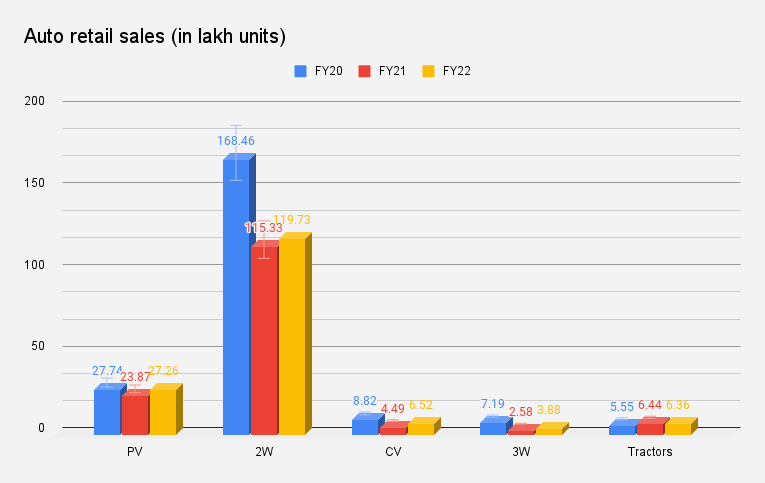

New Delhi: Auto retail sales in FY22 reported a 7% year-on-year growth to 1,63,75,799 units compared to 1,52,74,314 units in FY21. This comes despite the “total chaos especially in Bharat”, the auto retailers’ body Federation of Automobile Dealers Associations (FADA) said on Tuesday.

However, the sales are down 25% as compared to the pre-COVID year FY20, when the industry retailed 2,17,78,574 units. This was also the year of BS-IV to BS-VI transition.

One may note that the retail sales data from FADA is collated from VAHAN, in collaboration with Ministry of Road Transport & Highways (MoRTH), Government of India and has been gathered from 1,397 out of 1,605 RTOs. However, it does not include numbers from states like AP, MP, LD & TS as they are not yet on the VAHAN portal. Going forward, the dealers’ body said that they are in process of including AP and MP as well on the vehicle registration portal.

Vinkesh Gulati, President, FADA said, “FY22 was the first year of recovery after Covid hit us in 2020-21. The fiscal year didn’t begin on a good note as at the beginning of April, the second wave of Covid hit us hard. This time, the spread was not only limited to urban markets but also took rural India in its grasp. Unlike last year, the lockdown this time around was imposed by the State Governments and not by the Central. Many states continued to remain under lockdown even in May and for over 60 days impacted lives, economy and auto sales.”

FADA expects that the auto industry may come out of the woods and reach the pre-pandemic highs by FY24.

It also said that for India, the recent reverberations of war have, in fact, tilted the balance of risks downwards. The Government’s thrust on capital expenditure in 2022-23 can, however, be the gamechanger this time around by enhancing productive capacity, crowding in private investment and strengthening aggregate demand amidst the conducive financial conditions engendered by the RBI, and improving business and consumer confidence.

“A lot depends on how the Russia-Ukraine war unfolds. Also, for India to come out of the woods faster than other economies, we anticipate that there will be no further impact of Covid with vaccination being the shield,” FADA said.

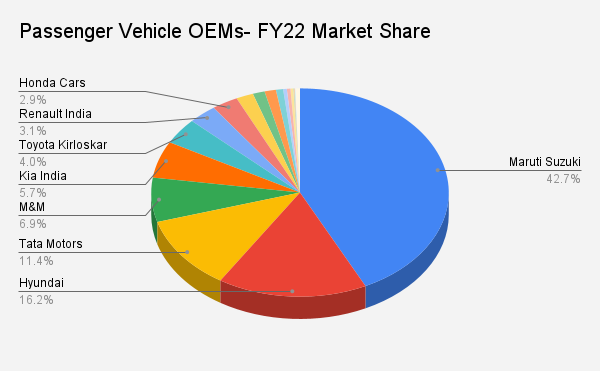

Passenger Vehicles

Country’s largest carmaker Maruti Suzuki reported a growth in retail sales to 11,65,483 units in FY22 from 11,63,042 units clocked in FY21. However, its market share came down to 42.75% in FY22 from 48.71% in FY21, marking a year-on-year loss of 6% in its share.

Hyundai Motor India also followed a similar trend with an increase in sales to 4,42,677 units in FY22 and decrease in market share to 16.24%. Its sales in FY21 stood at 4,14,552 and market share at 17.36%.

Meanwhile, Tata Motors was the biggest gainer in the segment – sales grew to 3,12,088 units in FY22 from 1,87,974 units in FY21, and market share to 11.45% in FY22 from 7.87% in FY21.

Mahindra & Mahindra also gained market share to 6.86% in FY22, from 5.35% in FY21. Toyota Kirloskar is another automaker joining its league, clocking share of 4.05% in FY22, from 3.24% in FY21.

The industry body expects the overall passenger vehicle segment sales to cross the 30 lakh mark in FY23.

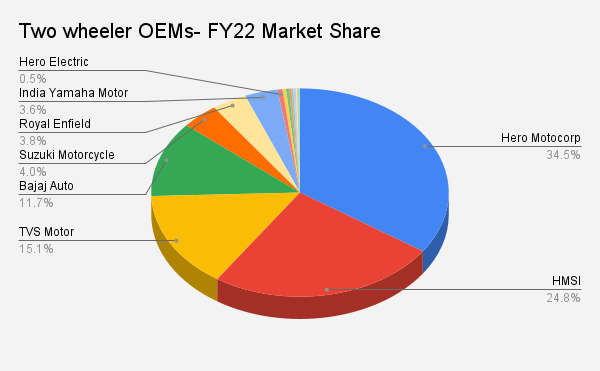

Two wheelers

According to the dealer’s lobby body, it is necessary for the Indian hinterland to get back on its feet for the industry’s recovery. In India, two wheelers occupy about 73% of automobile sales, out of which motorcycles take up about 70% share, which are further led by the commuter category bikes and sales from rural India.

In FY23, FADA is not very hopeful of overall two-wheeler sales reaching its peak. But it is confident that the electric two-wheeler sales which stood at 2.31 lakh units in FY22, will exceed 5 lakh units. This number may even breach the 10-lakh mark, if capacities increase significantly.

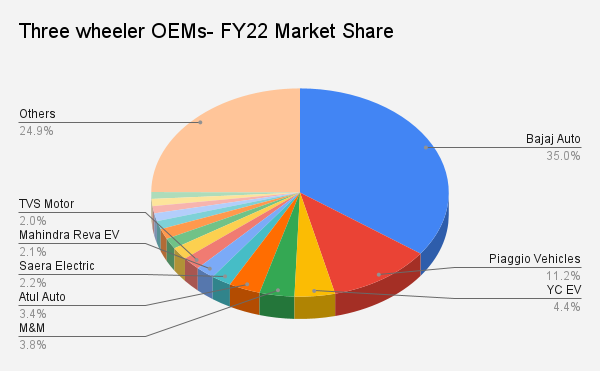

Three-wheelers

The top three-wheeler maker, Bajaj Auto lost almost 2% market share with 34.97% in FY22 from 36.66% in FY21.

However, Piaggio Vehicles saw the major hit with sales of 43,591 units in FY22 and market share of 11.23%. Its sales in FY21 stood at 47,323 units with market share of 18.33%.

The dealers’ body said that a major portion of three -wheeler sales is now shifting to CNG and electric now.

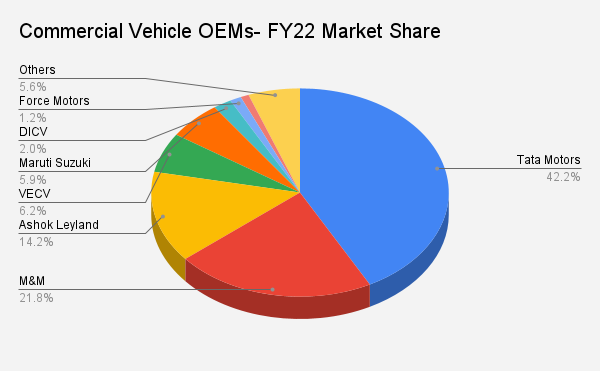

Commercial Vehicles

In the commercial vehicle segment, Tata Motors was the biggest gainer with a jump of about 6% in its market share. It reported 2,75,380-unit retail sales in FY22 with 42.23% market share against 1,63,171-unit sales in FY21 with 36.31% market share.

But Mahindra & Mahindra lost about 75% market share year-on-year.

This is also the only segment which has reflected recovery on a year-on-year basis.

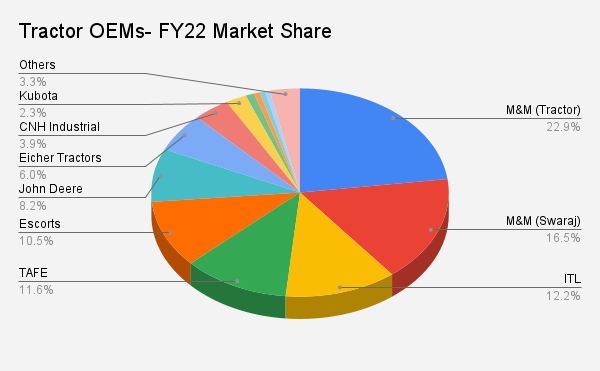

Tractors

In the tractor segment, the market share for OEMs was almost similar to the last fiscal year. FADA estimates that the retail sales of tractors would be around 6.50 lakh units in FY23.

Also Read: