New Delhi:

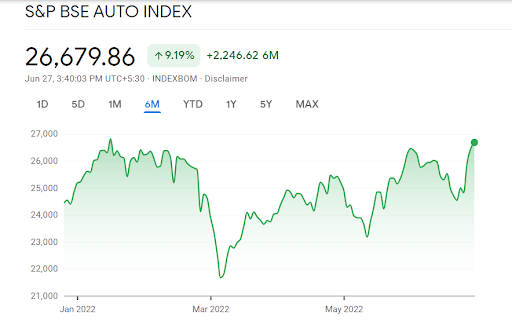

In the post-Covid rebound, shares of major automobile companies are outperforming the benchmark index for the past few weeks as the industry is expecting another month of robust car and commercial vehicle sales. In the past one month the S&P BSE Auto index has gained 4.3%, compared to a 2.7% decline in the S&P BSE Sensex.For the auto stocks, which have a direct connection with the national economy, things are swiftly changing for the better, according to market experts. A moderation in commodity prices, low base of last year and gradual easing out of the semiconductor crisis are turning the industry towards normalcy, foreseeing improved margins for all auto stocks in the coming quarters.

Another change that is being witnessed in the Indian passenger vehicle segment is strong demand prospects with record waiting periods across top selling models in the utility vehicle space. This shift is largely helping Mahindra and Mahindra (M&M) and Tata Motors more at the expense of Maruti Suzuki.

Continuing its surge for the last three months, the share price of M&M on Monday has touched a fresh life-time high of INR 1094.9 per share on the BSE, after gaining by over 2% intraday, outperforming the market on strong business outlook of its sports utility vehicle, commercial vehicle and tractor segment. The stock has rallied over 42% in the last three months compared to an 8.5% fall in the S&P BSE Sensex. It also gained over 63% from its 52-week low of INR 671 per share that was hit on March 8, 2022.

In the PV segment, the company currently holds an order book of above 1.7 lakh units which is equivalent to about six months of monthly sales run rate. The maker of Thar and XUV 700, saw about 88% jump in its SUV sales at 48,800 units in April-May of the ongoing financial year as compared to 25,934 units in the same period in FY22.

The company’s strong leadership in farm equipment, positive rural sentiment, and a strong commitment on building electric SUVs make it a candidate for the long-term portfolio. At standalone level it is India’s largest tractor manufacturer with over 40% market share and second largest commercial vehicle manufacturer, and fourth largest passenger vehicle maker.

Among the other individual stocks, Hero MotoCorp, Maruti Suzuki India, Bosch and TVS Motor Company also continued the northward trend in the range of 10%-13% in the past one week. Additionally, Eicher Motors, Tata Motors, MRF, Ashok Leyland, Minda Corporation, Bajaj Auto and Cummins India also gained between 6% and 9%.

Favourable factors

The recent rally in auto stocks are majorly on the back of decline in metals prices, improving chip availability and attractive valuations along with expected pickup in new launches ahead of good monsoon and festive season.

Metals are key raw material for the automobile space with steel and aluminium together constituting nearly 50%-65% of the overall input costs. In the recent past domestic steel prices are down nearly 20% post restrictions placed on their exports while global aluminium prices are down nearly 25% amid muted demand from key markets like China.

At present, aluminium is hovering around USD 2,466 per tonne compared to the peak of USD 3,878 per tonne in March 2022. Steel is currently down to INR 69,000 per tonne from the peak of INR 84,500 per tonne in April 2022.

“This softness of metal prices is a sign of relief and is likely to support profitability of the auto space in the near term. Over and above this, market leader in two-wheeler Hero MotoCorp has announced a price hike of up to INR 3,000 sensing healthy demand prospects with opportunity to realize better pricing and consequent operating margins,” ICICI securities said in its latest note.

That apart, the advancement of the southwest monsoon beyond the eastern parts of the country coupled with a cool off in oil buoyed auto stocks. Brent crude oil has corrected to USD 110 per barrel after skyrocketing to USD 130 per barrel in the past amid the on-going geopolitical crisis.

“Auto sector have been facing few headwinds including increased ownership cost and supply chain constraints. Recent softening in commodity prices is a positive for the auto sector. Normal monsoon would also brighten the outlook for some segments within the auto sector. Gradual recovery in auto sales volume is expected over the medium to long term,” said Arun Aggarwal, Vice President, Kotak Securities.

Outlook

Analysts believe that as the rural demand will start bottoming out in the backdrop of a normal monsoon, the two-wheeler segment will see improvement in demand. Moreover, channel checks indicate improvement in tractor demand as dealers across the country expect robust farmer spending outlook after they fetch good prices for their crops in the markets.

On the passenger vehicle front, consumer excitement is also upbeat with a series of new launches in the recent past and slew of impending launches namely Scorpio-N from M&M, New Brezza from Maruti Suzuki, and the new SUV from Toyota- Suzuki partnership among others.