The report suggests the cascading economic recessions, triggered by the pandemic did not have much impact on the electric car buyers even as the global automobile market contracted 16% in 2020.

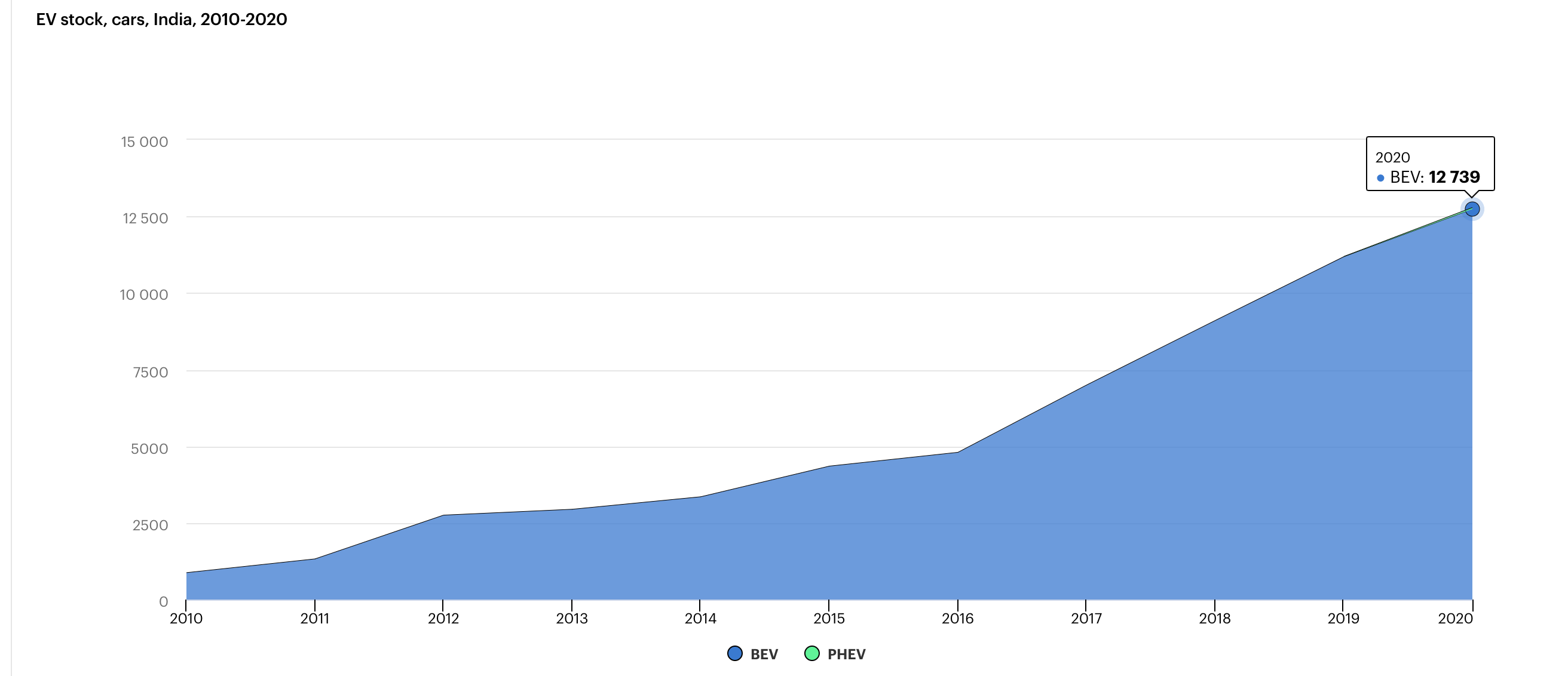

The year also upset the long-standing number one electric car market -China pushed to number two by Europe. Sales of electric cars in Europe soar by 137% year on year to 1.4 million while the sales of the electric car in China, grew moderately by 12% to 1.34 million in 2020. Interestingly, India’s total parked electric cars stands at 12700 units.

