Of late the solid-state batteries have been getting much traction. For many years, researchers have been trying to come up with something better, lighter, cheaper, and more efficient than lithium-ion batteries. It looks like solid-state lithium metal EV batteries are running up the trend.

In the meantime, there has been a huge price drop in lithium-ion batteries, their cost of manufacturing and raw material sourcing from what it was in the early 2000s.

The electric car giant Tesla has developed a technology that can cut the cost of its battery pack. During the recent Tesla Battery Day, Elon Musk, the Technoking of Tesla, said, “Tesla is coming up with a technology that is expected to lower its cost per kwh.”

This breakthrough is achieved by replacing the tab, a part of the battery that forms a connection between the cell and what it is powering. The new tabs with fewer cells, which Tesla is calling 4860 cells, will increase the energy capacity of the company’s EV batteries by five times, make them six times more powerful, and increase its vehicle’s range by 16%. The new cells will reduce the cost per kWh at the cell form factor level.

But these cost reductions will not stand the competition the solid-state batteries can offer. Solid-state batteries are difficult to make but will have many benefits if they are mass-produced.

Some of the key areas that solid-state batteries can dominate are:

· Renders faster charging times;

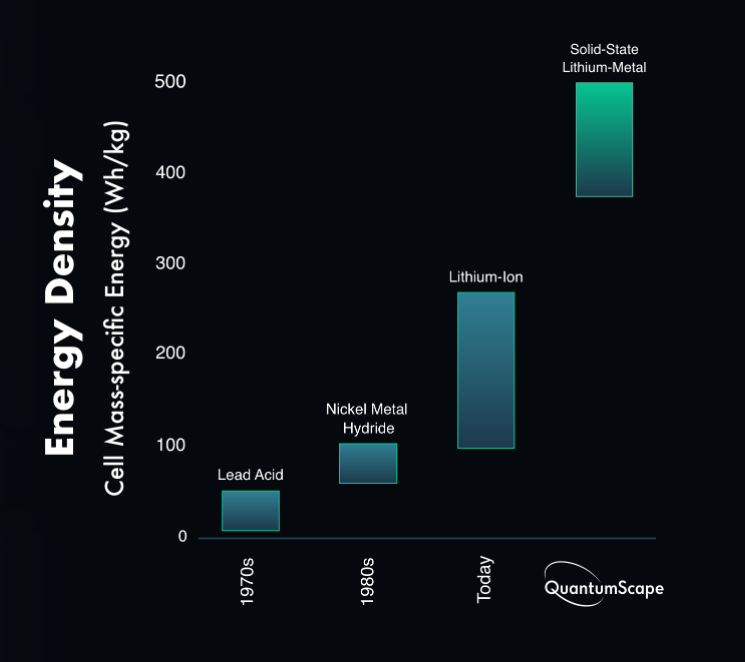

· Increases energy density up to 2 to 8 times;

· Maximum range of 500-800 km;

· Higher battery cycle life;

· No fire risk and no toxic chemicals.

But, other than these factors, is the real problem of using conventional lithium batteries instead of solid-state batteries the “power-to-cost ratio” or something else? Very few investors have any deep knowledge about the difference between the chemistry behind lithium solid-state batteries and conventional lithium batteries.

Working of the solid-state battery

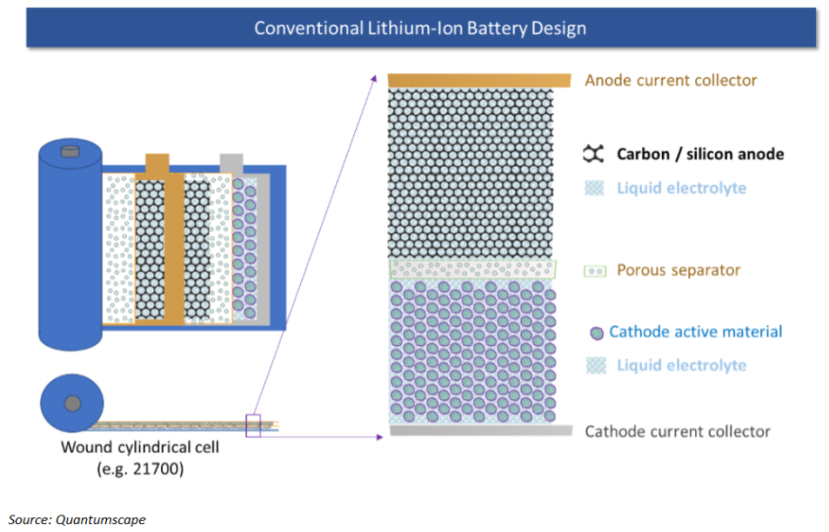

In a conventional liquid battery, an electrochemical reaction happens within a cathode and an anode through a liquid electrolyte within a porous separator. Usually, the anode is made from silicon or carbon material. When the cell is charged, energy is put into the system to drive lithium ions from the cathode to the anode, where they diffuse into the carbon particles that make up the anode.

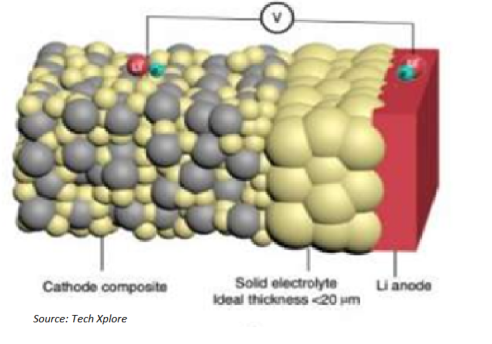

Compared with a lithium liquid battery, a solid-state battery can increase energy density per unit area since only a small number of batteries are needed. For that reason, a solid-state battery is perfect to make an EV battery system module and pack, which needs high capacity.

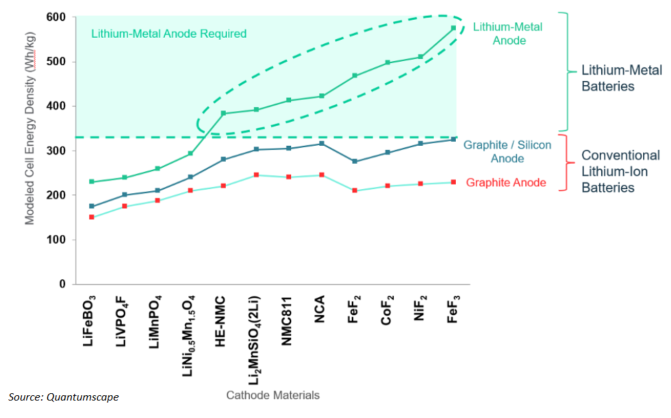

Researchers have investigated if some different metals within anode and cathode could help increase the charge density, decrease the charging time, and at the same time prevent degradation of the lithium batteries to make them strong competitors for the existing battery manufacturing companies and innovate the battery electric vehicles.

One such research paper published by a BMW team says that there can be multiple next-gen cathode materials that can match to three different anode materials: Lithium, Graphite/Silicon, and Graphite. The reason for this limitation is that higher-capacity cathodes need correspondingly thicker anodes to hold the increased amount of lithium, drowning out some of the benefits of the cathode improvement.

From the previous research, it is well known that lithium-metal anodes do not work with conventional liquid electrolytes due to the twin issues of dendrite formation when a battery is being charged and rapid impedance growth from a chemical side-reaction between the liquid electrolyte and the lithium metal. Impedance refers to the internal resistance of the cell; growth in this resistance reduces the energy capacity of the cell as well as its ability to work at high rates of power.

Any material which can reduce dendrite formation and decrease the internal resistance has got the upper hand while manufacturing the lithium solid-state battery. Many industries are currently working behind the wall to come up with the most reliable porous separator and solid electrolyte to remove dendrite formation and impedance.

Leading Solid-State R&D and Startups in the world:

Quantumscape, a company researching and developing a lithium solid-state battery is looking into adding pure lithium as an anode thereby reducing the carbon while increasing the energy density drastically. Looking ahead in the lithium technology and its core business values, the Volkswagen Group has partnered with this new solid-state lithium battery company to come up with a post-deal valuation of USD3.3 billion and filed an IPO through SPAC listed under the ticker (NASDAQ: QS).

BloombergNEF expects that these cells could be manufactured at 40% of the cost of current lithium-ion batteries when produced at scale. These reductions would come from savings in the bill of materials and the cost of production, equipment, and the adoption of new high-energy-density cathodes. To realise these reduced prices, the supply chain for key materials, such as solid electrolytes, not used in lithium-ion batteries today, needs to be established.

