has to be the largest to ensure a healthy pipeline.

We have been growing like an egg with the bottom segment smaller and with a smaller coverage than the segments above. For a maturing market, this cannot be sustainable. This works in a mature market with a vehicle penetration above 500 per 1,000 where entry-level vehicles are bought either as additional vehicles or by a reducing economically weaker section.

A maturing market has to grow like a ‘samosa’, with a larger base with wide coverage. There is no alternative to creating a sustainable growth model that ponders over a prolonged stagnation as the current one for over 24 months.

Too few and too ugly

How does the entry-level grow? Might seem simplistic, but the product offers need to be both numerous and aspirational. There are only five products on offer (Alto, S-presso, Kwid, E2O and RediGo) in a segment that is supposed to attract millions into owning a 4-wheeler.

Automakers like Tata Motors and Hyundai have exited the segment. With the Kwid numbers flattening and the RediGo a non-starter, Maruti Suzuki should have a home run here. If you look at the Alto and S-presso you would not think so. Why do cheap vehicles have to look ugly and act boring? To make the buyer conscious that he/she has bought a cheap vehicle and should be moving a notch higher into the realm of a WagonR or Celerio? Confounds me, as it is the entry-level that has to be most attractive to the first-time buyer!

The water pipe effect

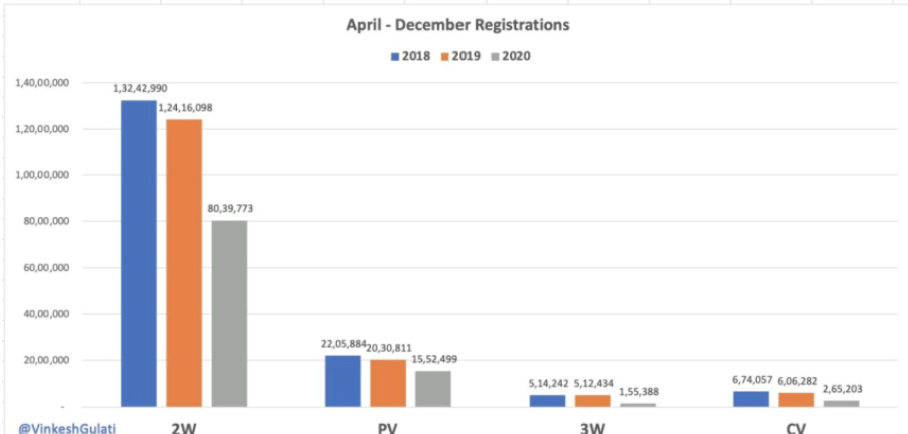

Source – FADA

Imagine a long water pipe. Open the tap and water the grass. Then close the tap and roll the pipe. Next time unroll the pipe and you find that voila, water pours out without opening the tap. It’s a long pipe and you water for some time before it all dries up. The water stored in the pipe is over. Without the tap, nothing will work.

The same principle applies to any market. To water it, the tap needs to be operational. For the PV segment, the base of 2-wheeler owners is the tap. Additional and replacement sales cannot be a sustainable model for any segment, more so an entry-level one.

The bloodbath in 2-wheeler sales and registrations is the primary cause for the mini car segment underperforming and seeming to lose relevance. The tap is half-closed, leading to a trickle through the water pipe. Only when it is fully open will the flow get healthy.

The leap of price

The cheapest mini car is Datsun RediGo at INR 3.32 lakh on-road in Delhi. The cheapest Alto is slightly higher at INR 3.41 lakh.

The average 2-wheeler from which a person aspires to own an entry-level 4-wheeler costs around INR 75,000. Even if one were to go for a 5-year loan, the leap is just too much, even when times are good.

The car makers will justify that given the rising input costs, the sticker price of an entry-level car at price parity has gone up by only 4%-5% over the last five years, much lower than the inflation rate over the same period. Accepted, but just that the price gap is still way too high.

If vehicle ownership is to increase sustainably in favour of the ‘samosa,’ then the sticker price should be 2.5-3.0 times that of the average 2-wheeler.

So, if the aspirant cannot get a new car at that price point, the used car is the best option. Scanning through a few used-car sites shows that one can choose a used mini car within that price band. Against a brand new Alto LXi, one can get a 3-year old Swift or i10 having done within 40,000 kms. This is the reason one saw a huge spurt in used car sales in the early stages of the lockdown. Once the stock was over, the sales trends are back to ‘normal’ as before the pandemic hit us.

The mini car has to be made more ‘affordable’ to the 2-wheeler aspirant if the segment is to see any long-term growth. That may be through smart financing and subscription/leasing options, bringing them closer to what the pocket allows.

For whom the budget tolls?

The anomaly of the entry-level/mini car segment needs to be addressed in the budget. The industry and its representative bodies have to build a strong case for stimulating its revival.

We must remember that a citizen pays a lower GST for a INR 70,000 smartphone than for INR 70,000 motorcycle! Just because the policy makers believe that a passenger vehicle is a luxury item and therefore needs a ‘sin tax’ on it.

I am sure the automakers and policy makers alike will have possible solutions up their sleeves. If they don’t and continue not to see eye to eye, the Indian automobile industry will continue to grow in a lopsided manner, not operating at its potential.

An egg is undoubtedly healthy and works very well for the mid-day meals. Also, it is surely tough to make an egg stand upright for long. The samosa has a wonderful base to rest on, is universal in appeal and can be consumed at any time of day or night.