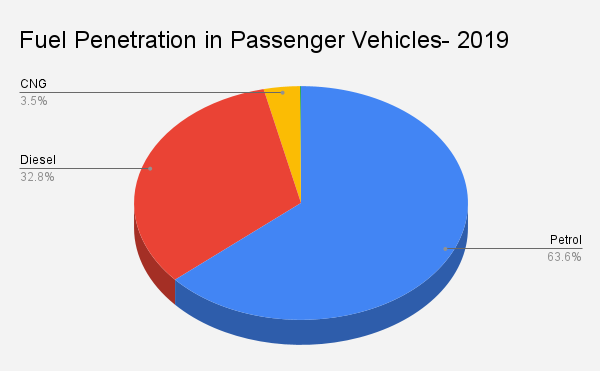

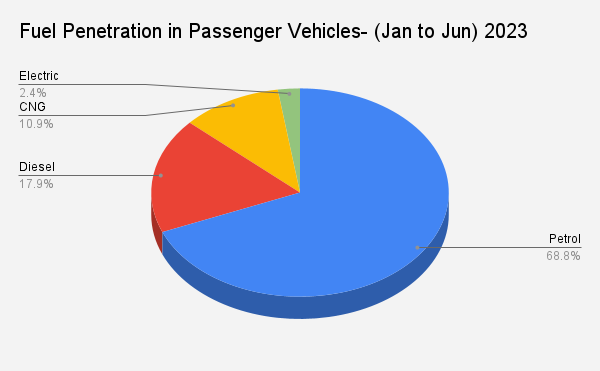

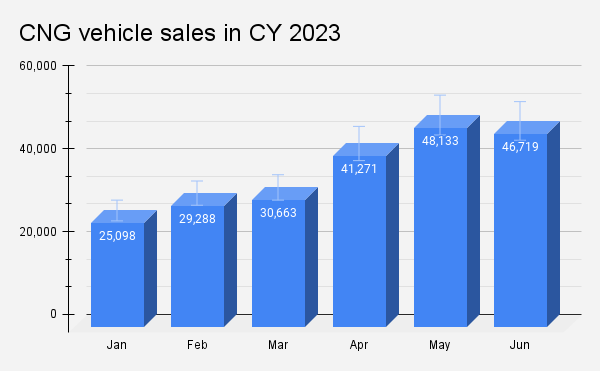

New Delhi: The share of compressed natural gas (CNG)- powered vehicles has gone up from about 3.5% of total passenger vehicle (PV) sales in CY 2019 to 11% in CY 2022, marking a growth of over 3X in three years. In 2019, the industry sold about 1.02 lakh CNG vehicles in the country, which has gone up by 31% to clock 4.21 lakh units in 2022.

Over the last few years, the sales volumes of diesel vehicles have also dropped while the share of electric vehicles (EVs) has gone up. Experts suggest the trend is expected to continue.

CNG price revision expected to keep up the momentum

Over the past one year, there had been a spurt in prices of CNG, led primarily by the hike in prevalent natural gas prices. Factors such as increase in blending cost and depreciation of the Indian Rupee also contributed to multiple price hikes.

In April 2023, the Cabinet Committee on Economic Affairs (CCEA) approved a new pricing plan by fixing domestic CNG price at 10% of the monthly average of Indian Crude Basket and notified monthly. The revised structure reduced CNG price by up to 10% across cities. It is expected to limit material increases as the Cabinet has set a ceiling price for gas produced from ONGC, OIL and nomination blocks.

The Government set an aggressive target to ramp up the number of CNG fueling stations across the country to 17,700 stations by 2030. CNG fueling infrastructure has been improving across the country, with a better fuel availability in Tier-II cities as well.

Given the increasing popularity of CNG variants, leading OEMs have been increasing coverage of CNG across their product portfolio. The growth in its penetration also help the OEMs meet the Corporate Average Fuel Economy (CAFE) norms. For the first six months of 2023, the sales of CNG models for the industry stands at 2.21 lakh units.

Ratings agency ICRA estimates CNG powertrain penetration in the industry to increase to levels of about 18% by CY2027, from about 11% in CY2022.

