Back in 1983, a young auto industry executive while driving through Delhi’s Hauzkhas suddenly stopped his Ambassador car, spotting a Citroen 2CV. This was Industry veteran Murad Ali Beg, who had returned from France after finishing his studies and was working with Escorts limited.

Murad had a great liking for the Citroen cars then, especially because of the suspension system, and very passionately wanted to bring it to India. He requested the owner of the car to allow him to borrow it for two days and luckily, he agreed.

The next move- he called on late Mr. HP Nanda, the owner and then chairman of Escorts. He took Mr. Nanda and his wife on an experience ride to Khan Market.

Mr. Nanda got convinced and they zeroed in on Punjab for a plant. They met the state government and gave them a demo after importing a couple of cars. Citroen too was very keen to transfer the complete manufacturing set up to India as they were stopping the production of 2CV, one of the most affordable cars, in the local market. But eventually, it did not take off.

“In those license days it was very difficult to create competition to Maruti and eventually the plan could not be formalized due to various reasons,” Murad said.

Around the same time, another brand of the French auto conglomerate formed a JV with Sri Chamunda Motors to make Peugeot mopeds but that too did not work out. Yet again they made a try in 1993, through a JV with Premier called PAL-Peugeot to make the Peugeot 309 cars.

Even though the PAL-Peugeot project took off very well with the terrific initial response to the 309 having about 5000 bookings, but then the partner had a tiff and they were not able to service the bookings they got; finally PSA departed.

Cut to 2010, again, the group started the Solus project in 2010 and had an agreement with Gujarat govt in June 2011, the product portfolio was finalized in August 2011, land ‘bhumi puja’ was done in Sep 2011, participation in Auto Expo in Jan 2012…but this time again the French automaker was unlucky in terms of Indian dreams.

As Avik Chattopadhyay, the person part of the then company’s leadership team in India said “..the after-effects of the 2008 economic crisis hit PSA and they almost went into bankruptcy; got money from the French govt and by selling equity from Dongfeng, logistics business and Faurecia and “indefinitely postponed” the India project in July 2012.” In all these abortive attempts, the group got many of its partners in India upset, agitated, and stamped a not-so-favorable legacy for the company.

Traditionally, European carmakers most often remain rigid to their headquarters policies which don’t succeed here.Murad Ali Beg, an industry veteran

After Carlos joined the Group in 2014, French auto major resumed the major turnaround and eventually resurrected the India entry. Carlos has strong exposure and understanding of the emerging markets which he acquired from his stint with the Renault-Nissan alliance.

In 2017, PSA Group (Now Stellantis) sealed the latest India entry plans. On January 25th, 2017, minutes after signing the deal, Carlos Tavares, CEO at PSA Group, and C K Birla, Chairman of India’s CK Birla Group gave ETAuto one of their first joint interviews through video conferencing from the City of Love- announcing the partnership for manufacturing cars and engine parts.

For the car manufacturing JV, PSA kept the majority 80% stake and 20% went to the Indian partner. C K Birla Group had Hindustan Motor Finance Corporation (HMFCL) facility available in Chennai’s Thiruvallur where they used to make Mitsubishi vehicles. But the car business with its Japanese partner did not progress much, it was in its favor to give the plant to PSA Group.

“To start with, it will be in the form of a modular plant in the sense that we will keep on adding capacity, but the idea is to have a capacity of 100,000 units,” C K Birla had said.

Then Carlos Tavares had said that “The first product to be launched from the Chennai plant will be in 2020, that’s the plan,”. The launch has been delayed and it’s going to be available for the customers in a few days but this product is largely meant as the brand introduction.

Now, the question is what the company has learned from the previous attempts, and is it too late for the entry?

“I wish my company was in India for the last 50 years. But that’s not the reality and I have to accept it and make sure we have the capability to make Indian customers happy with my products. If we come to Chennai – it’s an automotive hub in India — we will be having an opportunity of the supplier base already created by some of my competitors, which will make us much faster to align for the high localization rate in terms of market expectations and in terms of money. This is not about being late; it is also about being smart and learning from what other people have done, including successes and mistakes which I can properly evaluate,” Carlos had argued during his previous interview with ETAuto.

However, industry veterans still feel it’s too late to the party. “First of all they have started very late in India but they need an excellent quality product at very reasonable pricing. If you look at the latest entrants in the country they have burnt a bit of cash on products which anyone has to do while launching a product. But traditionally, European carmakers most often remain rigid to their headquarters policies which don’t succeed here,” says Murad Ali Beg, an industry veteran said.

