By Kaushik Narayan

The commercial vehicle (CV) industry is off to a very strong start with an impressive 77% growth during April – August. The revival in this period was led by the bus segment followed by the Medium & Heavy Commercial Vehicle (M&HCV), Intermediate & Light Commercial Vehicle (I&LCV) and the Small Commercial Vehicle (SCV) segments.

In the first 5 months of FY23, the top 5 manufacturers have sold 3.6 lakh vehicles against the sale of 7 lakhs for the full year last year. A combination of uptick in demand usually seen in H2 fuelled by a strong Festival season leaves the industry to have a breakout year in FY23.

The industry indicators like OEM sales, consumption signals, freight demand, truck utilisation and freight rates help us understand better the CV industry performance and health of the industry. We also look at the major trends that drive the CV and logistics industry.

Sales summary

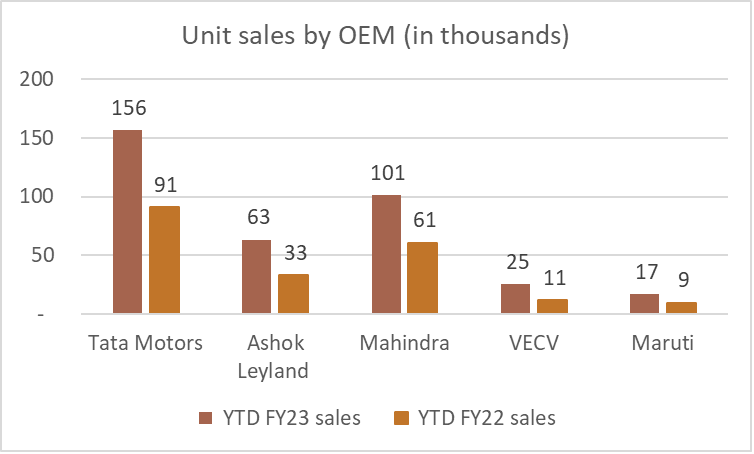

Sales by OEM: The overall industry grew 87% YOY against a low base (due to the impact of Covid last year). The top 5 manufacturers clocked 3,63,000 units in Year to date (YTD) of FY23 vs. 2,06,000 lakh units in the same time last year. Tata Motors has assumed its dominant position at the top of the CV Industry with Mahindra retaining the second place followed by Ashok Leyland, VECV, and Maruti Suzuki.

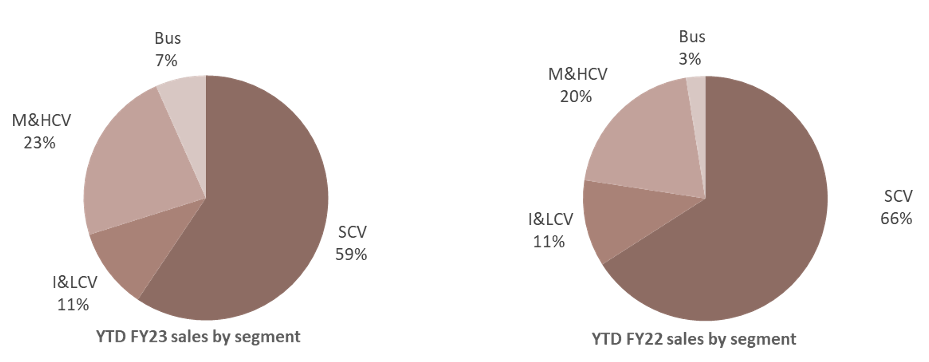

Sales by Segment: SCVs retained the leadership by segment in terms of unit sales. However, the M&HCV segment and the bus segment both posted impressive growth in contribution to overall industry volumes. The bus segment rebound was driven largely by the school segment. The I&LCV segment contribution continued to remain strong with a small growth this year. Tata Motors was the market leader in I&LCV, M&HCV and bus segments and came in a strong second behind Mahindra in the SCV segment.

Economic Indicators

Macro indicators: The Indian economy continues to remain strong despite global challenges. The war in Ukraine and a resulting global recession will also have an impact on India. It has led to high crude oil, cooking oil and commodity prices which have in turn led to high inflation. With the RBI actively increasing interest rates, inflation has plateaued. However, despite these challenges, India is on track to end the year with a growth of 5% to 7% and is expected to finish the year as the fastest growing country in the world this year.

