By Avik Chattopadhyay

Numbers today are the outcome of what was done yesterday. And they need not be the harbinger of what will happen tomorrow. But if your numbers persist while those of others’ jump it calls for a pause and close look. The pandemic has hit the entire automobile industry hard. However, since September there have been signs of revival, especially by passenger cars and UVs. The numbers show that the segment that continues to be in doldrums is that of the 3-wheeler.

What could be the reason for the disappointing performance of all the brands? Has the 3-wheeler segment lost its relevance, or is it because of a role change or new alternatives?

The numbers

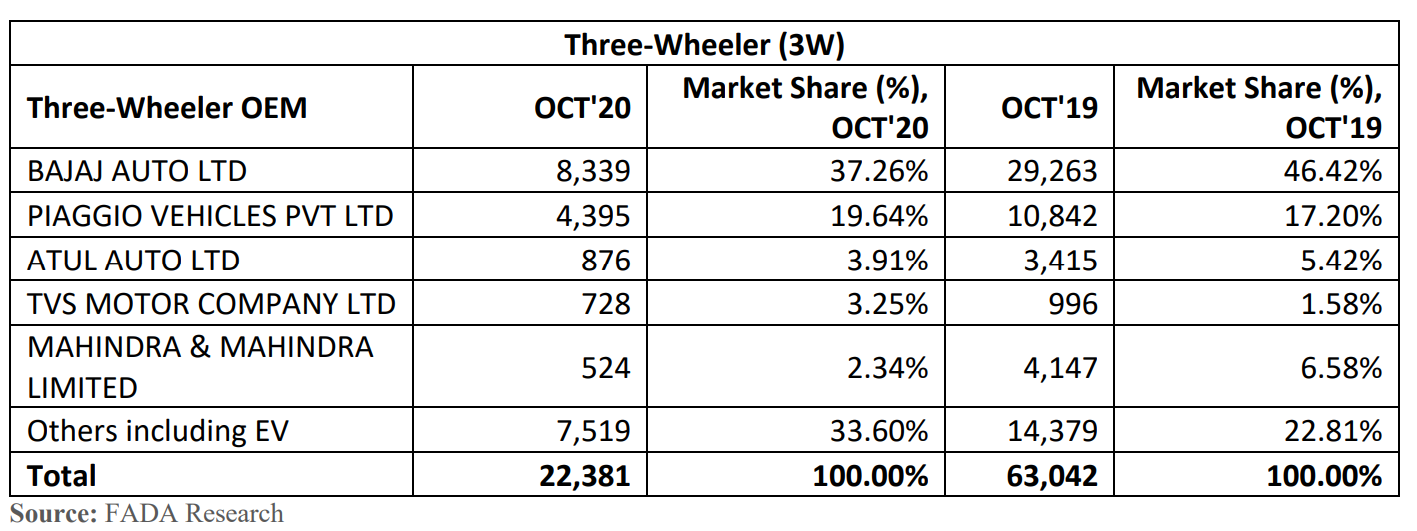

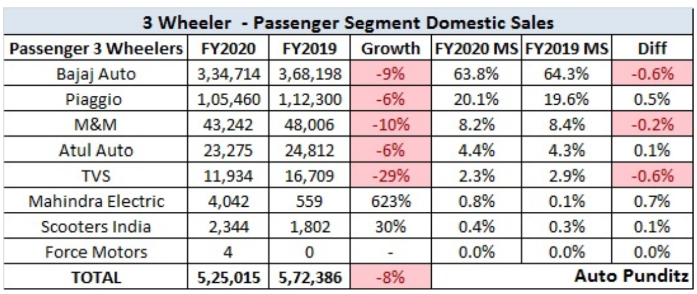

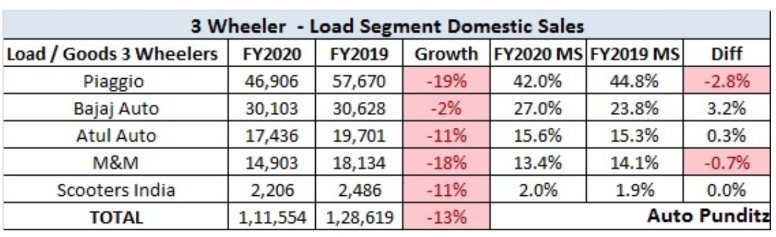

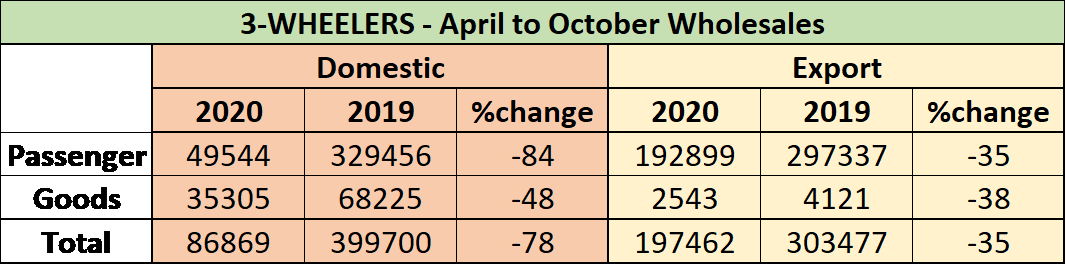

The April to October 2020 domestic wholesale numbers of 3-wheelers show 78% drop over 2019. Even exports fell by 35%.

