Mumbai: More car buyers intend to buy hybrid vehicles as compared to electric as their next vehicle even as the former comes at a steep premium according to a study. Factors like charging time, availability of charging infrastructure and safety of battery technology continue to impede faster adoption to BEVs (battery electric vehicles) according to the findings of Deloitte’s 2024 Global Automotive Consumer Study.

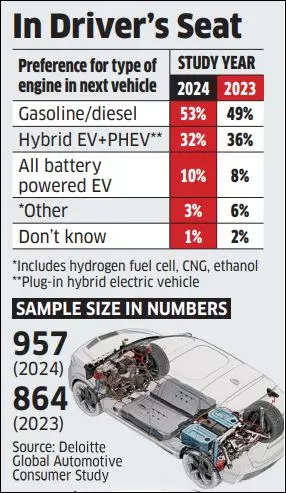

Close to 36% of the respondents surveyed in 2024 as compared to 32% in 2023 said they will prefer hybrids or PHEVs as compared to 10% for BEVs. Compared to 2023 the jump in the number of those favoring hybrids is 4 percentage points – double of what is seen among those likely to opt for EVs. Also, there’s an overall growing intent to buy a non-traditional engine vehicle-53% in 2024 compared to 49% in 2023 over petrol and diesel.

The intent to buy hybrids over pure battery electric vehicles comes to the fore even as EVs benefit from state as well as central government funded incentives which in turn has allowed manufacturers to price them better as compared to hybrids. This is despite the hybrids costing more than EVs. “People want to buy hybrids over EVs as it offers peace of mind that EVs can’t,” says Rajeev Singh, partner and consumer industry leader, Deloitte Asia Pacific.

PHEVs use batteries to power an electric motor and another fuel, such as petrol or diesel, to power an internal combustion engine (ICE). PHEVs can be charged using a wall outlet or charging equipment, by the ICE, or through regenerative braking.

“For a market like India, where charging infrastructure is still underdeveloped, the government should at least incentivize PHEVs which offer the benefits similar to an EV-can be charged at home and can be switched to the ICE mode in the event of the vehicle running out of charge,” he added. To be sure, owing to the policy thrust on EVs most automakers with the exception of the Japanese, are relying solely on EVs to attain the carbon reduction goals.

The Japanese manufacturers – Toyota, Suzuki and Honda are using a multi-powertrain strategy and have been asking for incentives to make hybrids more affordable. Even without the government, the incentives have continued to launch more affordable hybrid models which has helped in increasing the share of hybrids bringing it on par with EVs – from 0.5% in 2022 to 2% in 2023, as per industry estimates. Home-grown manufacturers like Tata Motors and Mahindra that have been investing heavily on EVs are against subsidizing hybrids.

The Deloitte study also shows that those intending to purchase an EV are not willing to pay significantly higher over ICE– 27% of the respondents intending to purchase ICE said they are willing to spend Rs15-25 lakh. This percentage was only 2 percentage points higher for those who intend to buy an EV. The trend is in contrast with a market like Japan where EV intenders are willing to pay a higher premium for EVs because of better affordability and environment consciousness, said Singh.

“In India, while buyers talk about environmentally friendly technology, not many are willing to pay when it comes to hitting the rubber to the road,” he said. For this reason, subsidies become important in bridging the gap. One of the reasons EV makers in India would want the incentives to continue over the next few years till EV penetration reaches 20%, he noted.