Consumption demand: FMCG companies, who are good indicators of household demand have reported healthy growth in the first half of the year. The automobile industry has also had a good start to the year; the 2-wheeler and 3-wheeler industries have resumed growth and most OEMs in the car industry are currently seeing significant waiting periods for fast moving models. Parcel services and E-commerce continue to grow along with agricultural goods. Consumption of capital goods including mining, cement and steel have also resumed after a long hiatus which bodes well for operators.

Freight Demand

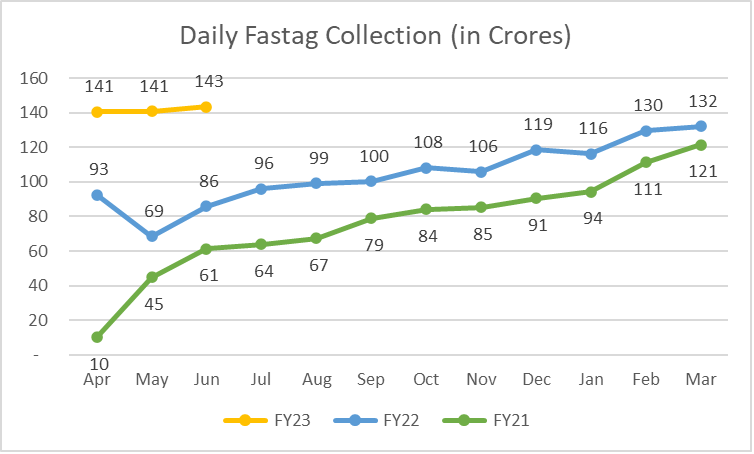

Fastag Receipts: Fastag collection continued to stay strong in H1 this year. The average daily collection in Q1 was 72% higher than that from the same period last year. The consistency of Fastag collection in Q1 at around Rs.141 crores per day and the growth over both the same period last year and a strong Q4 average of Rs. 126 crores per day bodes very well for freight demand in FY23. Fastag receipts carry a strong correlation with freight traffic since a vast majority of collection comes from the CV industry.

E-way Bills: E-way bills are documents issued for movement of goods interstate or intrastate. E-way bills generated in the first 4 months of the year grew by over 38% vs. the same period last year (30 crore bills FY23 vs. 21.7 crore bills in FY22). More importantly, E-way bills generated in each of the first 4 months fell within 6% of the all time high of 7.81 crores achieved in March 2022. Freight demand has consistently remained strong in H1 of FY23.

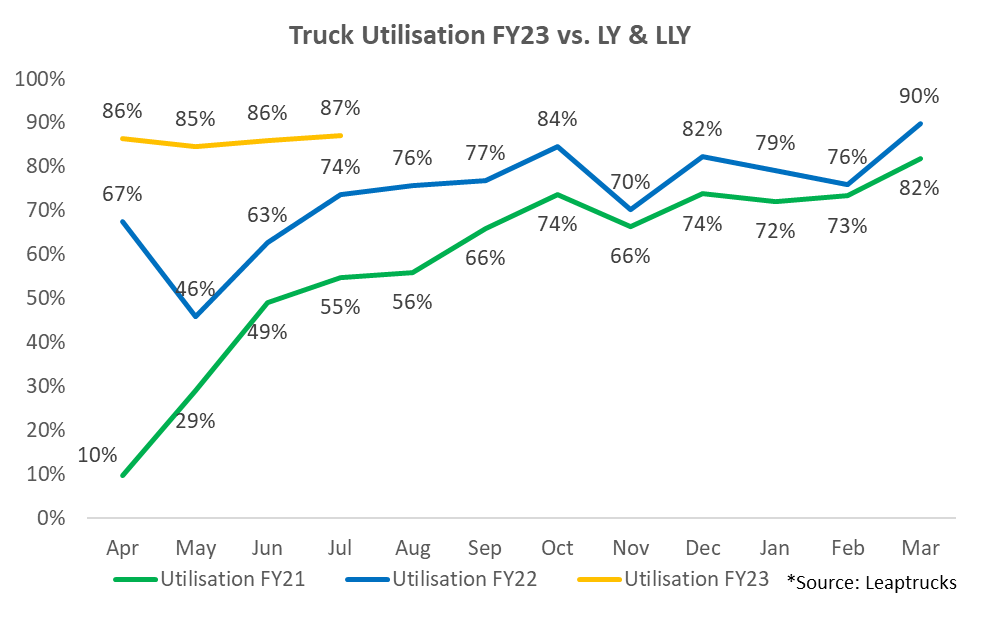

Truck Utilisation: Truck utilisation has also remained high in FY23. In the first 4 months of the year, Leaptrucks estimates utilisation to have averaged a very healthy 86%. This is considerably higher than utilisation levels seen in the past 2 years and has also crossed the utilisation levels seen in Q4 last year. High utilisation levels ensure that trucks spend more time running and earning money for operators with low idle time. This ensures that operators remain profitable and financially healthy.

