The biggest green warrior on Wall Street might soon partner with one of India’s most trusted conglomerates. BlackRock chairman and CEO Larry Fink is closing in on an investment $500-750 million (₹3,750-5,625 crore) in Tata Power Renewable Energy Ltd (TPREL), said people with knowledge of the matter.

That will value the subsidiary of listed Tata Power at around $5 billion (around ₹35,000 crore), said people aware of the development. Fink was among the earliest champions of climate change and sustainability linked investment; BlackRock is the world’s largest asset manager.

ET was the first to report, on September 22, about Tata Power restarting capital-raising plans, mandating investment bank Moelis, nearly six months after pulling out of talks with Malaysian state-owned energy giant Petronas for a potential $2 billion investment.

Due Diligence on

Canadian pension fund CPPIB was another potential investor that was evaluating the investment opportunity. But BlackRock’s chunky valuation of the business-buoyed by a $1 billion investment by TPG Rise in Tata Motors’ electric vehicle business – has made it a stronger contender to be the main anchor investor, said the people cited above.

Due diligence has begun after the initial screening of potential investors. The company is looking to close negotiations by December-end. Depending on investor appetite, the company may increase its capital-raising plans to $1 billion with multiple smaller co-investors.

As with the private equity group, BlackRock has dedicated pools of capital for clean tech and green energy investments. BlackRock’s third global renewable power fund raised $4.8 billion – almost double its initial target – to invest in assets around the world, drawing money from over 100 institutional investors, it said in April. Tata Power declined to comment. Tata Sons and BlackRock didn’t respond to queries.

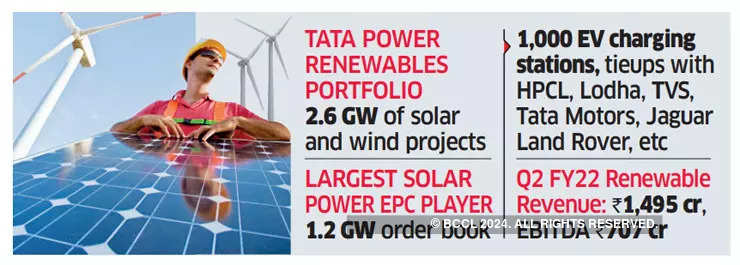

Unlike the previous attempt that sought to create an infrastructure investment trust comprising the generating green assets, this time funds are being raised for an entity that groups the entire renewables portfolio. This entity will include operating and pipeline independent power producer (IPP) assets, charging stations, rooftop solar, microgrids, panel manufacturing, engineering, procurement and construction (EPC). For instance, Tata Power Solar is a 100% subsidiary of the wholly owned TPREL.

Experts also see this as a potential value-unlocking and valuation-benchmarking exercise before an eventual listing.

Tata Power, the country’s largest integrated power company, has a stated plan to phase out coal-based capacity and expand its clean and green capacity to 80% by FY30. Renewable energy comprises almost a third of its total power capacity of 13 GW.

The management hopes to increase this share exponentially to 80% by 2030, as per the management’s commentary, to improve its environmental, social and governance (ESG) ratings and increase its appeal to overseas investors. Since January, it has commissioned or received letters of intent for solar projects with a capacity of over 1 GW. “The company has the potential to be India’s NextEra Energy, as it expertly straddles stable distribution and high growth renewable businesses,” said Apoorva Bahadur of Investec.

Analysts said the company is increasingly looking at a holistic strategy across the clean energy business spectrum like solar module manufacturing, solar pumps and electric vehicle (EV) charging that provides growth options and helps position it as an integrated renewables player. Investors have endorsed the shift – the Tata Power stock has appreciated 125% in the past six months, while the BSE Power Index has gone up 36.5% in the same period.

One of the key growth strategies is to focus on sunrise areas that are less capital intensive but gaining traction, such as solar EPC and pumps, transmission and distribution and the value chain of renewable businesses. Besides, the company is gradually moving into the business-to-consumer (B2C) value chain via electric vehicle charging stations and home automation, among others.

In solar for example, Tata Power has built a presence along the entire value chain – module and cell manufacturing, EPC and operations and maintenance (O&M) – for competitive advantage. The company also has a presence in upcoming battery storage technology and in August won the tender for the country’s first large-scale battery storage project at Ladakh, rated at 50 MWh.

Tata Power is also one of the frontrunners in solar-wind hybrid power and market leader in solar rooftops. In April, Tata Power Solar doubled manufacturing capacity at its Bengaluru facility to 1.1 GW, and has been looking to tap into the government’s Rs 4,500 crore production-linked incentive (PLI) scheme for solar modules. It submitted a bid to expand its cell and module manufacturing capacity to 4 GW, if the government’s initiatives come through.

For its EV play, Tata Power is leveraging the entire group to manage network access, billing, time of day (TOD) tariffs and others. While the market is still evolving, the overall opportunity size could be $3-5 billion over the next seven-eight years, assuming penetration of 30%, believe industry players.

This pivot coincides with the overall clean energy surge triggered by a combination of the decline in capital cost, technological advancements and political commitment toward climate change, making it the preferred choice for incremental capacity globally.

The balance sheet too has been broadly mended with restructuring and divestments, analysts said, giving a further boost to the stock. Net debt at the end of September was Rs 39,719 crore, of which Rs 13,733 crore is on account of the renewables business. Parent Tata Sons also invested $350 million in the company.

Last week, the company posted a 36% jump in consolidated net profit for the September quarter on the back of higher revenues. “The Q2 results of Tata Power (TPCL) manifest strong traction towards clean energy businesses and a head start with leadership status across,” said Swarnim Maheshwari of Edelweiss.