Leading mass-market carmakers are recalibrating product strategies to make more higher-margin vehicles, seeking to offset the impact of a circumspect 3-4% industry-level growth and rely instead on a customer segment that’s less sensitive to prices — and business cycles.

The most telling signal of this shift is that about four-fifths of sales are now concentrated in the INR 7.75-12 lakh price band.

The sub-INR 10 lakh segment — traditionally the industry’s volume driver — is seeing falling sales, data collated by Jato Dynamics showed. “With the price difference between entry and top trims quite high, carmakers are seeing a significant impact on profitability,” said Ravi Bhatia, president of Jato Dynamics.

“The winners will be those who can successfully straddle both mass market efficiencies and premium segment margins. For the world’s fourth-largest auto market, this transition marks a significant maturation point, with implications for global automakers’ emerging market strategies.”

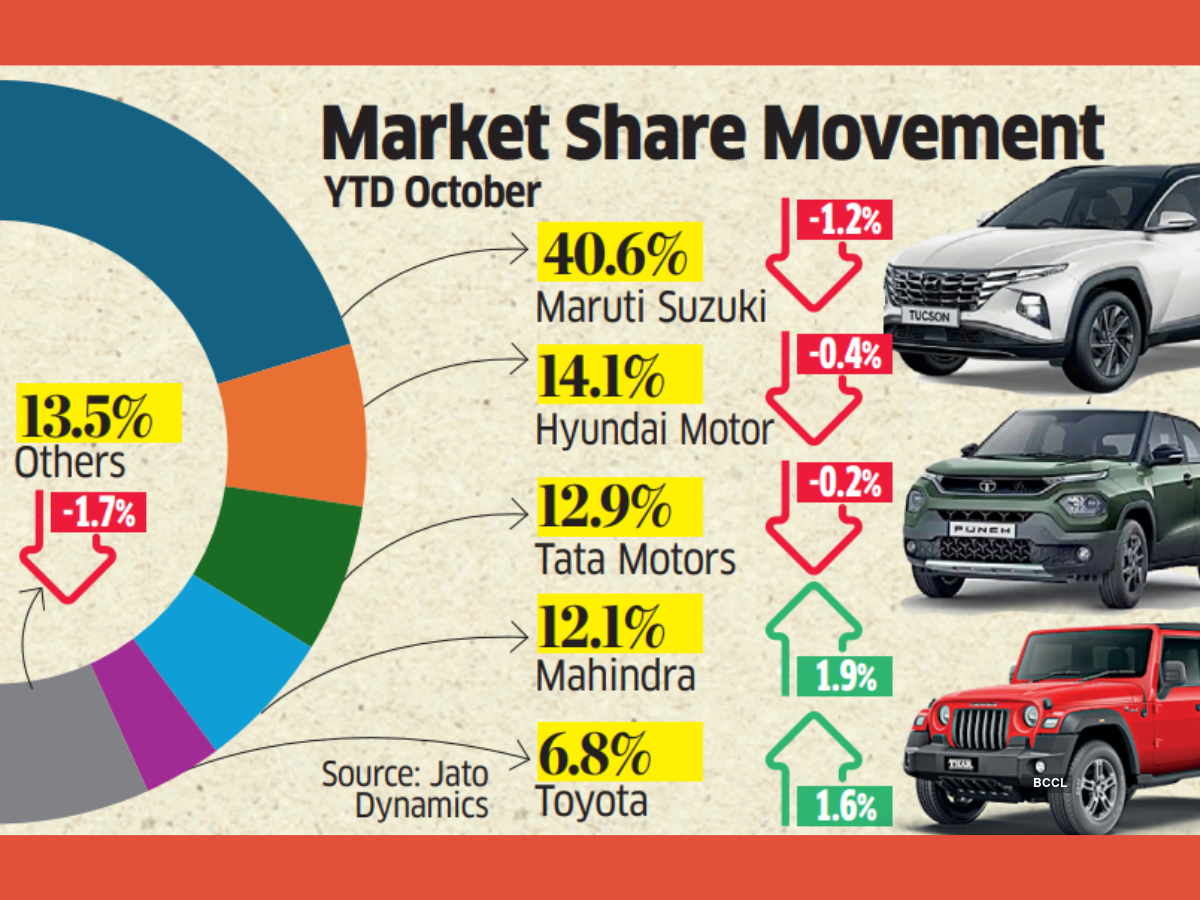

The upward pricing gradient is reshaping the market dynamics in an industry dominated by a handful of players. Market leader Maruti Suzuki, despite a slight 1.2% market share decline to 40.6%, has strategically expanded its presence in the INR 15-30 lakh segment.

Its recently launched new-generation Dzire, earlier more of a no-frills entry-level sedan, now comes in the INR 7-10 lakh band and packs in features the modern car buyer would demand, said Partho Banerjee, senior executive officer for marketing & sales at Maruti Suzuki.

Premium SUVs boost for M&M

Mahindra and Mahindra has posted the strongest growth among major players, gaining a 1.9% market share through its premium SUV offerings. Other key players like Hyundai and Tata operate at roughly one-third of Maruti’s volumes, creating an oligopolistic market structure, say industry experts.

“We are enthused by the broad-based demand across our portfolio with a healthy preference for our top-end variants indicating wider acceptance to our premium offerings,” said Nalinikanth Gollagunta, CEO, Automotive Division, Mahindra and Mahindra, which offers products in the INR 8-25 lakh price range.

While the UV major maintains a volume guidance for mid- to high- teens for FY25 for SUVs, the recently launched XUV 3XO and Thar Roxx will help it maintain a growth momentum. Similarly, Hyundai Motor India, which recently sold its shares locally in India’s biggest initial stock sale, is also seeing a shift toward higher trims in its lineup, with the premium segment becoming a larger portion of its overall sales.

“For the Indian customer, aspirations are taking precedence over functionality. Sunroof penetration in Hyundai models has gone up to 53% in the first six months of FY25, as against 47.4% in the same period last year,” said Tarun Garg, Chief Operating Officer and Wholetime Director, Hyundai Motor India.

On ADAS, which Hyundai offers in 8 out of 13 models, the penetration went up from 3.3% in H1 of FY24 to 14.4% in H1 of FY25. At the same time, penetration of automatic transmissions has gone up from 23.2% in H1 of FY24 to 25.3% of H1 of FY25.

The mass market saturation is pushing automakers toward a critical strategic choice, to either optimize costs to compete in the core INR 8 lakh sweet spot or move upmarket to chase premium segments with higher margins.