Shamsher Dewan, Senior Vice President & Group Head – Corporate Ratings, ICRA Limited, said that the new gas pricing policy has brought down CNG prices to levels seen nearly a year ago, thereby providing relief to the consumers. Rising gas prices slowed down the adoption of CNG powertrains in H2 CY2022, led by a decline in the running cost differential between petrol and CNG powertrains and a consequent increase in the payback period for the latter.

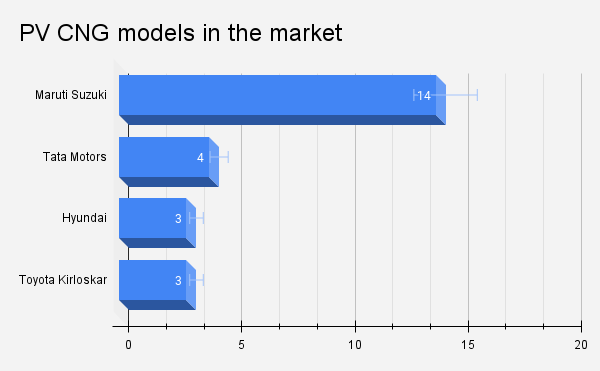

Currently, the Indian passenger vehicle industry has four major OEMs offering a total of 24 CNG models in the country.

Maruti Suzuki leads with CNG models across range

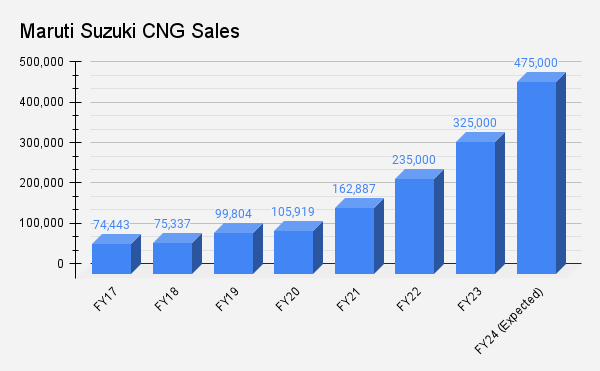

Country’s largest carmaker Maruti Suzuki India Limited (MSIL), which started its CNG journey in 2010, has increased its CNG penetration in the sales by over 4X in the last 6 years. In FY17, MSIL CNG vehicle sales were a little more than 74,000 units. This has gone up to 3.25 lakh units in FY23.

The carmaker offers CNG as an option in 14 of its 18 models. It clocked highest-ever quarterly sales of CNG vehicles at over 1.13 lakh units in the April-June 2023 period. The CNG penetration increased to about 27%.

Shashank Srivastava, Senior Executive Officer- Marketing and Sales, Maruti Suzuki, said, CNG penetration is largely dependent on three factors — availability of CNG fuel pumps, relative price difference between gasoline and CNG fuel, and the consumer experience.

“For FY24, our CNG sales target is 4.5 lakh to 4.75 lakh units, a share of about 27%. Our long-term goal is to increase CNG share to about 33% in our portfolio” Srivastava said.

CNG is also helping the automaker to maintain a stronghold after it stopped the sales of diesel vehicles on March 31, 2020, a day before the implementation of the Bharat Stage -IV norms Phase-I. The maker of Grand Vitara has also taken the hybrid route in the midsize SUV segment, where players like Hyundai Creta, Kia Seltos, amongst others, are seeing good volumes come from diesel.

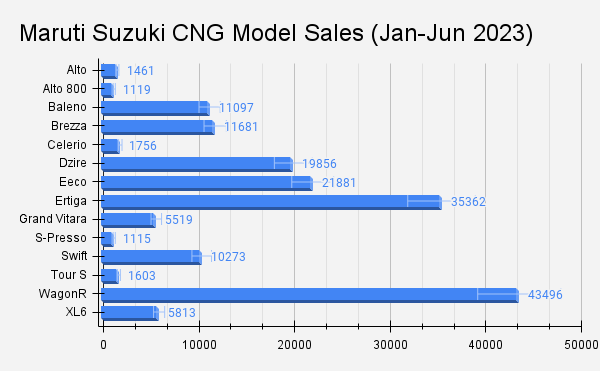

WagonR remains its best-selling CNG model, followed by Ertiga MPV. On an average, Maruti Suzuki’s CNG sales constitute 78% personal buyers and 22% private taxi sales, however it varies depending on the model.