Product Strategy

The PSA Group aka Stellantis has kicked off its journey with a C Segment SUV C5-Aircross aiming to launch the brand rather than having any volume pursuit or market testing, unlike other newcomers Kia and MG Motors. C-5, expected to be priced at about Rs 25 lakh, has only a minuscule market share of about 5%. Recently, many car makers like Honda Cars and Hyundai have stopped selling their models like CR-V and Santa Fe.

The product strategy on the face of it looks like a typical re-play of what other European carmakers had done in the past. The decision taken in the formative times is very pertinent as it stays the longest.

For example, Renault, when first came to India a decade ago, launched a slew of products like Renault Fluence and Koleos, directly borrowed from the developed markets but did not impress the Indian car buyers, and eventually they were discontinued after featuring among the least selling products in the country. Fluence, priced about Rs 15 lakh, Koleos at about Rs 23 lakh even topped the list of worst-selling cars in the country.

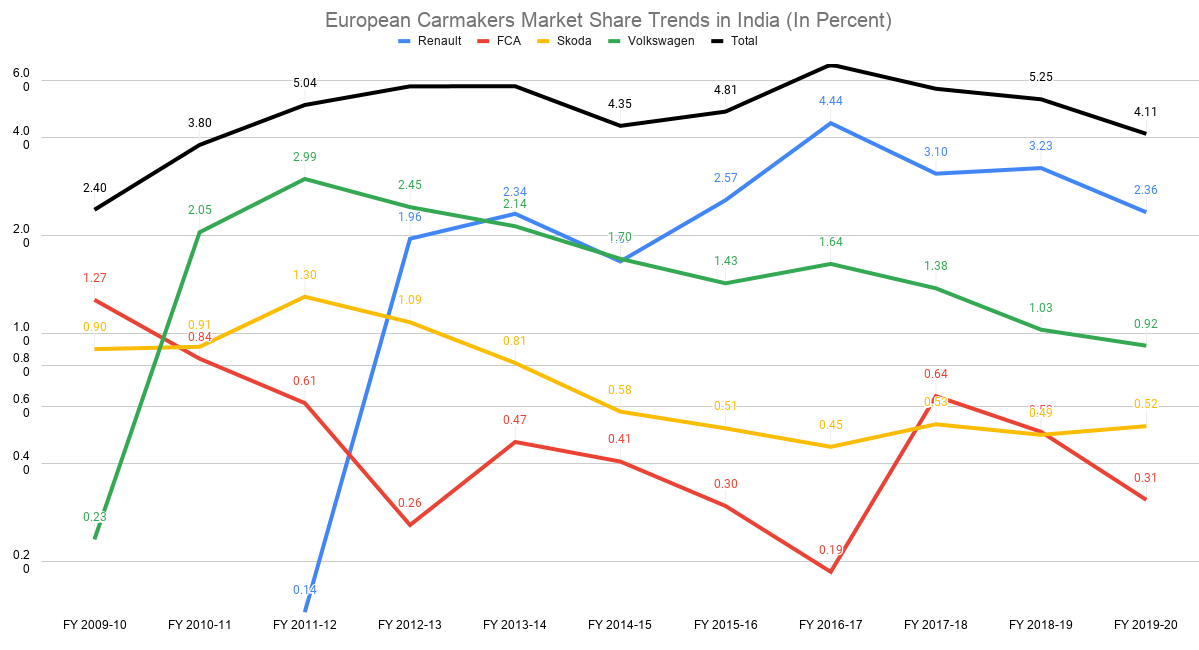

Similarly, Fiat struggled for years with its products like Palio, Punto, and Lenea and eventually bade adieu to the Indian market. Other European automobile majors Volkswagen and Skoda continue to struggle with a combined 1% market share despite more than a decade of continuous operations in India.

So, what’s been common among European carmakers in India. First, their product price and segment strategy was anything but close to right in the first go. Most of them either became too premium, directly borrowing strategy and product from their European markets while some tried to go by aping the market leader and go head on their strength rather than building their own strength.

That also did not work so well. Finally, Renault tasted a bit of success by launching probably India’s first refined and compact SUV Duster, and then eventually with yet another new and disruptive kind of product- SUVish entry-level hatchback Kwid. But, how much is it to celebrate? Even though Renault has achieved volumes, they are still burning cash and running in losses.

