The festive period of Navratri-Dussehra and Dhanteras-Diwali this year has delivered the worst performance for India’s automakers in almost a decade.

The main festive season from Navratri to Diwali is the peak period of activity in the personal mobility segment. But demand remained insipid this time, particularly in north India where Diwali has historically been a sentiment booster.

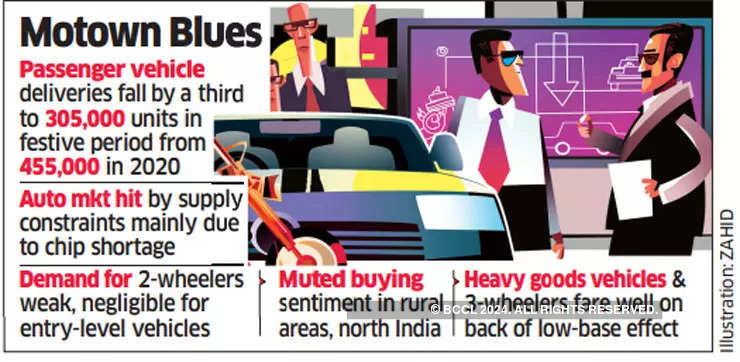

Vehicle registrations during the 30-day period declined by steep double digits compared with the same festive period last year. While the passenger vehicle (PV) market was hurt by lack of supplies, as a shortage of semiconductors forced automakers to cut down on production, there was an unusually sluggish demand for two-wheelers.

Supply-side Challenges Lingered

According to industry insiders, retail sales of passenger vehicles dropped by about a third in the 30-day period. An estimated 305,000 PVs were delivered this time versus 455,000 units last year, they said.

Based on data from the government’s VAHAN portal, which captures the registration numbers from 85% of the country’s regional transport offices, automakers retailed 238,776 units, compared with 305,916 units in 2020, posting a decline of 22%. Registrations of two-wheelers at 1.07 million units were 11% lower. Even tractor registrations declined 13%, underlining the stress in the rural areas. This data comes with a lag of 7-15 days, so it may take a few more days to capture the registration numbers close to Diwali.

This festive season has been the biggest dampener for automotive dealers in at least a decade, Vinkesh Gulati, president of the Federation of Automotive Dealers Association, told ET.

Recovery Hopes Dashed

“While one was hoping for recovery this festive season, supply-side challenges on semiconductors, coupled with prospective buyers giving precedence to healthcare over conspicuous consumption, especially in the entry-level segments for both cars and two-wheelers, had an impact,” he said.

There was very low demand for entry-level passenger vehicles, the federation said. While demand was strong for compact SUVs and luxury vehicles, supplies fell short.

Maruti Suzuki senior executive director Shashank Srivastava said on the demand side, there was reasonable traction with enquiries showing growth over last year and similar level of bookings. However, retails this year in the industry are estimated to have fallen by over 30%, largely because of supply-side constraints, he added.

“While last year the industry delivered a record year in the festive period, led by strong pent-up demand, this year the numbers may be a little misleading as the industry has been starved of supplies, even as the booking momentum is still sustaining,” Srivastava said.

Passenger vehicle dealers had an inventory of 120,000 units, enough to meet 8-10 days of deliveries, at the end of October – less than half of what they typically have ahead of Dhanteras and Diwali. Meanwhile, there are over half a million customers waiting to take delivery of the cars and SUVs they have booked before the festivals.

On the two-wheeler front, “The demand remains weak and even walk-in and enquiries were low in the festive period. Rural demand has still not picked up post the second wave of Covid,” said Gulati. The share of passenger vehicles in total vehicle sales slipped to 19% versus 21.5-22% historically during the 30-day festival period.

UP Bucks Trend

The sapping demand has been higher in north India compared with the rest of the country, barring Uttar Pradesh. India’s largest state by population, UP, posted a 3.5% increase in vehicle registrations, according to Vahan data, and it is the only large state that showed growth.

The states which have higher contribution to the country’s total sales volume, such as Maharashtra, Karnataka and Kerala that together contribute nearly a quarter, have posted a 6-9% decline in retail volume. Bihar, Delhi, Gujarat, Punjab, Rajasthan and Haryana – that together account for 30% of the volume – have witnessed one of the steepest declines in retail registration at 15-22%.

The outliers among the vehicle segments were heavy goods vehicles and three-wheelers, retail sales of which rose 88% and 67%, respectively, during the festival period, mainly helped by the low base of last year.

“After two years, we are witnessing some demand in the three-wheeler space albeit on a low base and that too majorly in the electric vehicle segment. CV is showing momentum only in pockets where there is infra spending done by either the Centre or states,” said Gulati.