When electric vehicles (EV) become more and more popular, can the automotive component industry be far behind?

Auto component makers in India are bracing for change. They have not only lined up massive expansion and investment projects but are also diversifying, derisking portfolios and entering into joint ventures (JVs) to ride into a brave new world.

As the component industry looks to invest $2-3 billion in the next two years, most ancillary makers say EV parts are contributing a sizeable chunk to their order books.

Multinational companies such as Fiat’s parent Stellantis are looking to source more components from India to support their EV programme. On his recent visit to India, Carlos Tavares, group CEO of Stellantis, said they are open to discussions with component makers and are ready to localise work on EVs, considering India’s low-cost supplier base. Other companies like Renault and Daimler may also look at sourcing more EV parts from India.

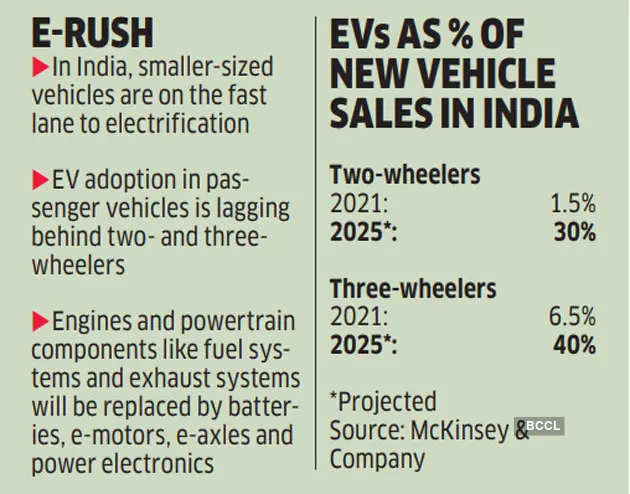

This follows a visible shift towards electric mobility in both two- and three-wheeler industries. By 2030, almost the entire three-wheeler industry and close to 80% of two-wheeler industry could become electric. The rate of change in the passenger vehicle (PV) and commercial vehicle (CV) sectors is slower — only 10-15% of PVs a n d about 10% of CVs are expected to be electric by 2030.

Automotive systems and parts manufacturer Sona Comstar says its revenue share from battery electric vehicles has gone up from 21% in H1 FY22 to 25% in H1 FY23. “We continue to build on our EV order book and now have 37 EV programmes across 23 customers,” says Vivek Singh, MD, Sona Comstar. Earlier, propulsion motors and controllers were used in electric two- and three-wheelers. Now these will be used in electric light commercial vehicles (LCVs) as well, which would see their revenue from EVs going up to 45% in FY26, adds Singh.

Companies such as Uno Minda foresaw the trend and started working on EV-specific products such as smart plugs, DC converters, chargers, charging cables and vehicle alert systems. “To hit the market faster, we entered into a JV with German manufacturer Friwo which helped add board chargers, battery management systems, motor controllers and battery packs to our product portfolio,” says Nirmal K Minda, chairman and MD, Uno Minda. Over the past month, it also added traction motors for electric 2W/3W by entering into a JV with Buehler Motor of Germany. Apart from investing 3% of its revenue in R&D, Uno Minda has announced capital expenditure of `390 crore in its JV with Friwo and Rs 100 crore in the JV with Buehler Motor.

Meanwhile, Flash Electronics, which manufactures automotive products, is on track to exceed `1,200 crore revenue in FY2023. EV contributes 8% to this. “We expect to double our turnover by FY2025 and EV-related products to be the main growth driver,” says Sanjeev Vasdev, MD, Flash. It plans to invest `150 crore in two greenfield manufacturing plants for EV products in Pune. It has also tied up with Poland-based electromobility component designer, Elimen Group, and the French company Enerstone to produce an advanced battery management system that protects the lithiumion cells from ageing.

“We are engaged with various customers to keep our business strategies aligned with their future plans,” says Aakash Minda, ED, Minda Corporation. “Our strategy is two-pronged. One, to disrupt the market with advanced versions of our legacy solutions like high-voltage wiring harness, digital clusters and keyless locking systems. Two, to map new product requirements in EV at the R&D facility in Pune.” Minda has recently partnered with EVQPoint, an EV solutions provider from Bengaluru.

The auto electrical company Lucas TVS is setting up three production lines to produce hub motors and middrive motors for electric two-wheelers, and ramping up production to 1 million units. KSV Babu, business head, e-mobility, Lucas TVS, says, “We are also dabbling in components for electric passenger cars. While it is still a small portion of the electric pie, it is seeing a lot of traction.”

Meanwhile, the industry body Automotive Component Manufacturers Association (ACMA) has conducted several tech shows for leading original equipment manufacturers (OEMs) in EV space such as Hero MotoCorp, Tata Motors, Ashok Leyland, Hyundai and Volvo Eicher to enable domestic components manufacturers to scale up and become globally competitive, says Vinnie Mehta director-general, ACMA. A study by ACMA and the Society of Indian Automobile Manufacturers has identified opportunity to the tune of $20 billion in the next five years for localisation of electric components.

Multinationals are also ramping up their exposure to electric components. Vitesco Technologies, the powertrain business of Continental, has signed agreements with many auto OEMs to supply integrated electric axle drive systems for cars and LCVs. It is also tapering down its ICE (internal combustion engine) vehicle exposure. “Our partnership with battery specialist Varta aims to develop new technologies and products for electric mobility and is working on a replaceable 48-volt battery for electric twowheelers,” says Prashanth Doreswamy, president & CEO, Continental India.

This shift is propelled by policies such as the Faster Adoption & Manufacturing of Electric Vehicles scheme and production-linked incentive schemes. It could make India an attractive, alternative source of high-end auto components for the world in the next five years.