Higher realisations and benign input prices will help offset the impact of 4%-6% volume decline, and enable a 6%-8% growth in operating profits for tyre manufacturers in fiscal 2021, the agency said in a report.

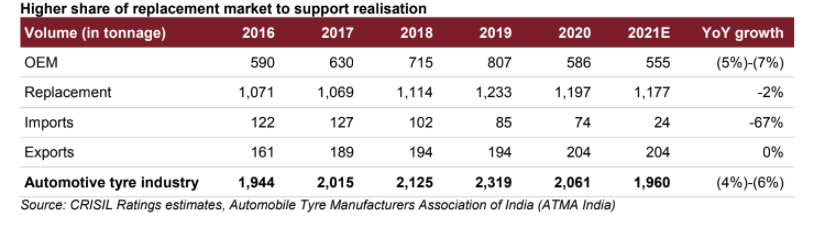

CRISIL Ratings analysed India’s top six tyre manufacturing companies, which account for about 80% of the automobile tyre sector’s INR 60,000 crore revenue. According to the analysis, phased implementation of capital expenditure plans will ensure a stable credit outlook for the tyre manufacturers. The sector derives 28% of its volume (in tonnage terms) from original equipment manufacturers (OEMs), 58% from the replacement market, 10% from exports, and the rest from imports.

Tyre offtake by OEMs is seen skidding ~5%-7% this fiscal primarily on account of a sharp decline in demand from the commercial vehicle (CV) segment, the report noted. However, this would get partially offset by robust demand from the tractor segment.

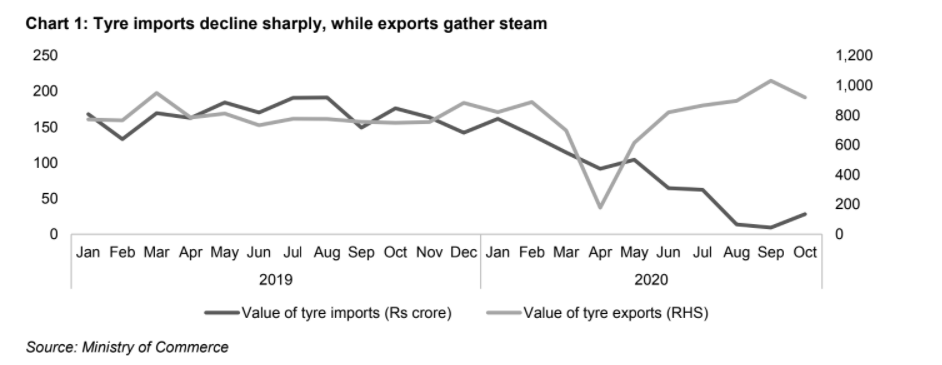

“Improved realisations on account of increased share of replacement demand (to 60% from 58% in fiscal 2020) and exports, which command better prices, will drive the increase in operating profits of tyre manufacturers this fiscal. Tyre makers have also increased domestic market prices after imports were placed on a restricted list in June 2020. The average realisation per tonne of tyres is expected to increase 4% to 5% this fiscal,” Anuj Sethi, senior director, CRISIL Ratings, said.

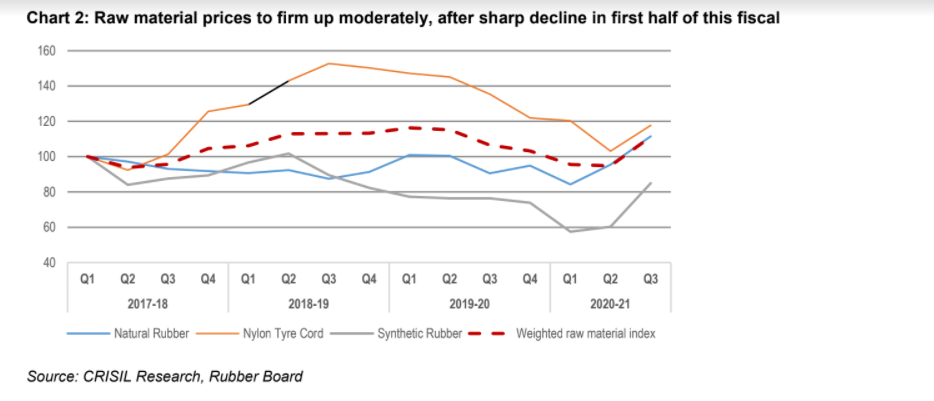

Though prices are expected to firm up moderately in the second half on account of lower global production of natural rubber and increase in crude prices, overall input cost will still be lower this fiscal, CRISIL said.

The rating agency highlighted that higher realisations and lower input cost will improve the average operating margin of tyre manufacturers by 100-120 basis points to about 14% this fiscal, leading to an average 6%-8% increase in operating profit.

Added to this, capital expenditure (Capex) is expected to remain modest this fiscal. As against the planned Capex of about INR 18,000 crore over fiscals 2021-23 (compared with INR 18,500 crore over fiscals 2018-20), Capex of less than INR 1,000 crore was incurred during the first half of this fiscal, and the companies are likely to exercise caution in stepping up capacity, given sufficient available capacity and uncertainty around the pandemic.

“The credit outlook for tyre manufacturers would remain stable over the medium term, supported by the likely phasing out of Capex plans and steady accruals.Gearingand interest coverage for the sample set is expected at around 0.5 times and 6-7 times, respectively, over the medium term, similar to the levels seen in fiscal 2020,” CRISIL said.

The extent of demand recovery, especially for CVs, and change in regulations regarding tyre imports, will be the key monitorables. Exports could benefit further if the US implements the proposed anti-dumping duty on select Asian countries, constituting 30% of US tyre imports.