Mini hatchback cars and affordable, non-electric motorcycles and scooters are set to register bumper sales in the coming months as India gets ready to celebrate its first ‘normal’ festive season after a gap of two years. An “above normal” monsoon, positive consumer sentiment and a generally upbeat mood are also expected to push sales of entry-level vehicles.

Vehicle makers, on their part, are drawing up aggressive plans with a focus on attractive discounts and new products to convert enquiries into sales.

Manufacturers such as Maruti Suzuki, Hero Motocorp and Honda Motorcycle & Scooter India (HMSI) are betting big on the festive offtake, with expectations of more than half of the pent-up demand for entry-level two-wheelers and cars coming through during the festive season this year.

They say a significant percentage of the buyers, especially in the hatchback segment, are first-time buyers and many of them are in category B&C towns.

“For these buyers, a car purchase is a big milestone in their life journey and obviously they want to begin such milestones in an auspicious period,” said Shashank Srivastava, senior executive director at Maruti Suzuki. “Typically, festivals are occasions where families expect something to celebrate and bringing home a new car is certainly a celebration.”

Positive sentiment

While vehicle makers are lining up new products for launch during the season, banks, both public and private, are working on offers and incentives to attract customers as they see a surge in retail loans demand.

Would be good to have a banker’s quote here, if possible

“We expect the momentum to build-up in the coming months on account of a combination of multiple factors, including a healthy growth in country’s GDP, a normal festive season after a gap of two years, better monsoon resulting in decent agricultural harvest and positive consumer sentiments,” said a Hero MotoCorp spokesperson.

The automobile market has recovered well from the Covid impact with the reopening of schools and offices. However, factors like compliance norms and rise in commodity and fuel prices have led to a rise in the cost of ownership for vehicle customers.

This impacted the demand, especially in the entry-level segment of cars and was a significant contributor in the lacklustre sales of two-wheelers, said Atsushi Ogata, managing director, president & CEO at HMSI. “With this in mind, we are approaching the festive season. While the season has certainly set the tone for us, we are positive that the coming months will bring in a balanced growth,” said Ogata.

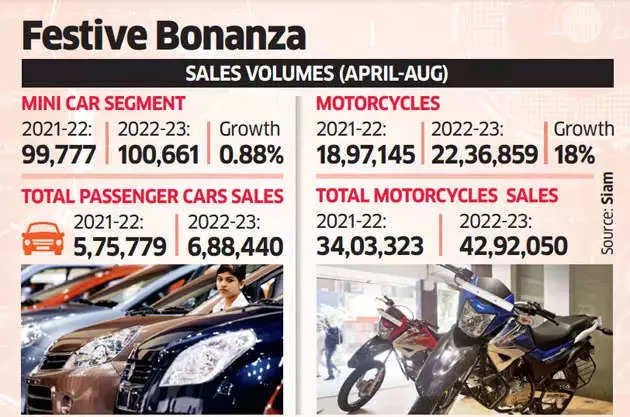

Sales have been lagging for the entry-level cars in the recent past. But they registered a marginal year-on-year rise of 0.88% between April and August this year, with Maruti Suzuki accounting for 90% of the sales. Maruti Suzuki sells Alto and S Presso in this segment.

Pickup in enquiries

The entry-level motorcycle segment, the largest contributor to total motorcycle sales, was led by Hero Motocorp with the sales of its Splendor and Deluxe growing 18% during this period, according to latest SIAM data.

Dealers too expect to see improvement in retail sales of entry-level motorcycles during the festive season. “Footfalls and enquiries have picked up, but it is yet to translate into sales,” said Nikunj Sanghi, owner of Rajasthan-based JS Fourwheel Motors, which has piled up inventory of entry-level vehicles, as their supply remained consistent while the demand had taken a beating.

While festive season sales are expected to grow 10-15% over the last year, they will still not reach the pre-Covid levels any time soon, two-wheeler dealers said.

Although India’s per capita cars and two-wheelers has been rising steadily, there is a large room for growth. According to estimates from consultancy firm Jato Dynamics, India, with a household count of 300 million, had 22.5 million cars in 2019-20, up 1.5% from 2016; and 149 million two-wheelers, a 12% increase since 2016.

These segments are yet to get saturated and there is still a lot of potential for growth, said Ravi Bhatia, president of Jato Dynamics.