In a matter of just a few hours, it was clear Ola had bungled this first step. Faced with reportedly a surge in traffic, technical glitches on the website stymied the process. What did not help was that Ola was also trying to offer a paperless finance solution to its consumers–a tricky process even for the most experienced in the business (viz HDFC Bank’s many glitches in online banking in the last few months).

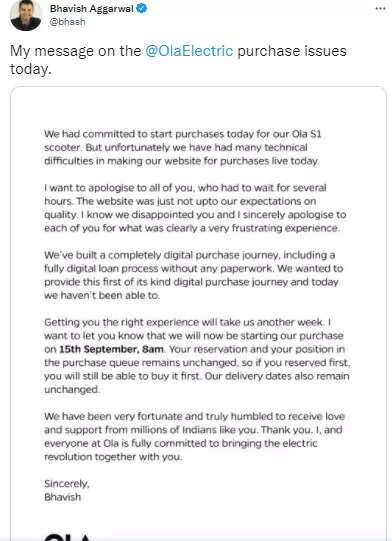

As a result, what was to be a day when the world would have come to know whether there was any substance in the hype, simply fizzled out as a startup ironically overwhelmed by the complexities of the tech world. For a company that has a successful shared mobility business wherein it claims an average 150,000 bookings everyday, its struggles on the day was even more difficult to understand. Fortunately, CEO Bhavish Aggarwal came out with an apology for the faux pas explaining what had gone wrong and setting a new date a week down the line for another attempt.

True to his promise, when the window again opened for purchase orders, it was almost glitch free. By the midnight of September 16 when the window closed, Aggarwal claimed to have sold scooters worth Rs 1100 crore though an exact number of how many units that meant was not shared. At an average cost between Rs 1.1-1.2 lakh without state subsidies (Ola S1 costs Rs 1 lakh and S1 Pro at Rs 1.3 lakh), it would mean the company has been able to notch up purchase orders for anywhere between 90,000 and 1 lakh scooters. This is a healthy number in an industry where annual volumes for electric two wheelers in 2020-21 was under 145,000 units. Round one to Bhavish.

The hype

Like most startups, the Ola electric story is accompanied with massive hype unseen in the industry since the Nano of 2008. It all started in May 2020 when it acquired Netherlands based electric scooter maker Etergo BV for an undisclosed sum. The first official confirmation of the foray was made by Aggarwal in March this year when he announced the company was setting up a massive factory of 10 million units in Tamil Nadu and would launch the first electric scooter by the middle of this year.

The scale of the factory that not only dwarfed any other electric two wheeler manufacturer in the world by some distance but even bettered the biggest conventional two wheeler factories, immediately caught everybody’s attention.

The flow of information to feed into this hype has been relentless even though the company remains reluctant to display all its cards in one go. In mid July it started taking bookings for the scooter with an amount as low as Rs 499. It claimed to have received over 1 lakh bookings in the first 24 hours alone but has not updated that figure till date.

On August 15, it displayed the scooter in flesh for the first time and also revealed the name and its pricing. At the same time, Bhavish made larger than life statements exhorting traditional automakers to reject petrol vehicles and join the EV bandwagon. The image of a disruptor is complete.

“He is the poster boy of new economy in the automobile sector in India,” says Avik Chattopadhyay, co-creator at Expereal India. “Look at the narrative they have set. Ola is a new age startup that gets into electric mobility, gets money from SoftBank, buys a dutch firm, Bhavish is the young energetic, dynamic CEO who is leading this entire thing. They hire big shot executives from all around the world to head different operations. They are building one of the largest factories in the world which will employ 10,000 women. The narrative of Bhavish as India’s Elon Musk who is out to clean the air and redeem this industry is a terrific one.”

The shift towards electric mobility especially in the two wheeler space has helped. Ola’s foray has coincided with petrol prices hitting all time highs further sweetening the cost of operations advantage that electric two wheelers already have over petrol powered scooters and mobikes. Add to that the unpreparedness of existing players in the market and the reluctance of traditional two wheeler firms to go all in, the door was left open for Ola to barge in with their big bang strategy.

“There is definitely an increased interest towards electric vehicles among the consumers at large. What Ola has done is provided a price protection against the purchase orders of Rs 20,000 so that is an obvious catch. It is a signal that prices could go up in future,” says Ravi Bhatia, president, JATO Dynamics. “The trend is towards electrification and customers want price parity that Ola is more or less and this is a low risk booking. Indian consumer is cautious and value conscious, so Ola has done well to de-risk the decision.”

