By Ashim Sharma

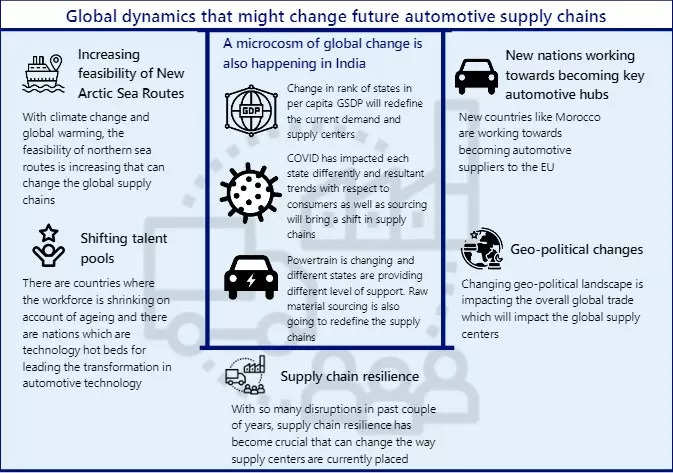

The global trade dynamics are changing, influenced by various short-term and long-term factors. The increasing feasibility of new Arctic maritime routes, development of new nations into automotive manufacturing hubs, changes in geo-political equations, supply chain resilience and shifting talent pools are among the factors of global dynamics that might change future supply chain hubs.

Increasing feasibility of new Arctic maritime routes: Since the beginning of maritime travel people have been exploring various arctic routes. They are some of the shortest ways to connect the northern hemisphere civilizations. However, the presence of permanent ice for most part of the year has rendered them commercially unviable.

With climate change, the situation is changing and countries like Russia, Japan, and China, which will benefit significantly from a shorter route connecting Asia and Europe, are actively exploring new options. Once these routes become commercially viable, the overall supply chain dynamics of the world will change.

In the summer of 2020, the Arctic region saw significant heat and the north eastern passage was open for a record 88 days. This north eastern passage reduces the distance from Japan to Rotterdam by 37% when compared to the current Suez Canal route. With the rise in temperature and global warming, though alarming, a viable arctic sea route is not far away.

New nations as auto hubs for Europe: Morocco, for example, provides a lower cost manufacturing hub for supplying to the nearby European markets as well as other African markets. The automobile industry in Morocco is a key industrial export sector encouraged by the fiscal sops and other concessions offered by the government for setting up manufacturing facilities in the country.

Some of the leading automotive players like Renault-Nissan, Ford, Peugeot, and Hyundai Motors are already in Morocco. The emergence of such new manufacturing hubs can potentially change the supply chain dynamics of the European automotive market.

Geo-political changes: Changing geo-political landscape is evolving the dynamics around the decisions about to trade or not to trade with a set of countries impacting global supply centers. Formation of the First Quad (Quadrilateral Security Dialogue) among India, Australia, Japan, and USA can affect trade routes and supply chain channels. The recent events of instability in central Asia are also some of the markers of possible change in the global raw material value chains.

As per a US study, Afghanistan could have the world’s largest lithium deposits with an estimated worth of USD 1 trillion. The fate of these resources now under the shadow of political instability can redefine the global electric vehicle value chain in the region.

Globally, competing power centers are emerging and they can redefine the way global trade happens and thus the global supply chains. China’s increasing control over mines in the African nations as well as investments in development of belt and road routes across central Asia can also change the global trade dynamics.

Supply chain resilience: Global automotive supply chains will also get evolved in the light of recent supply chain disruptions such as COVID 19 and the semiconductor shortage. This will lead to companies looking to incorporate close sourcing and multiple sourcing as their key supply chain strategies. These changes will redefine the current supply centers and may lead to the emergence of new hubs to cater to the global supply chains.

The EU is also investing heavily in localizing lithium battery manufacturing and thus reducing dependency on other countries like China. Vice- president of The European Commission believes that the EU will be able to cover all industrial needs for batteries of car manufacturers by 2025.

This will create multiple large hubs for battery manufacturing with the EU and China becoming the leaders. Lack of dependency on one large hub, China at the moment, will potentially increase the overall resilience of the EV supply chain.

Shifting talent pools: It is a well-known fact that every stage of the automotive value chain is undergoing tremendous transformation. It can be due to the advent of Electrification, Connectivity, Autonomous vehicles, overall Digitization across the value chain or the increasing role of embedded software in vehicles. Alongside this, there are countries where the workforce is shrinking on account of ageing and there are also nations which are the technology hot beds for leading this transformation.

The countries which do not have a sizeable demand and hence miss out on becoming production centers are entering other parts of the value chain like engineering services supported by language and technical skills or providing talent with managerial skills for leading companies in the future.

Therefore, the talent pool to work in the industry is also undergoing a reorganization across the world. And this will also be a major factor of production to be considered when deciding on the future manufacturing or technology development footprints.

Changing dynamics in India

Along with the changing global scenarios, India will also see some changes in the local distribution of demand and supply centers. The economic growth of Indian states, infrastructural developments and the changing powertrain will also play key roles in this.

