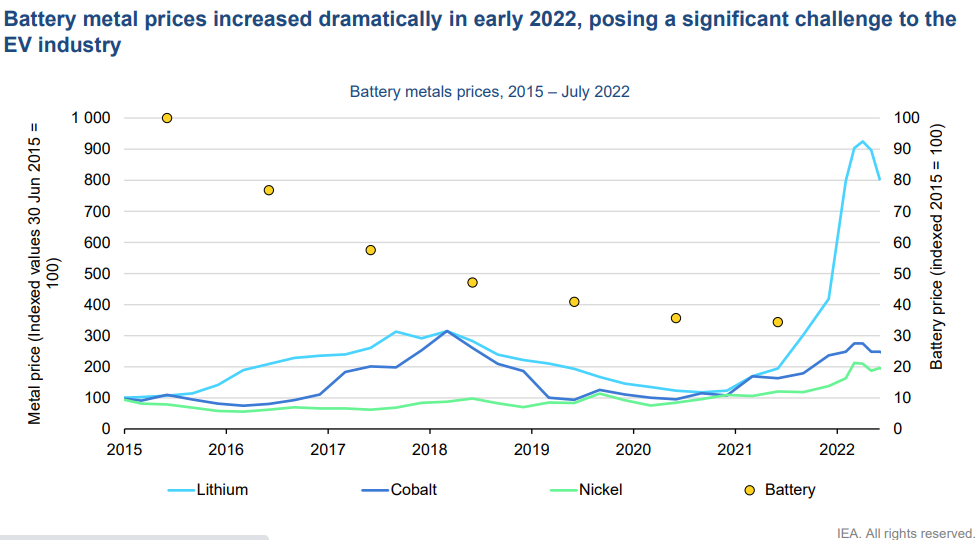

A surge in demand for electric vehicles worldwide along with increasing pressure on the supply chain of materials that go into EV batteries has seen an unprecedented rise in prices of those same materials this year. In the first half of this year, prices of lithium have jumped over 7 fold while cobalt prices have more than doubled and nickel has almost doubled. What is worse, this is likely to be a recurring theme in times to come as mass adoption of EVs takes off putting pressure on the supply chain that cannot cope with the demand.

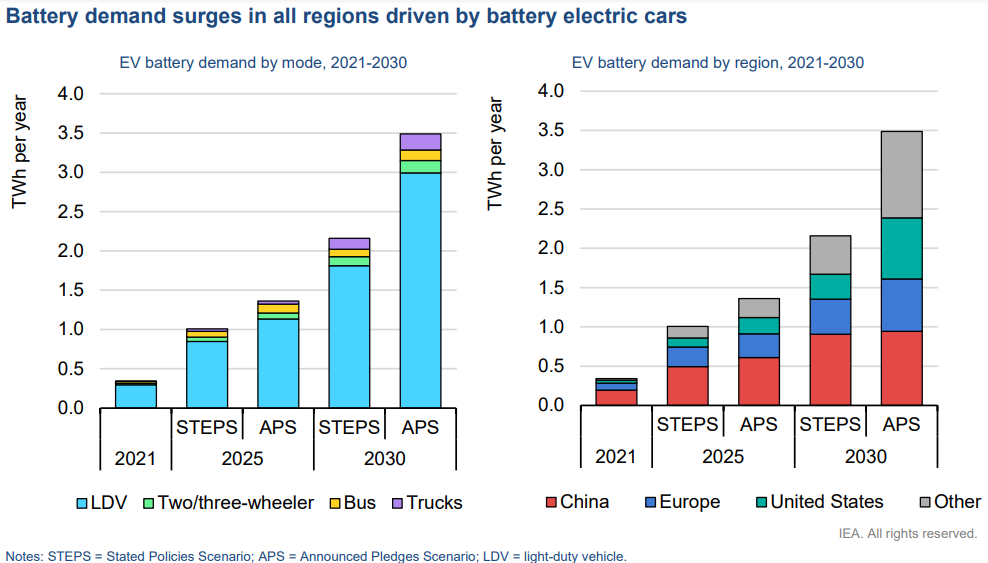

A recent report “Global Supply Chains on EV batteries” by Paris based autonomous intergovernmental body International Energy Agency (IEA) has highlighted the pressing need for massive investments in mining and processing of key battery raw materials if the highly likely scenario of an intense demand supply mismatch is to be averted. The report claims battery demand from EVs is likely to go up to conservative estimate of 2200 Gigawatt-hour (GWh) by 2030 and an aggressive estimate of 3500 TWh from today’s 340 GWh.

“This is a more than sixfold increase from the production level in 2021 for the Stated Policies Scenario and a ten-fold increase for the Announced Pledges Scenario. Achieving such production levels requires the manufacture of an additional 52 gigafactories of 35 GWh annual production capacity in the Stated Policies Scenario and 90 gigafactories in the Announced Pledges Scenario,” the report said.