The automaker discontinued the production of Alto 800 in March this year. However, its recently launched Fronx comes with a CNG powertrain option.

Tata Motors goes innovative, frees up boot space

Tata Motors, which entered the CNG space with Tiago and Tigor in January 2022, currently offers the option in four models, including Tiago, Tigor, Altroz and the recently launched Punch. The CNG penetration stands at over 40% for Altroz, 55% for Tigor, and about 20% for Tiago.

The market leader in the EV space currently enjoys 8% share of CNG in its portfolio. “By the end of the year, our aim is to reach 14%. Furthermore, we are aiming for about 25% share from CNG market by 2030. As we introduce more models, the CNG penetration will increase. We want to take up the CNG penetration equal to that of EVs,” Vinay Pant, Chief Marketing Officer, Tata Motors Passenger Vehicles, said.

Share of Tata Motors sales from different powertrain options in Q1 FY24

In May this year, Altroz became the first model from the company to get the first CNG-powered hatchback to offer a sunroof, and also debuted the automaker’s new dual-cylinder setup for CNG tanks. While the CNG tanks usually take up the boot space, Tata Motors has placed the two 30-litre CNG tanks under the boot floor in a way that it frees up some boot space.

This arrangement could be a setback for Maruti Suzuki, which is therefore also working on a “fresh design for better availability of boot space”, to improve the customer driving experience.

Early this month, ETAuto reported how Tata Motors is targeting to equalise its CNG share with EV sales.

Hyundai takes entry-level route

The country’s second largest carmaker offers CNG options in entry level products like Grand i10 Nios, Aura and the recently launched Exter. CNG powered mass-market models contribute to nearly 10% of Hyundai’s total sales. CNG sales as a percentage of overall sales is the highest for Aura at 72%.

CNG penetration in Hyundai models

| Aura sedan | Exter SUV | Grand i10 Nios Hatchback |

| 72% | 14.5% | 14.4% |

Tarun Garg, Chief Operating Officer, Hyundai Motor India, said, “India is a diverse country where a ‘one-shoe-fits-all’ philosophy does not work, as customer preferences vary region to region and in urban and rural markets. Overall CNG sales have grown in the past 2 years and it is expected that going forward too, the sales momentum will continue.”

Hyundai is offering the CNG option in the entry level models of each segment. “The (entry-level) segment comprises buyers who expect a Value-For-Money (VFM) proposition from their automobile purchase, with significant prominence placed on the cost of running, which is lower in the case of CNG. However, customer preferences in the upper segments differ from mass- market, volume in these segments is driven on the basis of elevated convenience through premium features,” Garg said.

Toyota Kirloskar joins CNG marathon

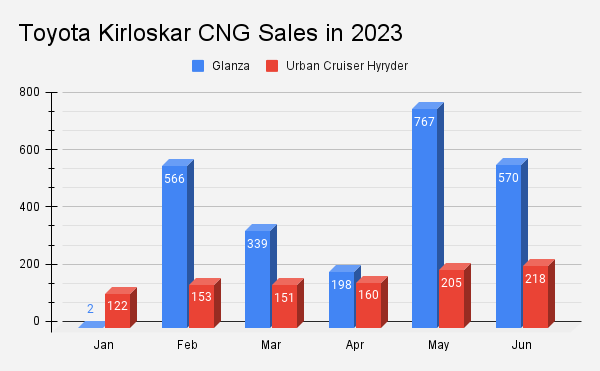

Toyota forayed into the CNG market in November 2022, with two models Glanza and Urban Cruiser Hyryder, both are products of the Toyota-Suzuki global pact.

In August, the company unveiled the seven seater Rumion with CNG powertrain option. The model is a rebadged version of the Maruti Suzuki Ertiga.