Changing economic position of states: From 2011-12 to 2018-19, the list of top 10 states based on Gross State Domestic Product (GSDP) has changed with the emergence of Karnataka and Telangana to the list. In future, due to changes in the existing industries and emergence of new industries, this can change further leading to alterations in the demand center landscape for automobiles.

Cities like Bengaluru and Hyderabad have emerged as IT hubs and are now attracting the startup world, making them home to the new age workforce. These trends will redefine the traditional demand centers as well as the product portfolio options desired by each of them. The overall supply chain will also have to be realigned to suit them.

The country is also striving to lower the cost of logistics from the current 14%-15% of GDP to around 8% and initiatives such as the National Infrastructure Pipeline can help remove the bottlenecks faced by some regions of the country to make them more attractive for investments in the future.

Impact of COVID-19

Uncertainty about new waves of COVID-19 still continues. The impact of each wave has been quite different across states. In the states that have suffered more, the supply chain disruptions have been severe. Going forward, if this trend continues, companies will look towards supply chain resilience with development of multiple supply centers and integrating them with efficient means of logistics.

The evolution of COVID as well as the path to recovery will play a major role in re-defining the supply chain dynamics of India. Some of the states have been slower to recover after the first wave than others and this change in the pace of development can lead to the emergence of new growth centers in the country.

COVID is also changing the way people work and new models of remote working, especially in the rising IT sector, can influence the current demand patterns.

Evolving automotive powertrain

Globally, adoption of electric vehicles (EVs) is increasing. At the end of 2020, there were a total of 10 million electric cars in the world. Electric car registration jumped 41% in 2020, despite the pandemic related global downturn depressing car sales by 16%.

Policy support drives EV development in India: The government’s efforts to push environmentally friendly vehicles through various policy schemes such as FAME II (Faster Adoption and Manufacturing of Electric Vehicles) will provide great support for the adoption of EVs in India. In addition to this, the Production Linked Incentive scheme for auto and automotive components will hopefully further boost the EV segment.

With national policies in place, some of the states have also come forward with additional support for the growth of the EV ecosystem including charging infrastructure and manufacturing. States like Karnataka, Telangana, and Andhra Pradesh have come up with their own state EV policies providing a conducive environment for transition to EVs from internal combustion engines.

The automotive supply chain will evolve to cater to the change in powertrain and the differences in state level policies will create different demand and supply centers for electric vehicles. States with more favorable consumer side incentives will see a rapid uptake in demand than other states. Similarly, states with favorable industry support will see an increase in supply centers for EVs.

Raw material sourcing for EVs

A key aspect of manufacturing EVs is the availability of raw materials. In comparison to ICE vehicles, EVs will require a supply of rare earth metals, lithium, cobalt, etc. As a result, countries like Democratic Republic of Congo, Argentina, Bolivia, Chile (Part of Lithium Triangle), China etc. will start playing a major role in global automotive supply chains. In the Indian perspective, this will lead to increased imports of raw materials thus providing an advantage to coastal cities / states for setting up manufacturing hubs.

Geological survey of India is also working on seven lithium exploration projects in Arunachal Pradesh, Andhra Pradesh, Chhattisgarh, Jammu & Kashmir, Jharkhand, and Rajasthan. If any of these projects turns successful, it can potentially have a sizable influence on the selection of battery manufacturing hubs for India. Innovative solutions like urban mining can also emerge as sustainable solutions to cater to the demand of electric vehicle raw materials.

Long-term scenario planning

Several factors have influenced the growth of supply centers for the automotive industry ranging from demand proximity, economic incentives, and raw materials to availability of good energy and transportation infrastructure, etc. Shifts in age demographics and income on account of trends such as remote working, rising income levels in the hitherto less developed states as well as the emergence of supply chain resilience as a global concern area in the face of the pandemic could fuel the setting up of alternative demand and supply centers in the future.

The overall raw material availability situation will also define the R&D roadmap of OEMs so that alternatives can be developed for inputs facing huge bottlenecks in their supply chains or for inputs for which the supply chains are uncertain and not very resilient.

The emergence of new ways of manufacturing and planning the overall footprint will get influenced by the various factors discussed above. Similarly new ways of working are emerging and they can change the way demand in the automotive industry is fulfilled, for example micro-factories, increased use of technology to coordinate production and logistics, and wider adoption of Industry 4.0 and IoT tools.

Therefore, there is a strong need to carry out a multi-factor scenario- based assessment of the way things could unfold in the future. This should then be used to decide future demand footprints as well as supply.

With climate change and global warming, the feasibility of northern sea routes is increasing. They can change the global supply chains. New countries like Morocco are working towards becoming automotive suppliers to the EU. Changing geo-political landscape is impacting the overall global trade which will impact the global supply centers. With so many disruptions in the past couple of years, supply chain resilience has become crucial. Firms that take cognizance of these and plan ahead of time may be able to reach commanding positions in the automotive industry.

(Disclaimer: Ashim Sharma is Partner and Group Head at NRI Consulting & Solutions. Views expressed are personal.)

Also Read