From being the only player in the BaaS initially, to facing a sudden outpouring of stiff competition from new entrants and biggies like Jio BP, global leader in the business- Gogoro, and a few local startups like Battery Smart, Voltup and Bounce, Chetan is taking all this in his stride.

Chetan, the man behind India’s first electric car, Reva, and a Stanford University graduate, aims to make USD 1 billion revenue by 2026 and plans to raise a few million dollars in equity and debt. The company also looks forward to going public, though not immediately.

“We have investors lined up now and there will be a time when they need an exit and probably then we will go public. We have exhausted only a bit of money raised,” Chetan said in a recent interaction with ETAuto.

Legacy strength

Chetan was drawn to solar, and electricity-powered cars during his college days. Taking a leaf from there in 1994, he started working on Reva even before Tesla came into being. After seven years of rigorous work and trials, Reva was finally launched in 2001 by his first startup – Reva Electric Vehicle Company.

Eventually, on May 26, 2010, Mahindra & Mahindra bought 55.2% controlling stake in Reva. Subsequently, the company was renamed Mahindra Reva Electric Vehicles Private Limited. Five years later, M&M acquired 100% stake in the company.

“What makes us different is our over three decades of experience in the EV ecosystem and ability to build safe and technologically advanced battery packs,” he said.

Beyond this, the starkest difference between him and the rest of the young startups is that he is grounded and practical. Unlike the ubiquitous and pompous trait of regurgitation of numbers, Chetan has a well-weighed plan.

He says he sleeps peacefully as “no one knows the technology as deep as we do, and the increasing number of players will only help as they help expand the market”.

New beginning

Chetan formed the new company named Sun Mobility in 2016 after exiting M&M. The venture brought the Maini family, the Sun Group and a prominent conglomerate, as key investors.

Now it has close to six years of research and development in creating a fool-proof, locally developed battery management system and in-house-developed battery swapping technology.

Basing his confidence on technological knowhow, he declares a smooth journey. “We have not witnessed a single fire incident though over 8000 electric vehicles are running on our battery services,” he asserts.

While most of the industry experts raise doubts about the future of swapping in passenger vehicles, most of them agree that the technology has big opportunities in the two-wheeler and three-wheeler mass mobility segment.

According to Precedence Research, the global electric vehicle battery swapping market size is expected to hit around USD 857.6 million by 2030 and is anticipated to grow at a CAGR of 23.85% during 2022- 2030. The company has invested about USD 100 million so far.

The Asia Pacific region, which has large two-wheeler and three-wheeler markets, contributed over USD 71 million to the total battery swapping business of USD 127 million around the world in 2021.

The developed markets like Europe and the US are not yet open to the business. Gogoro, the Taiwanese electric mobility company, leads the business with 500,000 subscribers. India, which has been the world’s largest 2W market and has a formidable 3W market, offers the biggest opportunity.

To weed out any risk, Chetan is beefing up operations in mobility as a service (MaaS) and gets over 80% of revenue from this business. Under MaaS, the company is leasing three-wheeler cargo and in some cases two-wheeler cargos too.

Business model

Sun Mobility is targeting both MaaS and BaaS for its growth, while the battery swapping market from USD 125 million in 2021 is to grow to USD 857 million by 2030 globally, the latter may contribute USD 75 billion, suggests reports.

Chetan says he looks at a total combined addressable market of USD 128 billion in India. He feels electrification will be fast paced in India as 80% of oil is being imported by 30 countries which are said to be transitioning to electric by 2040. India has discovered lithium in J&K which will help in reducing the battery production cost tremendously.

“About 50% of E3Ws will be swappable and 90% of E2Ws will have a swappable option,” he said. However, the disruption in the cell and battery price trend poses a major challenge.

As of October 2022, Sun Mobility used to Swap 11,000 batteries every day and one swapping station dispensed 14 batteries and one three-wheeler has three batteries and provides an on-road range of about INR 65 km. It expects it to grow to 30,000 swaps a day by the end of the fiscal year.

“Our aim is to have one million vehicles on our platform,” Chetan told reporters at the Auto Expo.

The cost of one full swap consisting of three fully drained batteries cost about INR 150. The company aims to have 500 swapping stations in FY 2022-23 from 180 stations in 18 cities (as on October 2022).