While the first launch also becomes very important and to break the image it really requires quite a disruptive product. But Volkswagen and Skoda are yet to see any such high point. One more noteworthy aspect is that most of these companies have remained one product wonders as most often, even if they get some success, it was mostly restricted to one product at a time. The other non-European newcomers Kia and MG Motors get instant success in terms of volume by creating their own niches.

So what has really PSA Group learned and how does the product strategy look like for India. It comes out clear that the carmaker is conscious of the fact that India is a market for value for money. Tavares had told ETAuto earlier that it conducted very deep research to understand. “We understand that the market is very demanding and value for money is a key expectation,” Tavares had said.

While value for money is an important aspect, Indian consumers have become style, design, and feature conscious. Price to a certain category (say above Rs 8 lakh) is not vital for a certain set of customers, especially, young and urban ones, they would rather shell out extra bucks for the right features and styling.

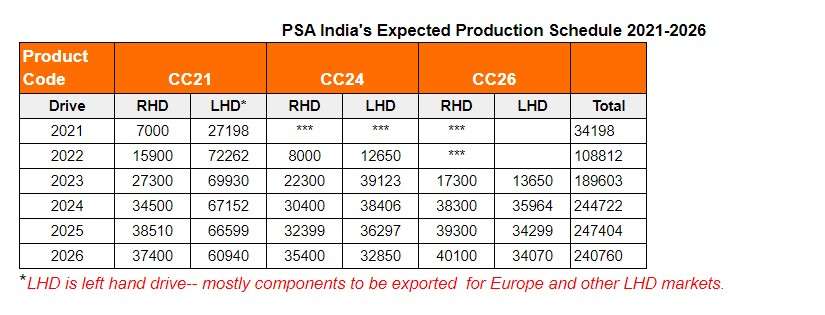

According to sources and company’s plans accessed by ETAuto, PSA Group India has lined up four products (excluding C-5 across) including at least one Electric Car in the next 3 years.

The first mass product, code-named as CC21, is based on the company’s C3 Air Cross already available in the overseas markets. This will be a sub-four meter product. According to sources, the earlier start of production for this product was July 2021 which now has been deferred to August-September 2021 and the launch will be around the festive season. The carmaker will also roll out an electric version on the C21.

The C21 is built on PSA’s Common Modular Platform (CMP), which shares componentry across a wide range of models to bring economies of scale. CC 21 will have three variants: NA, Turbo, Turbo AT.

It will be powered by a 1.2-liter turbo-petrol engine and 100% localised. The sub-4m will be competing with Nissan Magnate, Hyundai Venue, and the Maruti Suzuki Vitara Brezza.

The next product in the line is CC24. This will be another SUV slightly close to the Creta segment and will start production in June 2022, with a projected production of about 2200 units a month, which is quite a conservative number.

The third product code-named as CC26 will be a sedan to take on the likes of Verna, and Honda City which is one of the high selling brands. This could have been a possible product to bring back the iconic Ambassador but the company has no thoughts so far in this direction.

Cautious Approach

The company certainly looks to put its strongest foot forward. It has already maintained a lean approach in India. Adding to this is the company’s strategy to start with exports from the beginning itself to make a sustainable business case.

The production plan also reveals its conservative approach to the local market. It is corroborated by its tiny dealership across the country which is not going to grow beyond 20 in the next two years. Currently, it has opened about 10 dealerships on a pan India basis including Delhi, Ahmedabad, and Chennai as it keeps focus on the physical model of retailing.

The company justifies this strategy with its plan to empower sales through mobile outlets and digital platforms. However, experts believe that India is a typical market that has strong growth coming from small towns where the touch and feel matter the most in finally clinching the deal.

An SUV-focused approach will certainly work in favour of the company even as the retail network remains limited but with digital push, it may work well in the urban markets. However, its partner Jeep has also lined up locally manufactured SUVs including the use of the Stallantis/PSA platforms.

Top 3 hits and misses of PSA India strategy

| Hits | Misses |

| 1. SUV centric strategy which is the fastest growing | 1. Legendary brand issue and lack of awareness among masses |

| 2. Export oriented business strategy to assuage losses. | 2. Too late to the party with missing volume products |

| 3. Highly localized product plans to be competitive in the market | 3. Product plan not distributed well to a de-risk major change in customer preference |