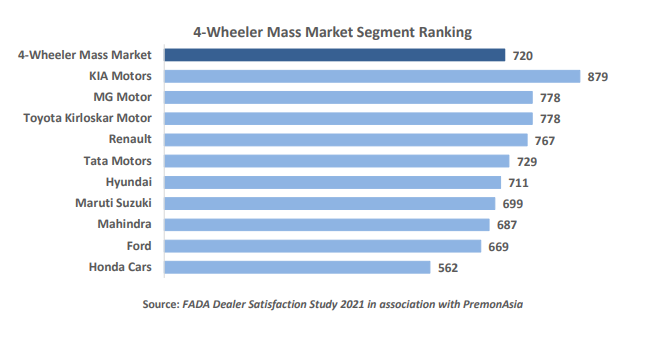

New Delhi: Korean car maker Kia Motors ranked first in terms of its dealer satisfaction in India, followed by MG Motor and Toyota Kirloskar Motor, as per a dealer satisfaction survey report released by the Federation of Automobile Dealers Associations (FADA) on Thursday.

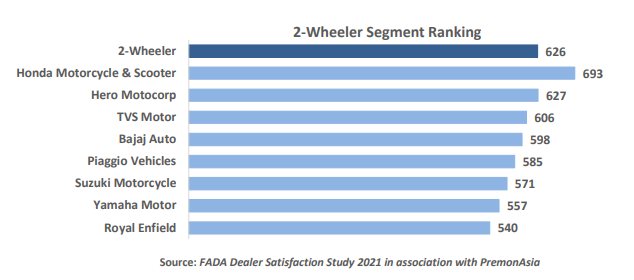

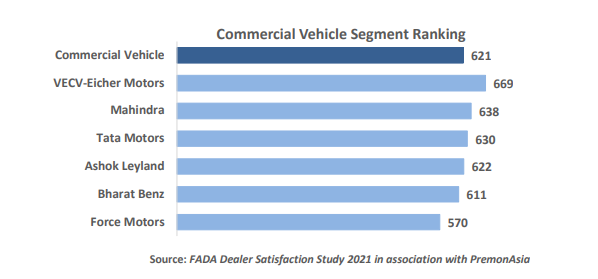

Honda Motorcycle & Scooter India (HMSI) emerged as the top most OEM in terms of dealer satisfaction in the two wheeler segment, and VECV-Eicher Motor in the commercial vehicle segment, the study said.

Maruti Suzuki India Limited (MSIL) and Hyundai Motor India ranked seventh and sixth respectively.

The market leaders have a widespread retail network across the country when compared with the more recent car makers Kia and MG who entered the Indian automobile market in 2019. Their product portfolio is also limited to three models each.

According to FADA, the luxury car segment was led by BMW and Mercedes Benz at number one, followed by Audi and Land Rover.

The study noted that In the four-wheeler mass market segment, dealers raised their concerns about OEMs not being receptive to their inputs for keeping viable and long term policy in mind while in the luxury car segment, the study found that training cost sharing arrangement by the OEMs was unsatisfactory and OEMs ability to fulfill vehicle order in correct specifications and quantity coupled with non-flexibility to choose workshop equipments were cause of major concerns.

The dealers’ lobby body claims that it took more than 2,000 samples for the study which was conducted in collaboration with a Singapore consumer-insight led consulting and advisory firm, PremonAsia “to examine the health of the relationship between auto dealers and their OEMs.”

FADA highlighted that at the overall industry level, viability Is the biggest concern of auto dealers across all segments of the Industry. Dealers attach a high importance of 27% on business viability, where OEMs need to exhibit greater sensitivity, particularly since the current satisfaction level on this factor is weak.

Honda Motorcycle & Scooter India (HMSI) emerged as the top most OEM in terms of dealer satisfaction in the two wheeler segment. This was followed by Hero MotoCorp, TVS and Bajaj Auto at second, third and fourth positions respectively.

“For the two wheeler segment, the biggest concern which the study highlighted was OEMs were not open to dealer inputs in terms of improving dealership cost structure from viability and policy point of view along with providing no support from OEMs on buy back of dead stocks of parts. However, the OEMs were fair in acceptance and rejection of warranty claims,” said FADA.

Vinkesh Gulati, President, FADA, said, “OEMs need to be cognizant of the evolving dealer expectations. While issues of concern such as dealership viability, support on sales and aftersales, openness to dealer inputs in decision making and designing long term policies are fundamental needs, there are clear signs that dealers expect their respective OEMs to go beyond.”

“For example, there is a need to have technology solutions and analytics to intelligently mine transaction data for business gains. Also, creating a digital platform to measure the effectiveness of marketing expenditure is reflective of a changing mindset,” Gulati added.

Rajeev Lochan, founder & CEO, PremonAsia, said, “The industry average satisfaction score of 657 indicates that OEMs have a significant headroom to improve in meeting the needs of their channel partners, particularly for the 2-wheeler and commercial vehicle segments. Kia Motors’ performance is commendable with segment and industry leading ratings across all the factors. Not only are Kia’s dealers satisfied with most of the hygiene needs, but they are also truly delighted with the product and their business viability.”

C S Vigneshwar, secretary, FADA, said, “The survey being filled entirely by the Dealer Principals, or their CEOs is a testimony of its accuracy and coverage of all aspects of dealerships in detail. DSS 2021 also has an equal distribution of samples from all 4 zones coupled with the right urban and rural mix.”

In commercial vehicles, VECV-Eicher Motor was ranked number one, ahead of Mahindra & Mahindra, Tata Motors and peers. The study for the commercial vehicle segment showed that while OEMs need to handhold dealers in improving sales efficiency & controlling cost of sales, they were quite happy about the overall product range and quality of fully built vehicles. Dealers were also satisfied as they could directly communicate with OEMs senior leadership team for discussing business viability and long term policies.

Read more: