New Delhi: Unlike passenger vehicle and two-wheeler that showed impressive sales growth, the domestic three-wheeler market, which is one of the largest in the world, is still having a difficult time in terms of sustaining businesses on the ground. With a consistent sharp decline in domestic sales by over 80% in the first half of FY21 ended September, the domestic three-wheeler industry seems to be in a perilous state, underscoring the COVID-19 fallout on shared mobility.

New Delhi: Unlike passenger vehicle and two-wheeler that showed impressive sales growth, the domestic three-wheeler market, which is one of the largest in the world, is still having a difficult time in terms of sustaining businesses on the ground. With a consistent sharp decline in domestic sales by over 80% in the first half of FY21 ended September, the domestic three-wheeler industry seems to be in a perilous state, underscoring the COVID-19 fallout on shared mobility.Increased preference for personal mobility, fear of infection from vehicle sharing, drastic fall in the last-mile transport requirements with the closure of offices, schools and other public places, together with the inherent financing problems and price hike after the transition to BS-VI are the stumbling blocks for three-wheeler market.

Even festival buying or pent-up demand failed to bring any cheer in the three-wheeler passenger and commercial vehicle market. Sales by Bajaj Auto and Piaggio, the two leading manufacturers of three-wheelers in India, crashed 65% and 55.5%, respectively in October. Together they account for about two-thirds of the overall three-wheeler sales in the country.

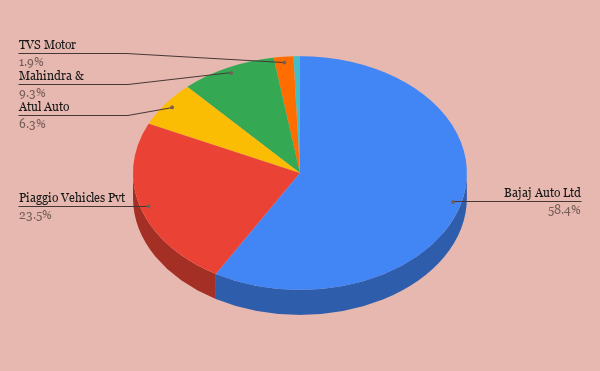

COVID IMPACT: BAJAJ AUTO LOST MARKET SHARE TO RIVALS

Between April and September, three-wheeler domestic sales stood at 84,849 units as compared 397,681 units, witnessing a decline of 78.66%, according to the Society of Indian Automobile Manufacturers (SIAM). While passenger carriers which constitute more than 80% of the total sales volume, tanked by 85% at 49,544 units, cargo segment posted a relatively lesser downfall of 48% at 35,305 units during the period under review.

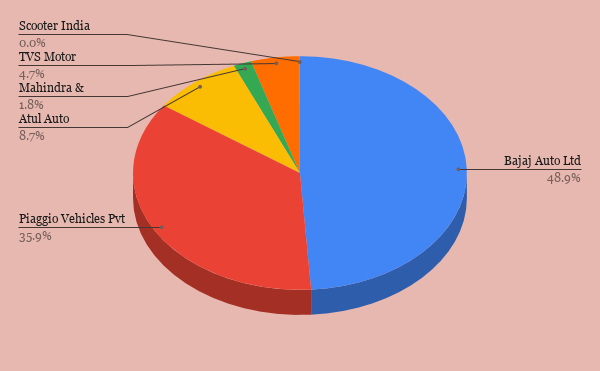

With passenger carrier demand refusing to pick up, the most dominant player of the segment Bajaj Auto with volumes of 28,701 units in April-September period lost market share by 950 basis points to be at 48.9%. A strong grip on the passenger carrier segment proved detrimental for the maker of Maxima Z as it not only saw more than 85% decline in its domestic sales in H1 but also lost its market share to rival Piaggio. Notably, Bajaj Auto’s market share contracted below 50% in H1 FY21 after a long time.

Meanwhile, Piaggio, the one with the second largest market share by sales volume, is singing a different tune. Even though its sales in H1 are down by 73% year-on-year at 21,035 units, the company was able to improve its market share by 1231 basis points to 35.86% due to a relatively strong portfolio in the cargo segment and the renewed demand for intra-city movement of small cargo.

According to Diego Graffi, Chairman and MD, Piaggio India, 70% of the company’s overall sales at present is coming from the cargo segment. “Due to consistent requirements in the e-commerce and grocery segment, we are seeing good traction in the cargo segment which has helped us in compensating the demand dearth. Now with the increased transportation of goods to rural and semi-urban areas we expect goods carriers sales to reach pre-COVID levels by next month,” he added.

FINANCE ISSUE, PRICE HIKE

This time around, the contraction in financing had impacted the sales of three-wheelers even before the pandemic. Analysts believe the three-wheeler segment could face about 50-55% decline in sales in FY21. They also indicated that things may only get worse before they can improve in the long run if the financing situation won’t improve in the coming months.

According to Ashutosh Tiwari, Head of Research, Equirus Securities the fear of infection has killed scope of steady earnings of three-wheeler auto drivers, particularly in passenger space, due to which loan defaults have increased at a massive pace in the last few months. Simply put, loan delinquencies occur when the borrower (in this case buyer of vehicle) fails to make repayments.

“Less usage of the vehicle means less income for the owner and he may not be able to pay the EMIs. In the past few months, delinquencies have gone up for three-wheeler financiers. In turn, financing agencies have become extremely cautious in three-wheeler financing due to this which is also impacting demand,” Tiwai mentioned. Notably, about 85-90% of three-wheelers in India are purchased through financing.

Company-wise sales in H1

| Company | H1 FY20 | H1 FY21 | %Change |

| Bajaj Auto Ltd | 193,131 | 28,701 | -85.14 |

| Piaggio Vehicles Pvt Ltd | 77,894 | 21,035 | -73 |

| Atul Auto | 20,741 | 5,119 | -75.32 |

| Mahindra & Mahindra | 30,670 | 1,029 | -96.64 |

| TVS Motor | 6,206 | 2,767 | -55.41 |

| Scooter | 2,054 | 11 | -99.46 |

| Total | 330,696 | 58,662 |

According to dealers, three-wheeler buyers are also bearing the brunt of massive price hikes post-BS-VI implementation. “The prices of three-wheelers in the diesel segment have shot up by about Rs 40,000-50,000. Due to this, the EMI payments of buyers have suddenly increased to Rs 8,500 from Rs 6,000 that resulted in postponement of purchase,” a Bajaj Auto dealer from the east region said on condition of anonymity.

Another dealer from Bihar said the uncertainty in the market will continue in the remaining months of this year as people are still reluctant to share a vehicle with another passenger due to the pandemic. “Not only are most people staying home, but those who do need to travel are wary of using shared vehicles. Certain pockets have imposed permit restrictions on passenger carriers which is further dampening the sales. Cargo segment has been our support all this while,” said Suyash, a Piaggio dealer, from Motihari district in Bihar. He mentioned that monthly retail sales of his dealership have come down to 70 vehicles from 250 vehicles in January.

As per analysts, in order to sustain this doom and gloom in the longer term, companies are focussing more on exports. Shruti Saboo, Associate Director, India Ratings and Research, indicated that OEMs are pushing their exports significantly and also eyeing new areas of expansion in the overseas market. “Currently many companies are exporting more in order to mitigate the losses of the domestic market. As there has been no clear indication on re-opening of corporate places we will continue to see strong export momentum within three-wheeler space in the upcoming months,” she added.