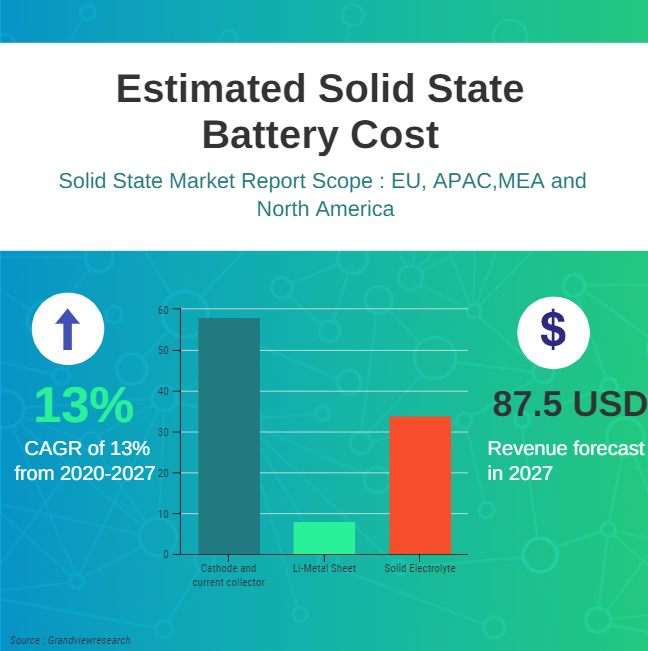

The global solid-state battery market size was valued at USD 32.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 13% from 2020 to 2027. Rising demand for solid-state batteries among end-use sectors along with the rising research and development activities focused on commercializing the battery cost are expected to propel the market growth over the forecast period.

China dominates the global market on account of the bulk manufacturing of batteries and the presence of major market players across the country. Vehicle manufacturers in China, such as Nio, Enovate, and Weltmeister, are focusing on the commercial development of solid-state batteries that can be used in the transportation sector. Moreover, the Chinese government is providing heavy funding to battery production projects, thereby driving market growth across the country.

Strategic partnerships among leading industry players are expected to further boost the product demand across several end-use segments. For instance, in February 2020, Panasonic Corp. and Toyota Motor Corp. announced a joint venture named Prime Planet Energy & Solutions, Inc. that will focus on the development, manufacturing, and marketing of solid-state batteries in the automotive sector.

Samsung SDI, Solid Power, Quantumscape, and Toyota are leaders in solid-state battery development. Solid Power claims it will have a 400 Wh/kg product in 2022. LMP (France and Canada) company formed by Quebec Hydro has commercialised solid-state batteries in buses. Mercedes is building the buses.

Solid-state battery technology in India

India holds a good chance of winning the new market provided it has strong investors and a well-funded research and development team. The Indian battery technology is not in a position to compete with those in the rest of the world, given the infrastructure and R&D limitations. Now lithium-ion cells are imported from China, South Korea, and Taiwan, or assembled battery packs are imported. The limited natural reserve of lithium, manganese or cobalt in India does not support any major expansion.

According to the government estimate, India will need a minimum of 10Gwh of lithium batteries by 2022, about 60 GWh by 2025 and 120GWh by 2030.

Recently, Omega Seiki Mobility partnered with C4V to introduce a solid-state battery in India. C4V says the battery manufacturing plant would start supplies from the second half of the current year. The plant location is to be announced soon as the company is in active talks with several state governments.

Will Solid-state batteries be the next crypto?

The biggest challenge for solid-state batteries is getting their prices down to where they can compete with the incumbent technology. That will take a while. For many uses, but especially for electric cars, traditional lithium-ion batteries won’t have much competition. So far, solid-state batteries have found application primarily in small milliamp hour batteries. There have been more than a dozen startup companies working towards this technology.

After the signing of the Paris climate agreement by the US President Joe Biden and his administration, many automotive and battery technology companies have started to invest billions into this technology. The US and China are likely to lead the solid-state technology. China has already funded solid-state companies working behind the wall.

(Disclaimer: With a Master’s in automotive systems from Kettering University (General Motors Institute), Flint, Michigan, the author is an automotive enthusiast. His area of interests covers battery electric vehicles, autonomous vehicles, artificial intelligence, shared mobility and telematics, connected vehicles and market trends. Views expressed are personal.)