New Delhi: The battery pack of an electric vehicle accounts for about 40%-50% of its cost. And this cost is the largest single factor in the price differential between electric vehicles (EVs) and internal combustion engine (ICE) vehicles.

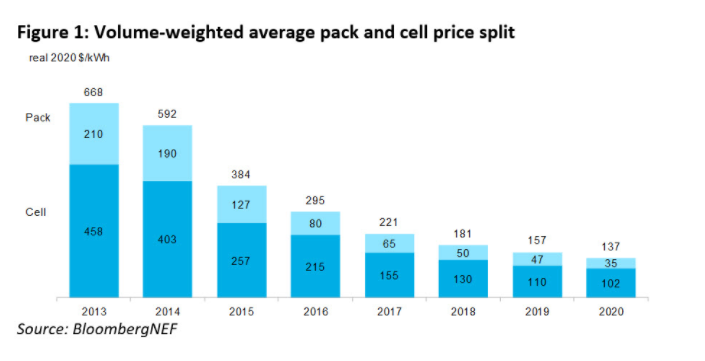

The scenario is set to change as the battery price has been declining steadily, and now it is at around USD 137/kWh, a fall of 89% from USD 1,100 /kWh in 2010. It will continue to fall further to USD 101/kWh by 2023.

These findings and forecast by BloombergNEF (BNEF) indicate that at this price for the battery pack the automakers should be able to produce and sell mass-market EVs at the same price as comparable ICE vehicles at least in some markets.

The 2020 Battery Price Survey of BNEF, a leading provider of primary research on clean energy, advanced transport, digital industry, innovative materials, and commodities, covers passenger EVs, e-buses, commercial EVs and stationary storage.

New cathode chemistries and falling manufacturing costs are expected to drive prices down in the near term. The prices of cathode materials have fallen since reaching a high in spring 2018, finding a more stable level during 2020.

The battery pack price fall this year can also be attributed to the increasing order sizes, growth in battery electric vehicle (BEV) sales and the introduction of new pack designs.

BEV pack prices are USD 126/kWh on a volume-weighted average basis. At the cell level, average BEV prices were USD1 00/kWh. This indicates that on average, the battery pack portion of the total price accounts for 21%.

It is to be noted that the forecast assumes that no subsidies are available. However, the actual pricing strategies will vary according to the automaker and region.

James Frith, BNEF’s head of energy storage research and lead author of the report, said, “It is a historic milestone to see pack prices of less than USD 100/kWh reported. Within just a few years, we will see the average price in the industry pass this point.”

The analysis further shows that even if prices for raw materials were to return to the highs seen in 2018, it would only delay average prices reaching USD 100/kWh by two years – rather than completely derailing the industry.

“The industry is becoming increasingly resilient to changing raw material prices, with leading battery manufacturers moving up the value chain and investing in cathode production or even mines,” Frith added.

Leading battery manufacturers are currently enjoying gross margins of up to 20%, and their plants are operating at utilisation rates over 85%. Maintaining high utilisation rates is key to reducing cell and pack prices. If utilisation rates are low, equipment and building depreciation costs are spread over fewer kilowatt-hours of manufactured cells.

It is a historic milestone to see pack prices of less than $100/kWh reported. Within just a few years we will see the average price in the industry pass this point.James Frith, BNEF’s head of energy storage research

One possible route to achieve these lower prices is the adoption of solid-state batteries.

BNEF expects that these cells could be manufactured at 40% of the cost of current lithium-ion batteries when produced at large scale. These reductions would come from savings in the bill of materials and in the cost of production, equipment, and the adoption of new high energy-density cathodes.

To realise these reduced prices, the supply chain for key materials, such as solid electrolytes, not used in lithium-ion batteries today, needs to be established.

Daixin Li, a senior energy storage associate at BNEF, said, “The increasingly diversified chemistries used in the market result in a wide range of prices. Battery manufacturers are racing to mass-produce higher energy-density batteries with some new chemistries such as lithium nickel manganese cobalt oxide – NMC (9.5.5) – and lithium nickel manganese cobalt aluminum oxide – NMCA – set to be mass-produced in 2021.”

Lithium iron phosphate – LFP – plays as a cost-competitive alternative, contributing to the lowest reported cell price of USD 80/kWh, Li said.