Freight rates, operator profitability

Steady freight rates: Freight rates continue to remain strong across most segments. The FreightSigns report recently published by CRISIL indicated that rates continued to remain strong in agricultural products, FMCG, market load, mining, cement and parcel / courier segments. Auto carriers, containers, petroleum tankers, steel and textile segments are yet to see significant improvement in rates. CRISFrex, the CRISIL index tracking freight, has also remained consistent over the last 3 months thanks to stable diesel prices despite fluctuations in crude.

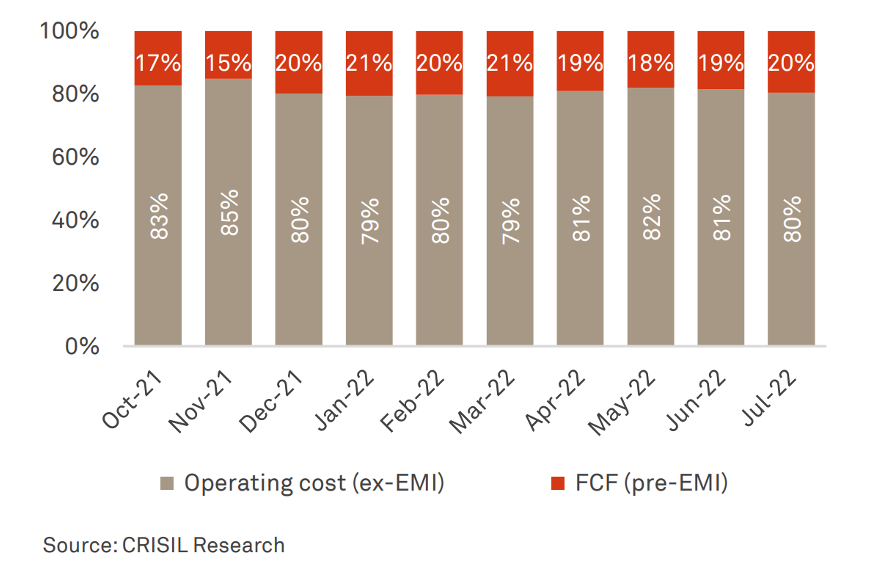

Healthy free cash flows and operator profitability: The free cash flow of operators has remained steady over the past 8 months. Steady demand, higher utilisation and improved freight rates have all contributed to free cash flow pre-EMI (Finance costs) of nearly 20%. Higher utilisation of trucks and steady profitability for operators will continue to drive demand for CVs in H2.

CV industry trends

Impact of macro-economic factors on operators. Low impact of rising interest rates: Interest rates have risen 3 times in 2022. Rising interest rates have impacted financing costs and in turn the EMI of operators. However, as long as freight rates remain steady and utilisation remains high, the impact of higher interest rates will not significantly impact CV industry volumes.

Easy availability of credit: All banks and NBFCs have posted excellent results in the recently concluded quarter and have brought their NPAs under control. The CV industry provides a great opportunity for both banks and NBFCs to disburse funds. NBFCs and banks that were cautious in FY22 have turned aggressive. Others that had a very poor penetration in the CV industry are also ramping up their presence leading to easy availability of credit at attractive Loan to Value (LTV) ratios for CV buyers.

