Indian auto industry is set to invest up to USD 7 billion, or about INR 58,000 crore, by FY28 to deepen localisation of advanced components from electric motors to automatic transmissions to reduce imports and capitalise on multinationals’ ‘China Plus One’ sourcing strategy.

Automakers and their suppliers are likely to make this investment between FY24 and FY28, industry body Automotive Component Manufacturers Association (ACMA) said.

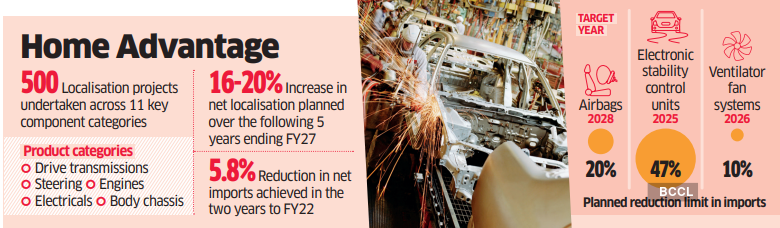

These firms have already undertaken more than 500 localisation projects across 11 key component categories including drive transmissions and steering, engines, electricals and body chassis at an investment of over INR 3,000 crore to reduce net imports by 5.8% (double the target of about 3%), or by INR 7,018 crore, in the two years to FY22, as per the latest assessment on localisation programmes jointly conducted by ACMA and Society of Indian Automobile Manufacturers (SIAM).

Work is on to increase net localisation by another 16-20%, or about INR 24,995 crore, over the following five years ending FY27, they said.

Projects are underway to reduce imports of airbags to 20% by 2028 from 26% in 2023 and 100% in 2012, those of electronic stability control units to 47% by 2025 from 63% in 2023 and 100% in 2015, and imports of ventilator fan systems to 10% by 2026 from 85% in 2024 and 100% in 2021.

Plans to deepen localisation of automatic transmissions, power control units, high strength steel, and combined charging systems are also on cards mid-term.

These components account for more than 75% of auto parts imported into the country.

Besides reducing imports, the industry also looks to make India an export hub for advanced auto components.

“World over, the industry is building resilient supply chains by reducing overdependence on any particular country or geography,” said Shradha Suri Marwah, president of ACMA.

“Value-addition from the Indian auto components industry has gone up significantly in the last couple of years and, with the Industry expected to invest another USD 6.5-7 billion in next five years in design and development and new age technologies including electronics and EV components, we are confident that not only will our imports come down (but) we will also become a significant net foreign exchange earner for the country,” he said.

Suri said the pace of reduction of imports in the last two years has been nearly double of that targeted by the industry at about 6%.

To be sure, China dominates auto parts supplies to India. However, its market share in automotive imports declined to 30% in FY22 from 32% in FY20. Indian automakers and suppliers imported components worth INR 1.36 lakh crore in FY22.

Industry stakeholders said that in addition to reducing dependence on China, localisation programmes will help expand India’s share in the global trade of advanced auto components going ahead.

Exports of auto parts from the country, in fact, increased by nearly one-third to INR 1.42 lakh crore in the two years to FY22, with suppliers shipping out components even to mature markets in North America, Europe and Asia.

“Globally, there is a massive transition taking place in the automotive industry with the advent of electric, connected and autonomous technologies,” said a senior industry executive who did not wish to be identified. “It is an opportune time as we move to new mobility to create more value-addition in India, so that we are more competitive going forward.”

Vinod Aggarwal, president of SIAM, said the localisation programmes undertaken by the industry, along with the INR 25,000-crore production-linked incentive (PLI) scheme by the government to address cost disabilities, have started showing results.

“Despite the sharp rise in customer demand for feature-rich vehicles across segments, the share of imports in total revenues of the automotive industry has declined by about 4% between FY20 and FY22,” Aggarwal said. “Industry turnover in these two years grew by 27.9%, while the growth in imports was only 8.7%, indicating that efforts towards localisation have started yielding results.”