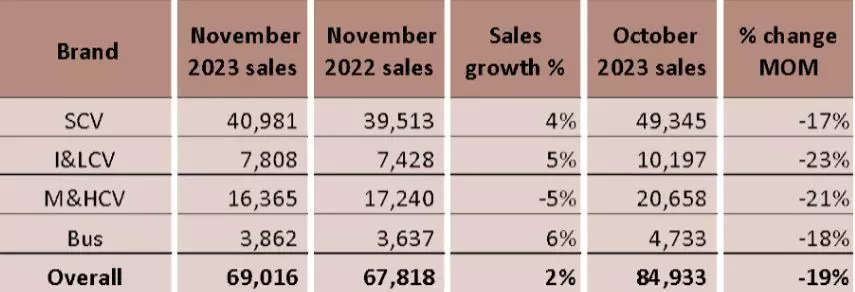

New Delhi: CV sales for the top 5 manufacturers grew by a modest 2% in November 2023. However, volumes also fell sharply by over (19%) month on month vs. October 2023. While we have observed a drop in volume in November post Diwali almost every year, the magnitude of drop from October this year has been a point of concern. The tepid sales were mainly owing to the regional elections across 5 states, challenges in flow of funds for state government contracts across multiple states, and delay in contract renewals in certain segments. While the SCV, I&LCV and Bus segments posted a growth vs. last year, the M&HCV segment dropped by (5%) as seen in the table below. All segments also dropped by over (17%) vs. October 2023.

CV sales for the top 5 manufacturers grew by a modest 2% in November 2023. However, volumes also fell sharply by over (19%) month on month vs. October 2023. While we have observed a drop in volume in November post Diwali almost every year, the magnitude of drop from October this year has been a point of concern. The tepid sales were mainly owing to the regional elections across 5 states, challenges in flow of funds for state government contracts across multiple states, and delay in contract renewals in certain segments.

While the SCV, I&LCV and Bus segments posted a growth vs. last year, the M&HCV segment dropped by (5%) as seen in the table below. All segments also dropped by over (17%) vs. October 2023.

Challenging growth

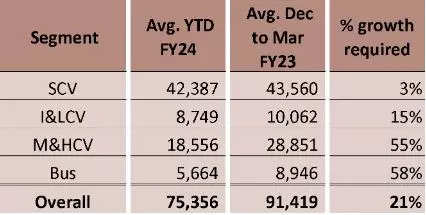

The average sales of CVs between April and November 2023

Major trends

Organised logistics and larger operators: The logistics market is transitioning from an unorganised to an organised market in India. This is especially evident in the ICV, M&HCV and Bus segments where organised and larger operators are growing faster. For the first time buyers and users (FTBs / FTUs) and Retail customers continue to be present in the SCV and the LCV segments with shrinking contributions.

- Improved access to Finance: More Public Sector Banks (PSBs) are working on a strategy to build a stronger portfolio in Commercial Vehicle Lending. While the financing in CVs was dominated by NBFCs and Private Banks, the entry of PSBs is expected to make financing more competitive and benefit operators.

- Stable freight rates: Freight rates continue to remain stable across major routes across the country. The abolition of State check posts and the introduction of electronic fast tags have ensured that the average running of trucks sold over the past 4 years continues to remain higher than pre-covid times.

- Increasing specialisation: Operators today are increasingly specialised in their operations. They have highly focused teams of drivers, operations control rooms and maintenance experts that ensure that their teams are built to offer solutions needed for the specific industry. Segments where specialists make up a large percentage of operators include Ecommerce, FMCG, LPG, Construction Materials and Cold chain transportation among others. This trend is likely to continue and we expect to see decreasing penetration of Market Load Operators or Generalists in this industry.

- Rise of electric 3 wheelers: The 3-wheeler segment has been the fastest growing segment in Automotive this year. While the passenger segment has revived to pre covid levels, a large portion of the growth has been driven by 3-wheeler electric goods carriers. With a lower purchase price, low running costs, and payload within a few hundred kgs of entry level SCVs, electric 3 wheelers have emerged as a major player in last mile delivery.

- Growing exports: OEMs continue to benefit from the Government’s push towards Atmanirbhar Bharat. While major Indian OEMs have seen success exporting to Africa and the Middle East, the advent of more reliable and robust BS6 trucks will give them an opportunity to start testing out more developed markets. Global OEMs are also making India a major destination for R&D and developing products made in India that will be exported across the world both as CVs and also aggregates like Engines, Gearboxes and transmissions among others.

- Multi modal opportunities: With over 70% of the Indian Railways’ Dedicated Freight Corridor (DFC) currently live, a few operators have already started focusing on integrating their operations. They will stand to benefit from opportunities when the DFC is expected to become fully operational by 2025.

- Moderating discounts: Discounts have been moderating over the past year in the CV segment. Cost of commodities have also softened over the past few months. Both these trends should help OEMs improve their price realisation and in turn improve profitability.

Upcoming opportunities

- Blockbuster quarter ahead: The last 4 months of the year make up approximately 40% of CV volumes every year. While there are challenges ahead, we anticipate that there will be opportunities to grow in all segments in the month of December and Q4 FY24 as seen in previous years. This year is expected to be no exception.

- School bus sales in Q4: School bus demand is expected to grow in the next 4 months. The lack of sufficient body building capacity and skilled manpower caused significant delays in school bus delivery last year. To avoid delays, many customers are likely to prepone their bus purchases prior to April, especially those planning to construct custom bus bodies.

- SCV sales: The SCV segment has an opportunity to outperform other segments this year. This segment recovered quickest post Covid, but has had flat growth over the last 2 years. There is potential for growth in this segment over the next 4 months.

- M&HCV Sales: The M&HCV segment has been a bright spot growing at 9% this year. A strong performance in the haulage, tipper and tractor trailer segments will help the CV segment finish the year on a bright note.

Near-term challenges

- Recently-concluded state elections: It is observed that in most states where elections have recently concluded, volumes drop for a few months before they go back to normalcy. This may be due to a change in government where there may be changes in policies, priorities and bureaucrats in key roles impact sales of CVs. Even when the incumbent retains control, there may be changes in Chief Ministers or Ministers in key roles that create temporary uncertainty.

- Upcoming general elections: Any advancement in the upcoming general elections may also have a short-term impact on CV volumes. The focus will transition from announcing new projects or driving existing projects to completion to the elections. Major contractors may also wait to make their purchases one elections are announced impacting the Construction segment.

- Longer lifecycle and improved quality of BS6 vehicles: BS6 vehicles from all OEMs have been built to last. These trucks offer improved reliability with robust aggregates like engines, transmissions and axles. While these vehicles cost more than their BS3 and BS4 counterparts, operators will utilise have the opportunity to utilise BS6 vehicles for a few more years in comparison to their counterparts from the previous emissions era.

Near-term outlook

This will be a December to remember as far as the CV industry is concerned. A strong December will indicate that the industry will go into Q4 FY24 will be riding on a high to finish the year with a growth of 3% to 7% vs. FY23 while creating a new record for annual sales of CVs. However, a tepid December may be an indicator for lower volumes and flat to negative growth vs. last year.

Long- term outlook

While the near-term outlook remains murky, the long-term outlook remains very positive for the CV segment for the following reasons:

- Strong GDP Growth: India is expected to be the only G20 economy to grow at 7% a year for the next 3 years. This bodes well for the CV segment which has outperformed almost every time the GDP growth has exceeded 5%. Many of the factors driving growth provide a direct impetus to the CV segment.

- Focus on infrastructure: While general elections loom around the corner, it is expected that India’s focus on building out a world class infrastructure will remain steadfast which in turn should drive CV sales.

- Scrapping policy: While a policy is now in place, there has been a delay in implementing the same. However, the government is expected to put in place a program to implement the same to reduce pollution on the roads and improve safety which should provide an impetus to CV sales.

In short, while the short-term outlook may not be transparent, the long-term outlook for the CV segment looks strong. A combination of world class products, ongoing reforms, focus on infrastructure and the country’s growth will drive the CV segment to new highs in the next few years.

(Disclaimer: Kaushik Narayan is the CEO of Leaptrucks (a platform for Used CVs) and the MD of PSN Group (One of the largest CVs Dealers in India). Views are personal.)