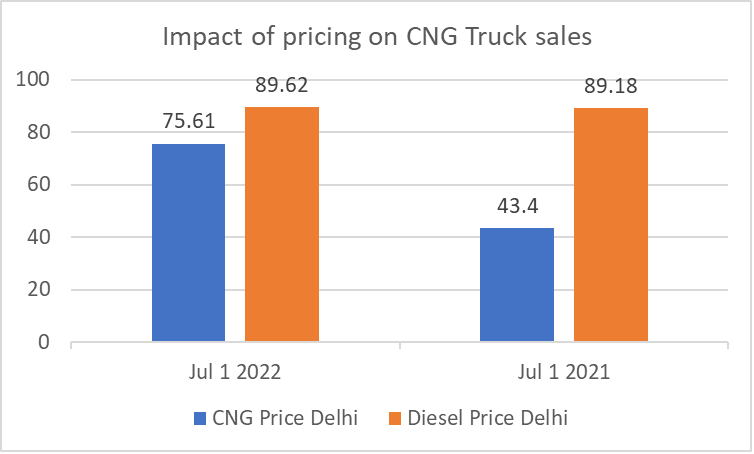

Lower demand for CNG vehicles: The penetration of CNG trucks in SCVs and I&LCVs had grown to nearly 30% of the overall CV industry in Q2 and Q3 FY22. In Delhi, the price difference was almost INR 46 last year. This year, the price differential is down to INR 14. In many other markets across India, the differential is even smaller at INR 5 or lower. Over 30% to 40% of customers had transitioned to CNG trucks in the SCV & I&LCV segments last year due to the price differential. However, more customers have returned to diesel trucks in FY23.

OEM Performance

Lower raw material prices: Steel and aluminium prices have softened starting Q1 FY23. It is roughly estimated that 65% or more of truck prices can be directly attributed to raw material prices. However, OEMs have not yet been able to realise the positive impact of the price drop in Q1 and Q2. They expect a positive impact to profitability starting Q3 FY23.

High discounts: Customers across segments continue to enjoy high discounts. Intense competition and available capacity have put operators in a pole position while negotiating deals. It was recently reported that Tata Motors is working with McKinsey to improve profitability. We anticipate that all OEMs will actively reduce discounts in H2 which should positively impact their results.

Semiconductor supplies: The impact of semiconductor supplies has not seriously impacted the sales of the top 5 OEMs. We expect the impact to be limited for the rest of the year. However, Bharat Benz has seen challenges in supplies of its Heavy-Duty trucks due to limited availability of semiconductors.

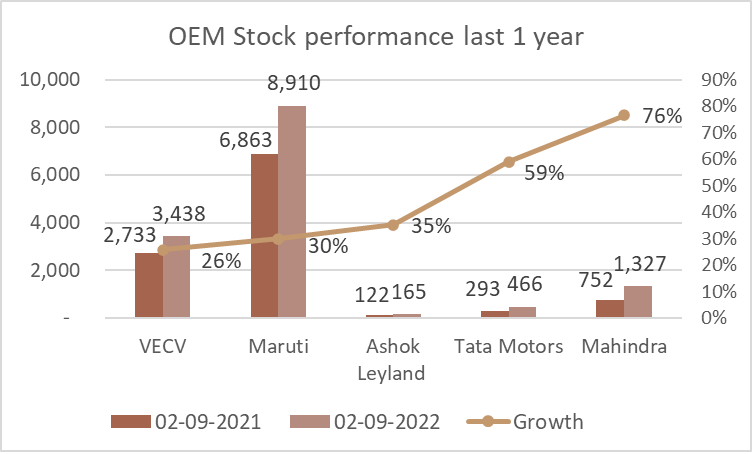

OEM stock performance: Auto OEM stocks have all been on fire recently. Most brokerages have been bullish on auto OEM stocks, especially passenger car OEMs since most of them are sitting on large back orders against successful new launches. Most OEMs with a major CV presence either have a large presence in the car segment like Mahindra and Tata Motors and Maruti, or like Eicher Motors that has a large presence in 2-wheelers. The only pure-play CV OEM is Ashok Leyland which has returned 35% over the past 1 year vs. the BSE Sensex that has returned 2% in the same period. At the same time, Eicher Motors has returned 26%, Maruti 30%, Tata Motors 59% and Mahindra a truly impressive 76%. We believe that these stocks have still not factored in the true growth potential in CVs in the current pricing.

Expected growth for the year: At Leaptrucks, we had estimated that the CV industry would have a strong year growing between 23% and 34% in FY23. We reiterate our estimate and anticipate the growth rate to settle closer to the higher end of our estimates based on trends witnessed in H1 this year.

(Disclaimer: Kaushik Narayan is CEO of Leaptrucks. It is a leading platform for the sale and purchase of used trucks, buses and construction machines in India. Views are personal)

Read Also: