New Delhi: Auto OEMs in April-June quarter of the on-going financial year 2022-2023 saw year-on-year improvement across segments on the lower base of the same quarter a year ago which was marred by the second Covid wave.

According to the latest data by the industry body, Society of Indian Automobile Manufacturers (SIAM), the first quarter of FY23 witnessed 54.7% jump in total domestic sales to 4,935,870 units compared to 3,190,202 units in the same period in FY22. However, the industry clocked 6,084,478 units in the same quarter of 2019-2020, which is a decline of 19% when compared to the current fiscal year.

The passenger vehicle (PV) segment sales grew by 41% in the first quarter (Q1) of the current fiscal and stood at 910,431 units from 646,272 units sold during the corresponding period of FY22, industry data showed. Throughout the Q1, the demand momentum for PVs was sustained amid improvement in chip availability. Experts expect PVs to stay at this level due to a higher open order book with all OEMs coupled with a gradual increase in PV volume with the supply-side constraints and commodity cost inflation starting to soften.

Within the segment, while off-take of hatchbacks and small cars grew by 22% at 411,441, sales of SUVs shot up by 62.4% at 464,558 in Q1 FY23. The off-take of vans grew by 50% and stood at 34,432 units.

Owing to the marriage season demand, sales of two-wheelers y gained 54.3% at 3,724,533 units from 2,413,608 units sold in the like period of FY22. Scooter sales in Q1 surged 100% to 1,207,903 units, while motorcycle sales also grew by 38% to 2,405,228 units.

According to Rajesh Menon, Director General, SIAM, recently the government has taken significant measures to ease the inflationary pressure and help the common man by reducing central excise duty on petrol & diesel and changing the duty structure to moderate prices of steel and plastic.

“The Indian Automobile Industry appreciates and thanks the government for these efforts. Industry also keenly looks forward to similar support on CNG prices which has seen exponential increase in the last 7 months. Support on CNG prices would help the common man, facilitate public transport and will enable a cleaner environment,” he added.

Driven by better fleet utilization, increasing replacement demand and improvement in the bus segment, the commercial vehicle segment sales for Q1 stood at 224,512 units from 105,800 units during the corresponding quarter of FY22.

Sales of three-wheelers also zoomed 211% in the quarter under review to 76,293 units from 24,522 units in Q1 of FY22.

Overall exports in the quarter under review went up marginally by 0.45% to 1,425,967 units from 1,419,471 units shipped out during the corresponding quarter of FY22

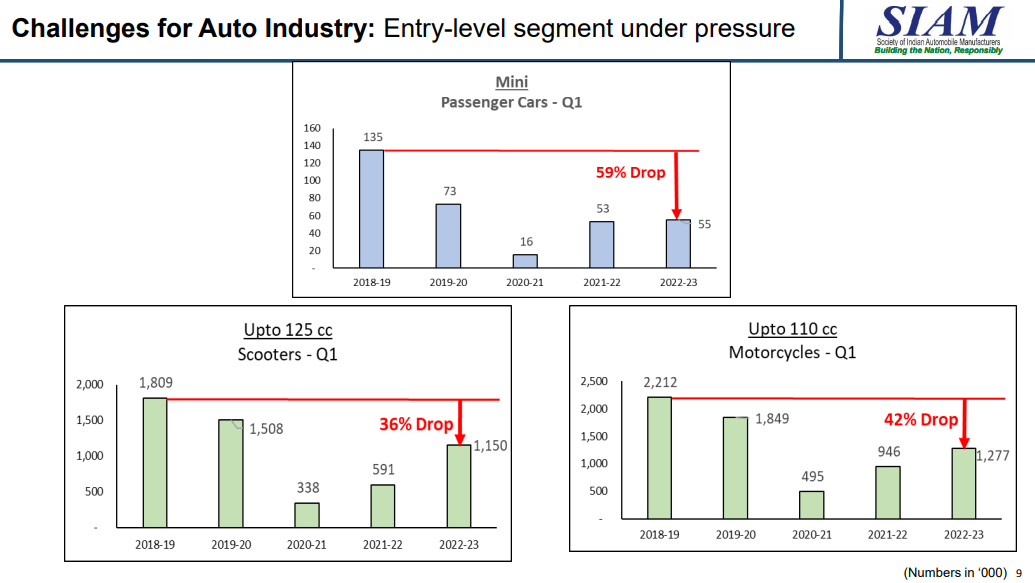

Entry-level segment under pressure

Demand for entry level cars and two-wheelers in India have been under pressure for more than three years now. The industry has been struggling with its own issues like chip shortage, commodity inflation and more, coupled with multiple price hikes of the products.

From the peak of Q1 FY19, the sales of mini cars has dropped by over 59% as most of the first-time buyers, mostly in urban areas, are in a mood to think big and are opting for the more exciting and loaded vehicles, giving the entry numbers a miss.

In the two-wheeler segment, scooters up to 125cc saw a drop of 36% in Q1 FY23 over the same quarter in FY19. Mass segment motorcycles of up to 110cc also tanked 42% from the peak of FY19 in Q1 FY23 majorly on account of inflated input cost and high fuel prices.

Going forward, it is estimated that a good monsoon will further boost Kharif yields, thereby improving farmer incomes, which bode well for motorcycle demand in the rural market.

Also Read: