New Delhi: About 80% of luxury electric cars in India cost over INR 1 crore. While the price is a limiting factor in the sales of luxury electric vehicles (EVs), local production can ease the situation to an extent, says the German luxury carmaker Audi.

The company, which locally produces the internal combustion engine (ICE) models in India, is in the process of working out a timeline with the parent company for localising the EV models to make them affordable to many more.

“About 90% of the cars that we sell in India are produced here. We are working with our headquarters on localisation of electric cars as well. We have not finalised the plan yet, but it is only a matter of ‘when’ and not ‘if’,” said Balbir Singh Dhillon, Head, Audi India.

“We will need to create capacities when we assemble the electric cars, and that is also an area where we are working,” he said.

On Friday, the German automaker launched the Q8 e-tron in India, after a gap of eight months from its global launch. The model, which is launched in two body styles of SUV and Sportback along with two battery options, comes at a starting price of INR 1.14 crore (ex-showroom).

The import of cars as CBU (Completely Built Unit) attract a higher tax in India while for the cars that are assembled in the country as CKD (Completely Knocked Down), their effective import duty is comparatively lower. In October last year, market leader Mercedes Benz introduced its first locally assembled electric sedan EQS 580 in the country.

Growth target

Audi India sold 4,187 units in CY 2022 and achieved 27% YoY growth. The company’s retail sales stood at 3,474 units in the first half of CY 2023, marking a growth of 97%, as compared to 1,765 units in the January to June period in 2022.

Currently, the automaker sells six models in the EV portfolio – Q8 50 e-tron, Q8 55 e-tron, Q8 Sportback 50 e-tron, Q8 Sportback 55 e-tron, e-tron GT, and the RS e-tron GT. The new Q8 e-tron becomes the seventh launch in the EV line-up.

As of today, EVs contribute to about 3% of Audi’s overall sales in the country. The luxury carmaker has set an ambitious target to achieve 50% sales from EVs by 2030. This comes in line with Audi AG’s global target of committing to become an all-electric vehicle maker by 2033.

“We are committed to our petrol plus electric strategy. I agree that there are still customers who want diesel and we are losing them, but even the markets like Punjab and the South region where the diesel demand used to be very strong is seeing a decline,” Dhillon said.

In April 2020, the share of diesel was about 80% in the luxury space. Within three years it has come down to less than 40% now. When Bharat Stage-II norms kicked off in India in April 2020, Audi and a few other carmakers completely moved away from diesel as a fuel.

Currently, Audi has “sufficient capacity” available for ICE car manufacturing for the next five years at its Group plant in Aurangabad.

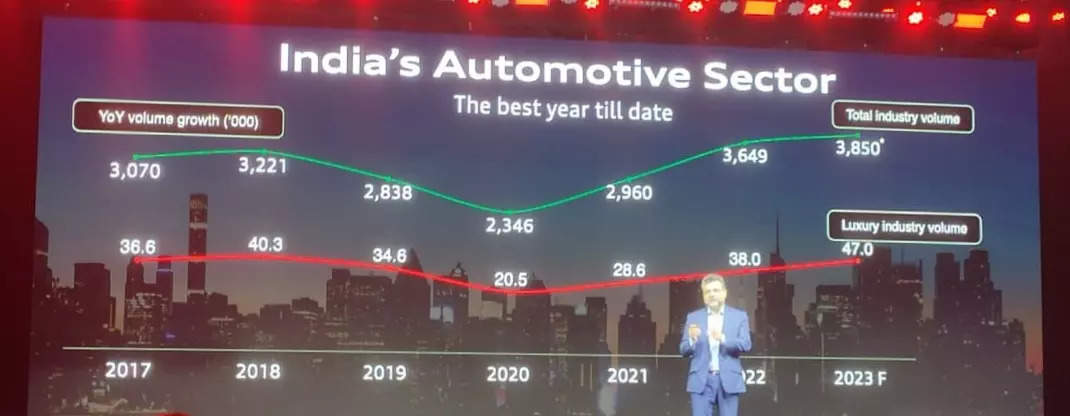

Owing to the low base of last year, Dhillon expects Audi to clock a double digit growth in India in CY 2023. He estimates the luxury car segment to clock 47,000 units in 2023.

Renewed focus on pre-owned cars

About 25% of Audi India’s new car sales come from existing customers. However, as the price of cars in the industry has gone up drastically during the past few years, customers are looking at cheaper alternatives of owning a luxury car. With this line of thought, Audi has increased its focus on the pre-owned car business by expanding the Audi Approved: plus outlets.

The company, which has 24 pre-owned car showrooms today, plans to grow this to 27 by the end of the year.

“We have 29 new car showrooms. We are targeting to have almost similar number of pre-owned car showrooms and give the same experience to its customer that we give to a new car customer. Then eventually these customers will be our new car customers in the next two or three years,” Dhillon said.

“We want to make the selling of pre-owned cars an organised business. We want our customers to eventually sell their Audi cars to us,” he added.