Automobile companies are gearing up for a record number of launches in the coming months as the semiconductor shortage that has plagued the industry eases.

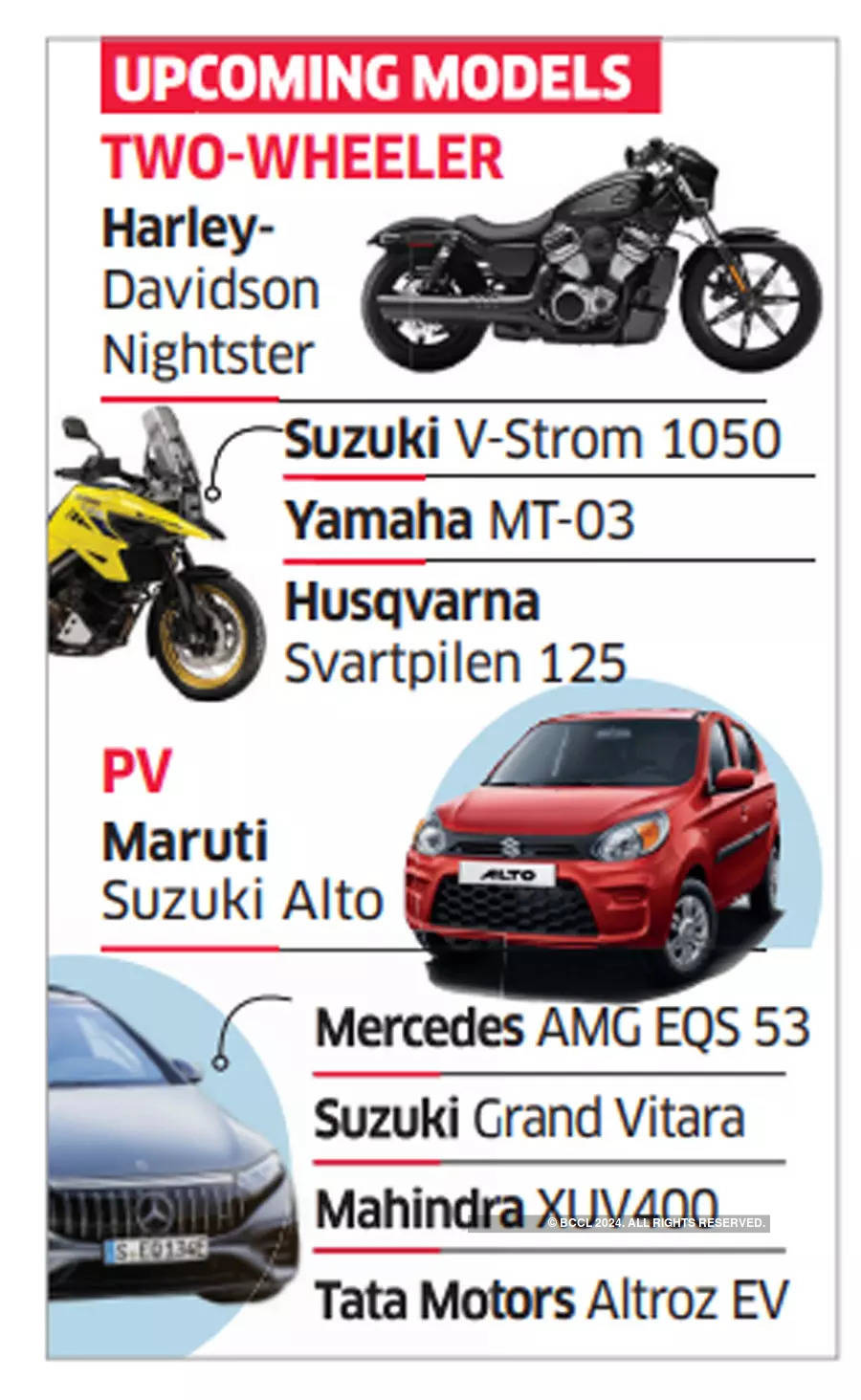

FY23 will see an unprecedented 21 passenger vehicle launches and 17 two-wheeler launches, mostly in the upcoming festive season.

The maximum action in the passenger vehicles market will be in the sports utility and electric vehicle segments. Some of the launches include Toyota Hyryder, Maruti Suzuki Alto, Mercedes AMG EQS 53, Audi Q3 and XUV400.

“In the auto industry, new models are typically planned 38 to 46 months in advance. The Covid lockdown period probably affected the pace of development work on new models temporarily. But with the strong bounce-back, both in work environment as also the market, auto OEMs have resumed development work on an accelerated basis.

This probably explains the bunching up of launches in the current year,” said Shashank Srivastava, senior executive director, Maruti Suzuki. The company plans to launch a refreshed Alto 800, Jimny SUV, among others.

Festive Fireworks

If the semiconductor shortage had continued, manufacturers would have been forced to postpone launches, said Srivastava. With the situation easing and festive season on the horizon, many manufacturers are going ahead with launches, he said.

Luxury car maker Mercedes-Benz is betting big on EV launches in the festive season. “We have lined up a very aggressive EV roadmap for India, and beginning this festive season, we will be launching two much-awaited luxury EVs – the EQS 53 AMG performance EV and the ‘Made in India’ EQS 580 luxury EV,” said Martin Schwenk, MD & CEO, Mercedes-Benz India.

Tata Motors, which has seen record sales of over 1.3 lakh vehicles in Q1, FY23, is also banking on the festive season. “We have continued to introduce new products and variants at regular intervals, resulting in the sustenance of consumer excitement for our products. We are expecting strong festive sales this year, starting with Onam, by offering customers an immersive ownership experience both online and offline, said Rajan Amba, VP, marketing, sales and customer care, Tata Motors Passenger Vehicles.

Financiers on their part are bullish about the launches. “This time around, the situation is a bit different. In the past, in the run-up to the festive season, financiers and dealers would work together with the auto OEMs to attract customers with attractive incentives and finance schemes. This time, with the inventory availability being low, there is no requirement to offer schemes,” said Ramesh Iyer, VC & MD, Mahindra Finance.

While the demand outlook is strong, the supply-side challenges continue on account of parts shortages. This, however, is not expected to impact product launch strategies.

While the demand-supply gap will remain even in the festive period, some manufacturers are doling out exchange bonus benefits to keep up the demand momentum. “We have rolled out consumer offers in the range of Rs 20,000-40,000, depending on the model and trim,” said Tata Motors’ Amba.

Hero MotoCorp, which has been facing pressure on entry-level sales, said on the product front, the company was adding new and upgraded products to attract customers. “With the forecast of a normal monsoon, and encouraging farm activity, we expect a positive turnaround in sentiment and market demand,” said a company spokesperson.

Similarly, Honda Motorcycle & Scooter India (HMSI) is considering an entry level low-end motorcycle in the commuter segment. “The development is going as per plan,” said Atsushi Ogata, managing director, HMSI.

Federation of Automobile Dealers Associations (FADA) president Vinkesh Gulati said the launches are a last push by ICE (internal combustion engine) two-wheeler makers to ensure they don’t fall any further in sales.