Untested and Unproven

A lot of the practices that Ola Electric has introduced like the pre-bookings or purchase orders that are reminiscent of flash sales so prevalent in the smartphone sector, or the absence of dealerships as the point of sale and service, are unheard of in the traditional way the industry functions. Unlike other sectors like consumer durables where the physical touch and feel of the product isnt that critical, in automobiles it remains one of the key aspects. Till date not one person outside the company has test driven the scooters. Yet, the response that Ola seems to be getting is baffling for the puritans.

“People want to experiment and try new things. There is so much hype generally around EVs with the government talking so much about it that people want to get their hands on an EV. Ola benefitted from that,” says Puneet Gupta, director, IHS Markit. “But they will have to now deliver on their promises. There are questions that will be answered in the next few months. The basic scooter is from Europe (Etergo) and we have not seen them being tested in various parts of the country here. So we dont know how the scooters will adapt to the variety of climatic conditions that India has.”

On paper, the S1 and S1 pro surpasses the specifications of any scooter–electric or otherwise, in the country today. The one thing that will be tested the most is the range. With the S1 pro, Ola claims a range of 181 kilometers and with the S1 that is equipped with a smaller battery, it is 121 kilometers. While in real conditions, it will be less, if it is significantly low, there could be a backlash.

“That is the thing about hype. It can save you a lot of marketing dollars but it is a double edged sword. If the product doesnt deliver, it can also backfire spectacularly,” says Chattopadhyay. “The key then will be how he conducts himself. If the scooters dont perform too well, but he is honest and frank enough and that is how he approaches the whole situation then people will accept it and give him another chance. As the new face of startups it will show that not only are they young, ambitious and energetic but also truthful and willing to learn from their mistakes. If he on the other hand comes across as arrogant, then there will be a problem at least with individual customers.”

Another area that could be a potential pitfall is how Ola ramps up production at its factory. As a services firm, it does not have the experience of managing the supply chain as complex as in the automotive sector. Beyond the hyperbole, it is something that bothered even Elon Musk at Tesla.

“Production is hard. Production with positive cash flow is extremely hard,” Musk tweeted earlier this month.

It does not help that Ola has not shared a detailed timeline of how it intends to ramp up at its factory. Neither has it said by when it will deliver all the orders it has received on September 15-16–customers have received delivery dates stretching into January 2022. All that it has said is that it will reopen the window for purchase order on November 1 possibly eyeing another bumper sales ahead of Diwali, one of India’s largest festivals when consumers are in a mood to splurge.

“They are playing it cleverly but as the September 8 incident shows us, not everything may go to plan. And in the automobile industry, a small error can be disastrous,” says an industry analyst who requested anonymity citing Ola as a potential client in future. “The product is key. Even a small recall can be expensive. And this early into its existence, it can shake consumer confidence in the company forever. They seem to be in a rush which is never a good thing for a new company. His (Bhavish) first scooter has not even hit the road and he is already talking about cars. A baby has to crawl first before it can start to run.”

Rivals are also picking over Ola’s strategy to not deploy traditional dealers. Bhavish’s idea–much like Musk at Tesla, is to do away with the intermediary dealers and deliver the scooters right at the doorstep of consumers. Much like any other e-commerce product. Electric vehicles by nature because of the small number of moving parts, require less service than a ICE vehicle. Aggarwal believes with the use of technology, it can also be offered at the doorstep.

“Please dont forget, we have a wide network of Ola cabs across the length and breadth of the country which we can tap into as well,” an Ola official said.

Competitors arent impressed and believe this could be a major flaw in Ola’s gameplan.

“Whether it’s an incumbent or a new company–they have to be serious for the long term. They have to have the customer’s interest in mind with a service network, spare parts availability, etc. A lot of companies forget to do that,” Naveen Munjal, managing director of Hero electric, currently India’s largest electric two wheeler company told ETAuto last month after Ola announced the prices of its scooters.

“We’ve been in this market long enough and the automotive sector is different, it involves a lot of backend, strong supply chain, a robust manufacturing network and at the front end –a dealer and service network and spares availability. Then you have to get the customer to experience the brand with the right blend of performance speed, range and price. I don’t really see this in the competition,” he added.

Undeterred and unflustered for the time being, Aggarwal marches on. On Thursday, he put out a blogpost called the “Rise of New Mobility” where he underlined his vision reiterating that India has the chance to leapfrog old mobility and adapting to new mobility. The poster boy for new age mobility in the country is sticking to the script.

Big words ought to be followed by big action on the ground. Next 6 months should answer all the ifs and buts.