The technology wave in India’s auto sector is sparking a new sense of dynamism. Electrification has revamped product development, supply chain and several other functions with increased software integration and other digital-first capabilities. In parallel, it is also leading to a front-end transformation.

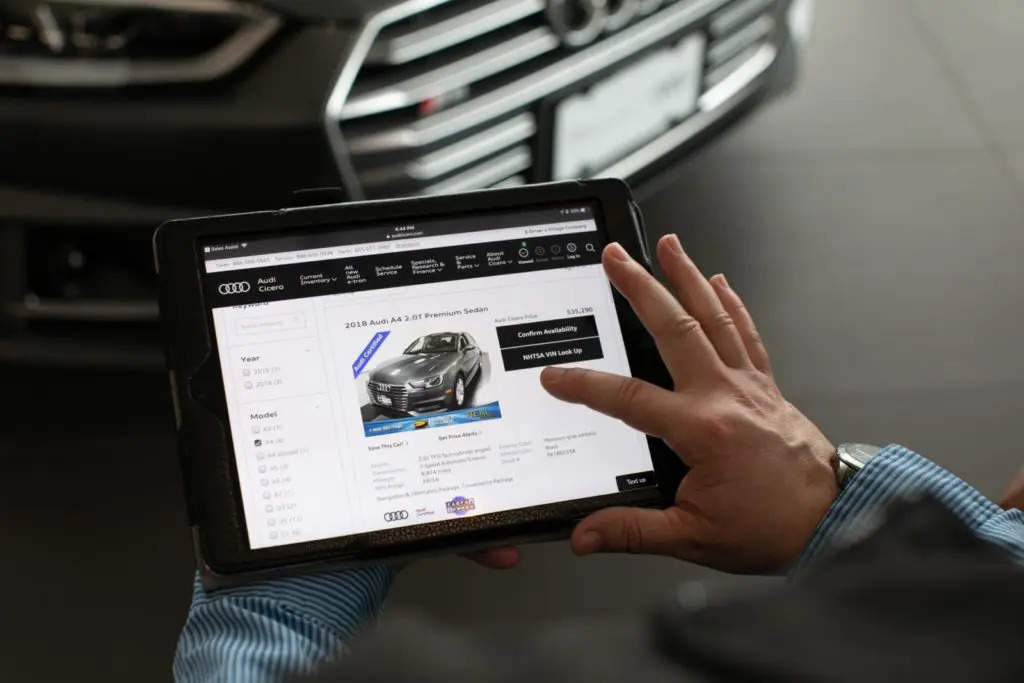

After decades of being wholly dependent on brick-and-mortar experiences led by dealerships, the go-to-market (GTM) model in the auto sector is now shifting to include digital-enabled routes. OEMs across the board in India – whether incumbents or ‘attackers’, passenger cars or scooters, conventional internal combustion engine or electric – are riding the tech wave to explore new models of customer outreach, engagement, and retention.

Omni-channel purchase

A key shift is the rise of digitally-savvy customers – not just GenZs, but also millennials and GenXers who are increasingly comfortable with online purchase experiences. According to a global McKinsey study on emerging consumer preferences across industries, half of the online shoppers rely on social influence for awareness, 66% of millennial consumers expect real-time customer service, and 90% of the consumers are omni-channel users.

These behaviours can be seen in the Indian automotive sector as well. A McKinsey survey of over 1,100 EV customers and prospects in India has identified shifts in automotive buying patterns: for buying a new-age vehicle, customers rely on as many as 25 sources, including online sites, before deciding. About 50% are willing to buy online; at the same time, 80% would not buy a vehicle without a physical experience and a test drive. This duality reflects the customer’s reliance on an omni-channel experience, which in turn needs to reflect in an OEM’s go-to-market model.

The hybrid D2C model

There are two opposite ends within the automotive GTM spectrum – traditional dealer-led, largely offline model and the new-age direct-to-consumer, largely online model. While both have their pros and cons, they are now seemingly converging about mid-way into a ‘hybrid D2C’ model.

One of the strengths of leading automotive OEMs in India has been their physical channel network. Their strong products, branding and marketing capabilities have complemented well with dealers’ on-ground capabilities of sales and customer engagement. However, with more consumers adopting online purchase journeys, OEMs are looking to re-define customer engagement digitally, thereby garnering a higher share of Customer Lifetime Value.

On the other hand, the ‘attackers’ especially have experimented with several direct-to-consumer (D2C) models over the past two to three years: some went online only and later realized the need for physical touchpoints given the nature of the category and customers’ continued need for a ‘touch and feel’ experience. Others started with a D2C model with a combination of digital and company-owned and company-operated physical experience centres. They are now experimenting with franchise models along with channel partners to tap into their decades of experience and entrepreneurial capabilities, enable faster pan-India scale-up and improve cost structures.

Seven building blocks

A successful automotive hybrid D2C business can be built on the foundation of seven building blocks.

• The first is to clearly define the role of dealers: for instance, defining who owns the ‘buying experience’ of the customer, and developing a thus aligned operating and commercial model with the dealers.

• The second is to develop digital solutions for all, incorporating new-age capabilities to build digital products for customers, dealers, strategic partners, service technicians and internal users.

• The third involves introduction of new-age OEM operations like at-home-test-drive, delivery-at-home, and on-the-spot service. This requires several phy-gital assets to provide a seamless experience to customer, with robust digital integrations at the backend.

• The fourth, and integral component, is direct sales and after-sales propositions, which involves redefining customer engagement through multiple touchpoints to maximize Customer Lifetime Value.

• The fifth, personalised digital marketing through a robust digital stack along with a business control tower tracking marketing, operations, CSAT levels across the omni-channel journey the customer has come to expect.

• The next step is creating a new-age tech organisation with the right mix of traditional automotive core capabilities and emerging tech capabilities across digital product management, analytics & data science, UI/UX design etc.

• Then, it is to eventually implement a modular-friendly user testing system that spans the spectrum of product, infrastructure, digital, manpower and physical operations, enabling robust governance through DevOps tools.

The transition to D2C is less onerous than it looks, with concerted effort, an automotive player can migrate to the hybrid D2C model in less than six months. Incumbent OEMs can lead by moving beyond brick-and-mortar plays to harness the customer outreach potential offered by digital channels. New-age OEMs can fortify their digital strengths by establishing offline partners to deliver still-needed physical experiences to customers.

Disclaimer: Bhavesh Mittal and Nitesh Gupta are, respectively, Associate Partner and Partner, respectively, in McKinsey & Company’s Bengaluru and Gurugram offices. Views are their own.