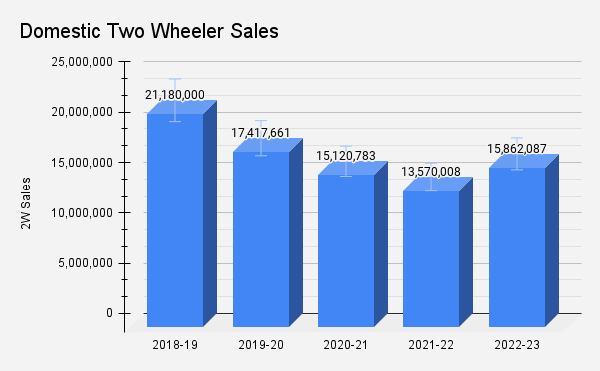

New Delhi: The domestic two wheeler industry posted a year-on-year double-digit growth in 2022-23 after three consecutive years of decline. It clocked 15.86 million units in the fiscal year ended March 2023, up 17% from 13.57 million in the last fiscal year. However, the segment is still at a 9-year low, recording sales below 2014-15 when it stood at 16 million units. The industry’s peak sales was recorded in 2018-19 at 21.18 million units.According to the Society of Indian Automobile Manufacturers (SIAM), the two wheeler segment has reported a negative CAGR of 6.97.

Analysts suggest that the retails continue to remain weak and demand for lower CC models has not yet picked up. Entry-level segments have witnessed a price hike of about 50% over the last three years, thereby adversely impacting the industry sentiments.

Rural economy is not showing signs of revival yet and it has not been able to spur any increase in auto demand. “The natural rural demand pull is only visible during the festive months. Despite good monsoons and better crop realizations, demand has largely remained subdued due to rising inflation and the high total cost of acquisition,” said Motilal Oswal.

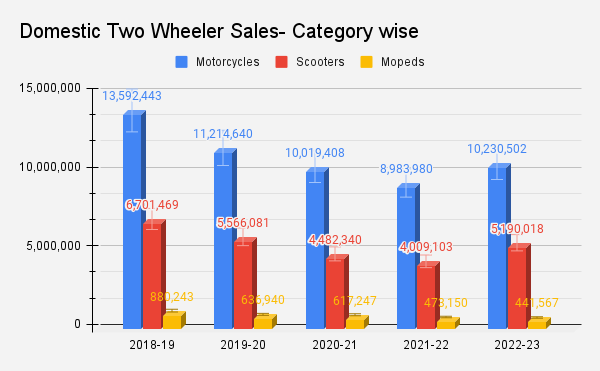

The scooter-focused OEMs face a shortage of stock at the dealer’s end, while motorcycle-focused OEMs have an inventory of 60-70 days, it said.

In the entry-level scooter segment (75cc-125cc), domestic sales have dropped to about 4.8 million units in 2022-23 from 6.66 million units in 2018-19. The entry level motorcycle category (75cc-110cc) sales also dipped to 5.23 million units from 8.42 million in 2018-19.

Analysts say that the industry needs to see 2-3 years of good per capita income growth with relatively muted or moderate inflation. For 2023-24, recovery of the entry level commuter segment looks challenging. However, they seem positive about the industry not reporting any de-growth from here onwards.

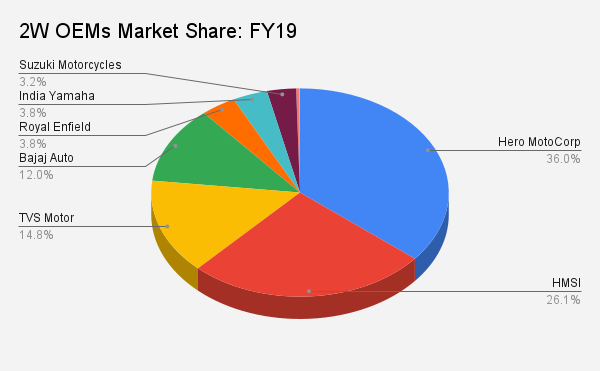

Hero, HMSI, Bajaj lose share; TVS, Suzuki gain

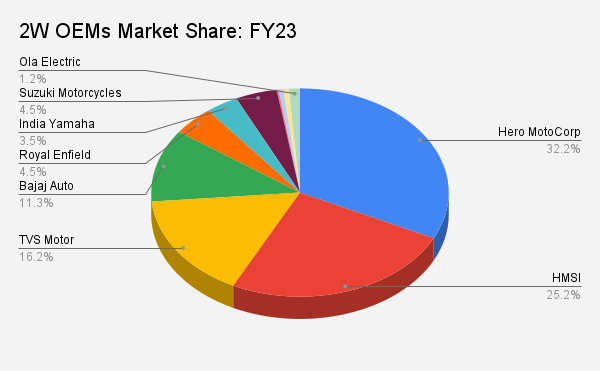

Compared to five years ago, domestic sales for all the mass market OEMs, but for Suzuki Motorcycles, were in the red. Hero MotoCorp which clocked 7.6 million in 2018-19 was down to 5.1 million units. HMSI also dropped from 5.5 million to 4 million units.

Hero also observed the highest drop in its market share from almost 36% in 2018-19 to 32% in 2022-23. The share of Honda Motorcycle & Scooter India (HMSI) and Bajaj Auto was down by one percentage point each.

During FY23, HMSI marked its foray into the commuter motorcycle market with Shine 100. The company has plans to launch 3 ICE and 2 EV models this year.

“We expect the domestic 2W industry to recover gradually and Bajaj Auto would witness market share improvement with better supply of components and new launches in successful Pulsar brand going ahead,” said Reliance Securities.

It may also be noted that about 5% of two wheeler sales during 2022-23 was electric. Back in 2018-19, the electric two wheeler models were negligible and did not eat up any share of the ICE market.

Electric two-wheelers penetration

According to the data shared by Society of Manufacturers of Electric Vehicles (SMEV), the industry sold 7,26,976 high-speed electric two wheelers (speed > 25 km/h) in 2022-23.

Hemal N Thakkar, Director – Consulting, CRISIL, said, “Sales of electric two-wheelers have definitely started to impact its ICE counterpart. While only 5% of the two wheeler sales come from EVs, in the scooters segment, it is at 15%. Going forward, the 110 cc segment of scooters will continue to remain under pressure from electric vehicles.”

CRISIL expects that if the supply side challenges do not occur, the electric two-wheeler industry in India should easily be able to clock 1.2 million unit sales in 2023-24.

The central and state governments have been critical in creating a demand momentum. However, the electric two wheeler adoption ended with an annual shortfall of more than 25% over the minimum target set by Niti Aayog and various research organizations, SMEV said.

“For demand to sustain even after the end of subsidies, prices of EVs have to come down, as 75% of the two wheeler market is price sensitive,” suggests Motilal Oswal.

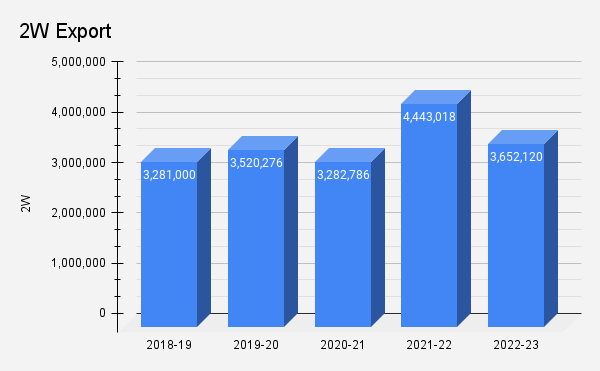

Export market

In 2021-22, two-wheeler exports were at an all-time high of 4.43 million units. However, during 2022-23, the shipments dropped 18% to 3.65 million units.

For market leader Bajaj Auto, exports dropped over 25% to 1.6 million units in 2022-23 as against 2.19 million in the previous fiscal year.

The largest markets for two-wheeler exports from India are Africa and Latin America, which together constitute about 60% of the share. Other countries include Bangladesh and Sri Lanka, amongst others. The South Asian countries went a little slow because of the issues that those economies themselves are facing.

Talking about Bajaj, Reliance Securities said, “On the export front, we have seen subdued performance over last 3 quarters due to inflation and currency devaluation in key markets, while it has stabilized from further deterioration now. We believe that though export has bottomed out and it would improve sequentially Q1 FY24 onwards, but pace of growth would be much slower and export volume would be about 25% below peak level in FY24.”

Analysts suggest that a few markets like Nigeria and other African markets were under pressure. However, these are gradually easing now and the scenario looks better since the past two months.

“We should start seeing a good momentum in exports in H2 FY 2022-23. The first half will continue to be under some pressure as the domestic manufacturing will also take some priority. Looking at how things are improving globally, exports may also post a marginal growth in FY24,” CRISIL said.

Outlook for FY24

ICRA estimates total two-wheeler volumes (including domestic and exports) to register a growth of 6-9% year-on-year in FY 2023-24 on a severely contracted base.

Shamsher Dewan, Senior Vice President & Group Head – Corporate Ratings, ICRA, said, “The domestic market is expected to drive the recovery with the export outlook remaining weak. Retail offtake, after remaining healthy during the festive season, lagged pre-pandemic levels over the past few months, dampening hopes of a sustained recovery. Rural demand remained weak, thereby impacting the entry level motorcycle segment, and its recovery remains key. Fears of impact of heavy rainfall on rabi yields and a possible El Nino occurrence on monsoon precipitation thus remain monitorable.”

CRISIL said that going forward, the commuter segment will continue to be under some pressure. But considering that the base has been fairly low and IMD forecasted a near-normal monsoon, 8% – 10% growth is expected for the industry in domestic sales, with the premium motorcycles category leading the momentum.

“This is also the second year post-Covid, when schools, colleges have opened up normally. So the commuter segment has also started to pick up, but then the entry level segment is going to face challenges because of the falling real income and rising inflation. We expect the two wheeler industry to reach peak sales of 21 million in 4-5 years,” said Thakkar of CRISIL.