The company claims that it uses completely localized BMS that resulted in zero fire cases so far. “We are using a pouch battery with the ability to expand in heating conditions along with a precipitator sheet,” an executive at the Sun Mobility R&D center said.

The pouch battery packs, though costlier than the cylindrical ones, are safer. According to sources the cost of a cylindrical pack comes to around INR 8000 to INR 16,000 per kwh while the pouch one costs between INR 15,000 and INR 22,000 kwh.

The industry pundits feel that the swapping business faces major hurdles on two counts. First, the disrupted and uneven power supply which may reduce the uptime and may pose challenges especially in the rural and small towns.

Second, the vehicle architectural challenges specially for the passenger segment which is being addressed with a key focus on two-wheelers and three-wheelers. The company has deep collaborations with Ashok Leyland Ltd, Piaggio Vehicles Pvt Ltd, Uber India, and others to set up battery swapping stations for them in India.

Sun Mobility counters that it is initially focusing on the big towns and cities and current uptime for most of the stations are almost 90%.

Under the mobility as a service business, the company leases three-wheelers, goods and passenger carriers, at INR 16000 per month with almost 2500 km for free which includes battery swapping.

For two-wheelers, the company has put INR 4000 as monthly subscription and both businesses put together the company has employed over 7000 people.

Key investors

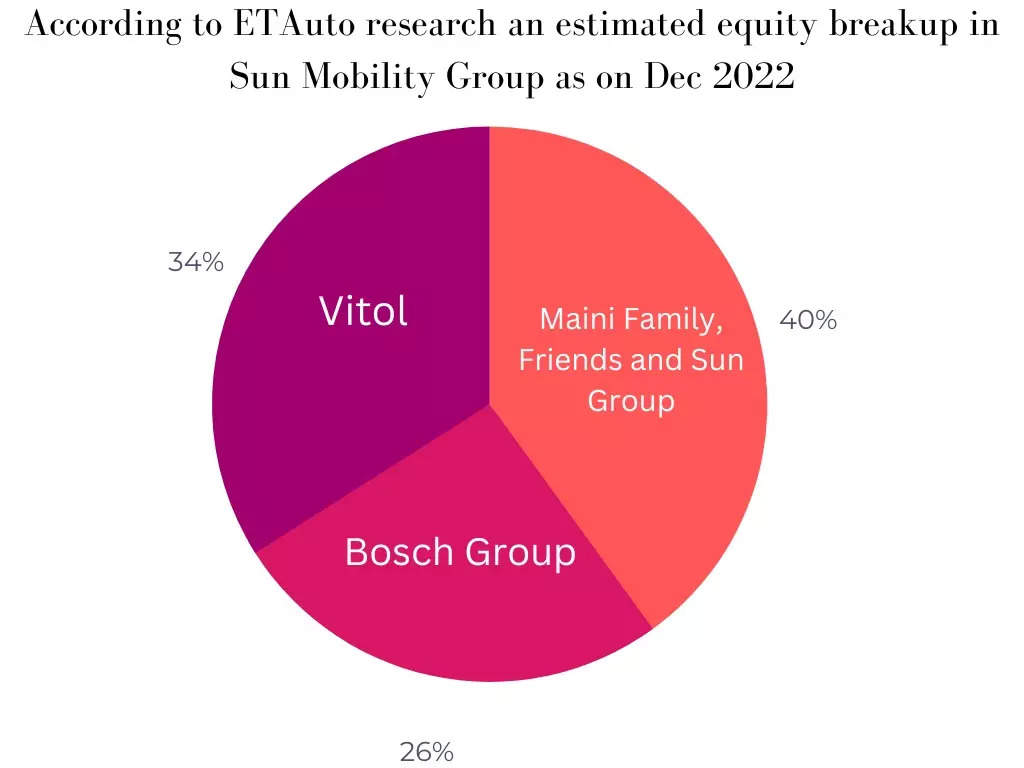

September 2020: German automotive component manufacturer Bosch picked up a 26% stake in SUN Mobility. This was mainly on technology supply. Currently Sun mobility’s charging stations are manufactured with the support of Bosch.

October 2021: Sun Mobility in October closed a USD 50 million funding round led by Vitol, a global independent energy trader and investor in zero-emission and renewable energy assets.

Also Read: