New Delhi: The micro dealerships (revenue up to INR 200 crore) in the country have had a perceptible drop in retail sales, revenue, and customer footfalls in showrooms during the pandemic in 2021, according to the ETAuto report.

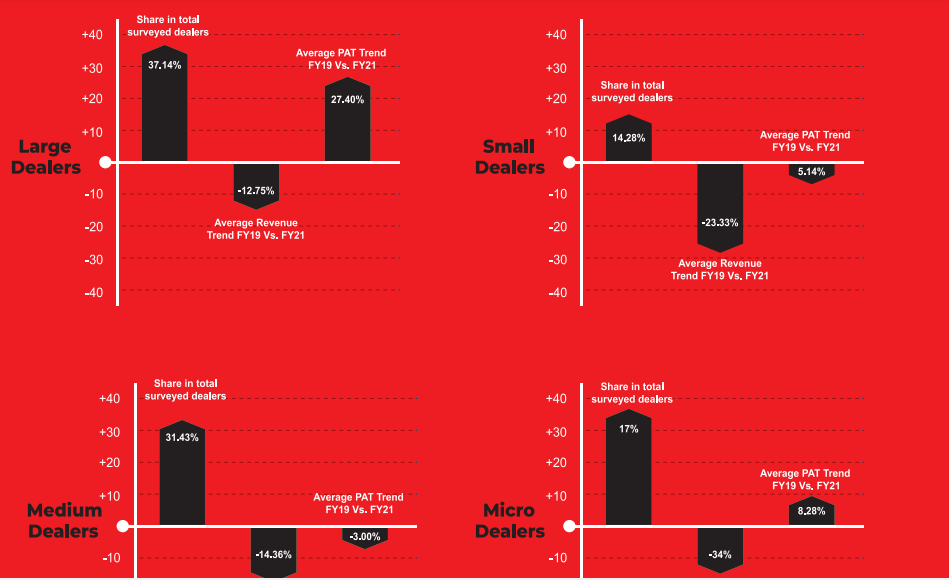

An assessment by ETAuto.com of its Top 100 Power Dealers List indicates that due to business pull back and the resultant tightening of margins, the average revenue of the micro dealers dipped by 34% in FY21.

Source: ETAuto.com Top 100 Power Dealers List Report

Out of the 200 dealerships surveyed, about 17% of them were micro dealers. Medium dealers (dealership group with revenue of INR 400 crore to INR 700 crore), accounting for 31% of the participants, saw a moderate 14% drop in revenue. Large dealers (Dealership Group with revenue of INR 700 crore and above) who constitute 37% of the participants, witnessed their top line fall by 12.75% in the period under review.

In line with the shrinking industry, overall revenue of the dealerships also dipped, inflicting the smaller ones (among the dealers surveyed) the most – at an average decline of 23.3% in FY21 over FY19.

Compared with the base year FY19, average dealership profitability jumped by 18.81% in FY21 mainly due to the lean and downsizing efforts. In terms of revenue, large, medium, small and micro dealers saw profitability trends of 27%, -3%, -5% and 8% respectively.

The profitability can be largely attributed to efficient cost and manpower management. Close to 51% of dealers under our coverage reported negative manpower costs. Their strategy has been to improve manpower productivity, to invest in training, and to change the strategy where the return is low.

While on an average the capital cost of Indian automobile dealers spiked by 31%, the average manpower cost was brought down by 14%. Within the segments, top 10 passenger vehicle (PV) retailers reported about a 10.75% decline in revenue from car sales last year while their volume fell by 30%.

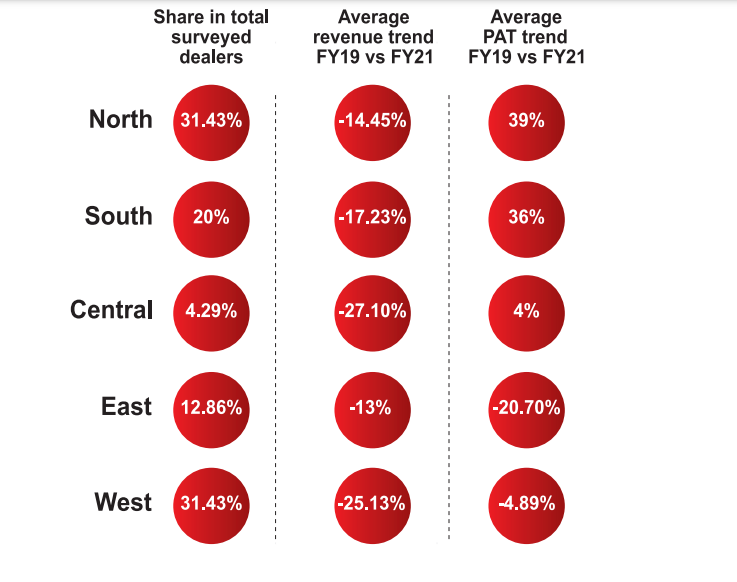

In a region-wise analysis of the automobile dealers, the study finds that the North performed the best with an average increase in profitability of 39% in FY21 over FY19 while the average revenue dipped by 14.5% in the same period. It was followed by South which saw revenue slip by 17% but profitability went up by 36%. Average profitability of the dealers in the eastern part of the country declined the most by almost 20%, followed by dealers in the western region.

Source: ETAuto.com Top 100 Power Dealers List Report

Dealers expect 15% sales growth in FY23

According to our study the dealerships on an average are expecting 15% sales growth in FY23. While showrooms have been adjusting to their “new normal” since 2020, increasingly challenging inventory shortages brought a new meaning to the phrase in 2021. Despite this, ongoing inventory shortages, rapid digitalization and changing consumer preferences are still creating new opportunities for dealers in 2022.

The quantum of growth forecast is higher in the PV and two-wheeler segment. As the OEMs begin to slowly pull itself out of the crisis by identifying alternative sources, dealers hope that the supply situation will improve in the coming quarters and they will be able to streamline their delivery process.

For months now, a global chip crisis has plagued auto manufacturers, forcing them to cut back on vehicle production and distribution to local car dealerships. The chip shortage — coupled with other pandemic-related logistics issues — has led to empty dealership lots, limited options and extended wait times for ordered vehicles.

Considering the challenges of Omicron and shortage of semiconductor chip Kataria Automobiles said, “the base of the current calendar has been lower, it is expected to grow on account of the pent up demand and availability, expecting significant growth in the second half of the year.”

Now with the situation gradually improving on the supply side and consumers’ intent to purchase cars is close to pre-COVID-19 levels retailers are expecting a decent sales growth this year.

To get more insights on the Indian auto retail market, grab your copy now.

Also Read: