Carmakers have started offering discounts and freebies this fiscal after a hiatus of three years, hoping to entice new buyers and clear record inventory levels.

Car dealership stock reached an all-time high of 310,000 vehicles at the start of the financial year. This is leading companies into pushing sales by expanding into smaller towns and cities, potentially igniting a price war, multiple car retailers and company executives told ET.

This could be the first price war since the easing of the pandemic. Car sales surged after the pandemic, but chip shortages hampered production, resulting in extended customer waiting lists and leading automakers to suspend discounts.

Most manufacturers have launched consumer offers in April.

Car market leader Maruti Suzuki is offering benefits of up to ₹58,000 on mild-hybrid variants of the Grand Vitara SUV, while the Fronx compact SUV is available with total benefits of up to ₹68,000. The company is also offering the Baleno hatchback and Jimny SUV with maximum benefits of up to ₹57,000.

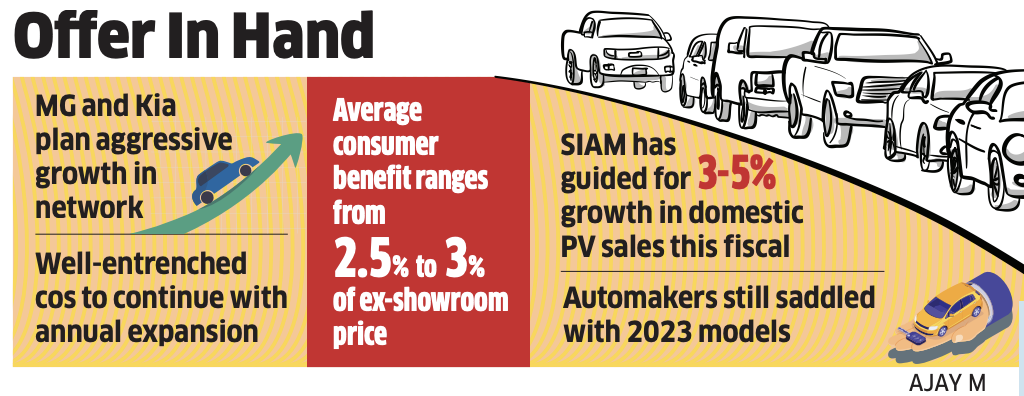

The discounting trend is also seen in other companies. Tata Motors’ Nexon SUV, for instance, has consumer benefits of up to ₹50,000. Similarly, one can avail of benefits ranging from ₹35,000 to ₹48,000 on Hyundai Motor India’s i20, Venue, Aura and Grand i10 models. Average discount across companies presently stands at 2.5-3% of the ex-showroom price, as per industry estimates.

After significant destocking in the December quarter to make way for 2024 models, carmakers took to restocking in the March quarter causing inventory build-up. “Dealers are still saddled with 2023 models and offering steep discounts to liquidate stock,” said an industry executive.

Industry body Society of Indian Automobile Manufacturers (Siam) has guided for a 3-5% growth in domestic passenger vehicle sales this fiscal. The modest sales forecast comes on the back of a high base of 4.2 million vehicles in FY24 when sales rose 8.6%.

However, some like Mahindra & Mahindra are optimistic of growing faster than the industry. “While SIAM’s projection is single digit for PVs and 10-11% for UVs, we see ourselves growing ahead of the industry growth in mid-to-high teens,” said Nalinikanth Gollagunta, CEO, automotive division, M&M.

Others have a conservative outlook. “Hyundai Motor India’s start to the calendar year 2024 has been good with the launch of the new Hyundai Creta and Creta N line. We move forward in the year with cautious optimism,” said Tarun Garg, chief operating officer.

While current stock levels are not alarming and come on a high base, it indicates wholesales or factory dispatches are outpacing retails, said an analyst at a domestic brokerage.

The sales push is set to manifest through network expansion. While well-entrenched manufacturers like Maruti Suzuki India, Hyundai Motor, Tata Motors, and M&M undertake routine network expansion every year, newer entrants which saw their market share slip in FY24 are looking to penetrate deeper to rebound sales.

For instance, Korea’s Kia, which entered the Indian market in 2020 and claims to have the largest sales network among new entrants plans to expand its touchpoints from the current 522 in 236 cities to 700 touchpoints in 300 cities, with equal focus on tier-I and tier-II as well as upcountry markets.

“We are strategically investing in India for the present and the future and committed to building a strong network to offer our new-age customers uniform and premium experience,” said Hardeep Singh Brar, national head, sales and marketing, Kia India.

Similarly, MG Motor India plans to enhance its reach from the current 380 touchpoints in 170 cities to 520 in 270 cities this fiscal as it prepares to enter the next phase of growth under new owner, JSW Group, said a company spokesperson.