This would mean a commensurate increase in production of the three key raw materials–lithium, cobalt and nickel. Demand for lithium is slated to rise to 330 kt by 2030 as per the conservative estimate of the Stated Policies Scenario. This would be a four fold increase from 80 kt production in 2021. In the more aggressive Announced Pledges Scenario the demand would jump 6 fold to a record 500 kt. EV batteries were already responsible for almost half of global lithium demand in 2021 and the share would rise to between 70-80% by the end of the decade.

Similarly in the case of cobalt demand would rise 45% to 250 kt and for nickel by 60% to 4200 kt in the conservative estimate accounting for 25% and 20% of the total demand from EVs respectively by 2030. In the aggressive scenario, the numbers inflate further by 65% with the share of EV going up to 40% and 30% respectively.

“In order to meet this surge in lithium demand, around 30 new lithium mines are needed in the Stated Policies Scenario by 2030 and 50 new lithium mines in the Announced Pledges Scenario, assuming an average annual lithium mine production capacity of 8 kt,” the report said. “To meet the projected demand in 2030 in the Stated Policies Scenario, 41 nickel and 11 cobalt additional mines are needed – a significant scaling up requirement. For the Announced Pledges Scenario, 60 nickel and 17 cobalt new mines are required in 2030, (assuming average annual mine production capacity of 38 kt for nickel and 7 kt for cobalt).”

More importantly, all of this investment and expansion has to happen now. If not, the stated target of achieving net zero emissions in subsequent decades, would not be met.

“Demand is projected to increase by 30% per year for lithium, 11% for nickel and 9% for cobalt by 2030. By comparison, supply of lithium in the past five years has increased 6% per year, nickel by 5% and cobalt by 8%,” it said. “Therefore, meeting the Net Zero Scenario demand for electrification requires large investments in the supply of battery minerals – just as in all other clean energy technology sectors.”

“Pressure on the supply of critical materials will continue to mount as road transport electrification expands to meet net zero ambitions. Cell components and their supply will also have to expand by the same amount,” it added. “Additional investments are needed in the short term, particularly in mining, where lead times are much longer than for other parts of the supply chain – in some cases requiring more than a decade from initial feasibility studies to production, and then several more years to reach nominal production capacity.”

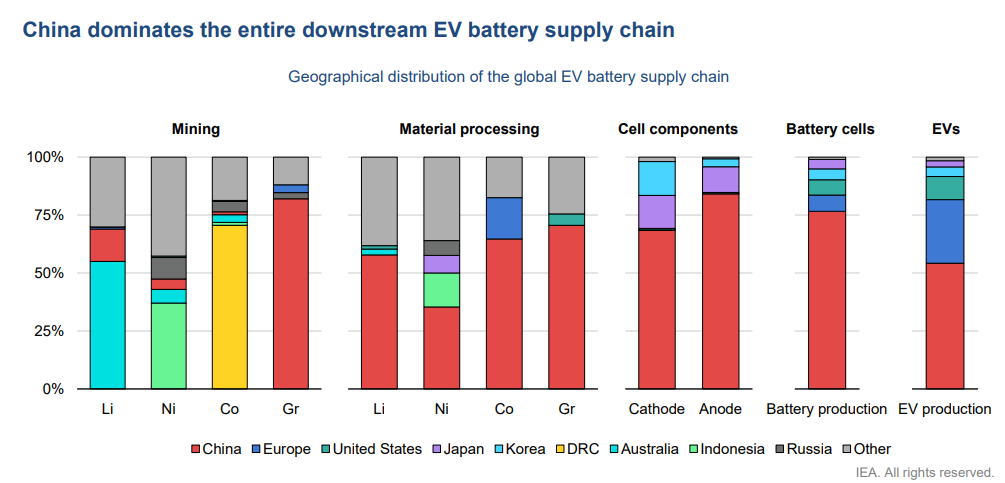

The report also highlighted the dominance of China in the entire value chain of battery materials. Currently, three-quarters of battery cell production capacity is in China, with the same for the specialised cathode and anode material production, where the dragon accounts for 70% of cathode and 85% of anode material global production capacity. Over half of global raw material processing for lithium, cobalt and graphite also occurs in China. Further, with 80% of global graphite mining, it also dominates the entire graphite anode supply chain end-to-end. With an EV battery production capacity of 655 GWh in 2021, China has a 76% share in global battery production capacity. It also has a head start over others in investments in advanced cell chemistries of the future like sodium-ion batteries.

“Governments in Europe and the United States have bold public sector initiatives to develop domestic battery supply chains, but the majority of the supply chain is likely to remain Chinese through 2030,” it said. “For example, 70% of battery production capacity announced for the period to 2030 is in China.”