While the drastic decline of passenger carrier 3-wheelers can be explained by the hit public transport has taken in these months, the drop in goods carrier 3-wheelers is a matter of concern. A local auto-rickshaw fleet may not grow due to reduced consumer demand. While the e-commerce and delivery services are seeing a spike due to changed buying behaviour, why do the ubiquitous delivery vehicles not see a revival in numbers?

The retail numbers more or less mirror the wholesale in terms of drops over 2019-20. It was not such a good year for the category as data shows vis-à-vis 2018-19.

The crucial role of the 3-wheelers

Just like the commuter two-wheeler and entry-level car, the three-wheeler is one of the key contributors to democratising mobility in any economy. It has traditionally been the “last mile” mobility solution for transporting people and goods.

Its compact size, low turning radius, the flexibility of application and frugal operating costs made the 3W popular for both the owners and the users. It has provided employment and nurtured micro-enterprises.

When e-commerce logistics and multi-modal mobility are the buzzwords, the 3-wheelers should see a bull-run, and any blip in sales can only be temporary. With greater penetration of all services, from apparel to medicines, there should never be a dull moment for this segment.

And if the 3-wheeler segment experiences one of its dullest moments while its role remains intact, has someone else come and upset its applecart [no pun intended]?

The alternatives…

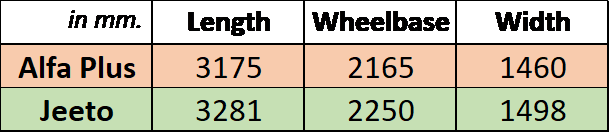

Let us study two offerings from Mahindra in the “Small Commercial Vehicle” space – the 3-wheeled Alfa Plus and the 4-wheeled Jeeto S6-16.

While Jeeto costs more than double the Alfa, the point I am raising here is that the 4-wheeled micro CVs are eating into the 3-wheelers. The 4-wheeled options offer greater operational stability, payloads and life. Over the lifecycle of the vehicle, it pays back for its

For passenger carriers options like Bajaj Cute are available. The brand has opened up a new segment of “quadricycle” – basically a 3-wheeler with a 4th wheel! Tata Motors has an interesting product called Magic Iris.

Bajaj Cute

For any commuter using a Bajaj RE or TVS King, the closed Cute or Iris is a better option unless one wants to travel in an overloaded 3-wheeler. The closed vehicle construction also allows for the incorporation of hygiene protocol which may become standard in the days to come. While this category is yet to gain traction, the alternative that is taking the wind out of the passenger carrier 3-wheeler is the electric auto-rickshaw. Not included in the SIAM and FADA data releases, one does not have any idea of how this new mode of last-mile mobility has mushroomed all around us, making it almost like a cottage industry, with scant safety standards in operation. It has badly impacted 3-wheeler sales with the pandemic driving a big nail into it.

The verdict

The role played by the 3-wheeler in last-mile mobility is unquestioned. Just that there are alternatives on either end of the spectrum are applying pressure and questioning its very raison d’etre.

It is up to date in the market with green powertrains and emission control with CNG and electric versions. Its light construction already makes it energy efficient and frugal.

The Achilles heel is safety. Given the role the vehicle plays in the intra and inter-city transport, its frontal and side-impact standards need to be at par with that of a 4-wheeler like an Alto or i10. More so, as the vehicle is not covered and does not offer any side protection. The electric ones are basically coffins on skateboards, with just tubes bolted onto a floor. It is a shame that they are allowed to ply on our roads under the nose of CMVR, obviously with vested interests at play.

Once the proposed Bharat New Vehicle Safety Assessment Programme comes into operation, it must ensure no compromise on this front. It seems improbable that the three-wheeler will pass the crash test requirements, given its inherent instability and lack of protection.

That is why Bajaj cleverly evolved the RE into the Cute and is pushing the new category of the quadricycle. While the automakers see it as a threat to the entry-level passenger car, it is actually a real threat to the three-wheeler. The current three-wheeler makers need to wake up to the fact that unsafe vehicles cannot be dished out any more, under whatever pretext of cost, access or adoption. They can work towards building the quadricycle segment into a significant one.

Our popular 3-wheeler was anyway facing a downturn over the last one year. The pandemic has dealt it a timely body blow. This is the opportunity for it to be phased out, by regulation. It shall always remain etched in our memory but need not remain on the roads.

(The author is co-creator of Expereal India. Also, he is former head of marketing, product planning and PR at Volkswagen India.)

(DISCLAIMER: The views expressed are solely of the authors and ETAuto.com does not necessarily subscribe to it. ETAuto.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.)