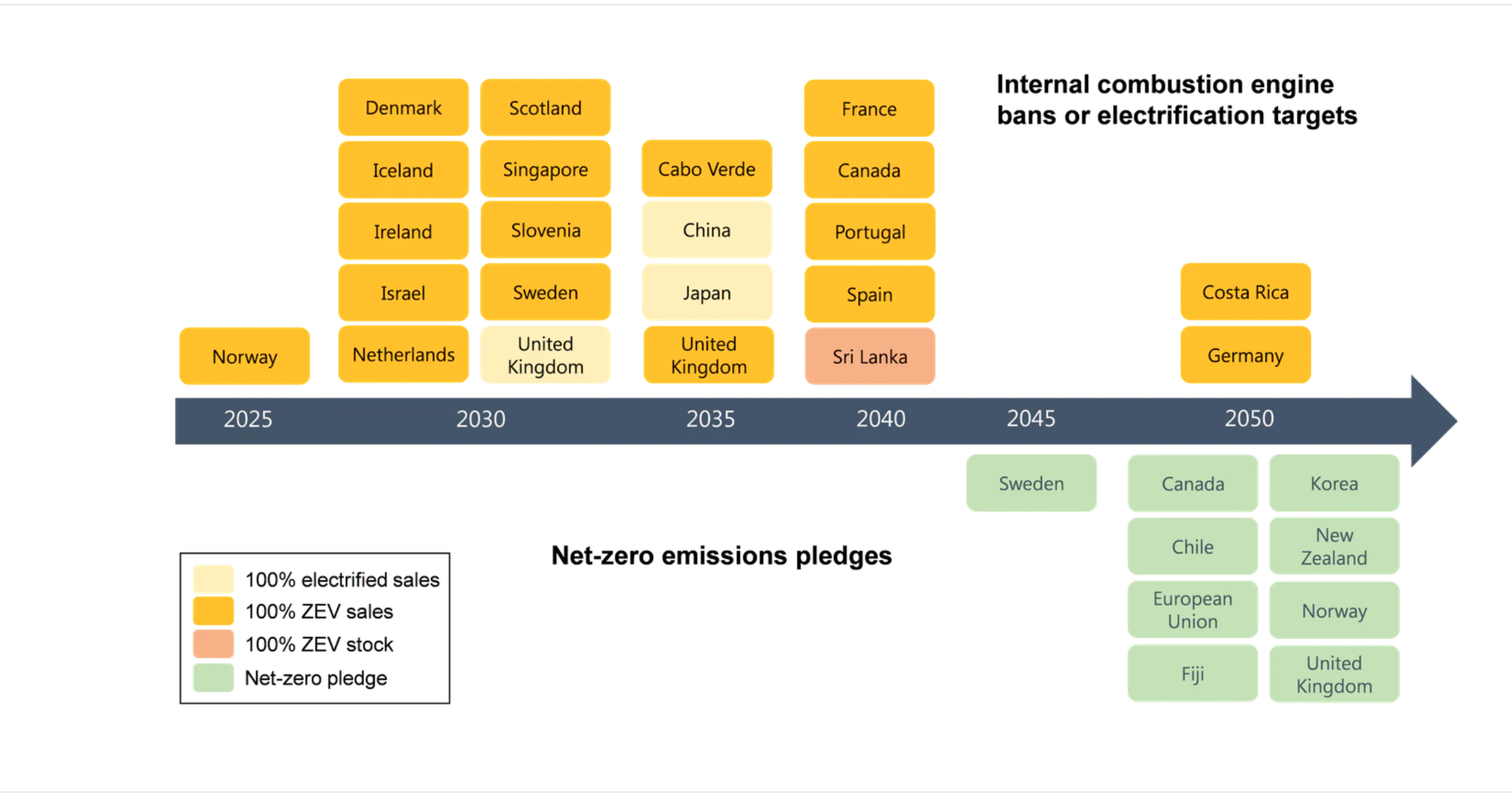

The spike in the demand for electric cars in Europe was mainly attributed to supportive regulatory frameworks such as many countries were strengthening key policies like CO2 emissions standards and zero-emission vehicle (ZEV) mandates. Last year, at least 20 countries had announced bans on the sales of IC engine cars or mandated all new sales to be ZEVs.

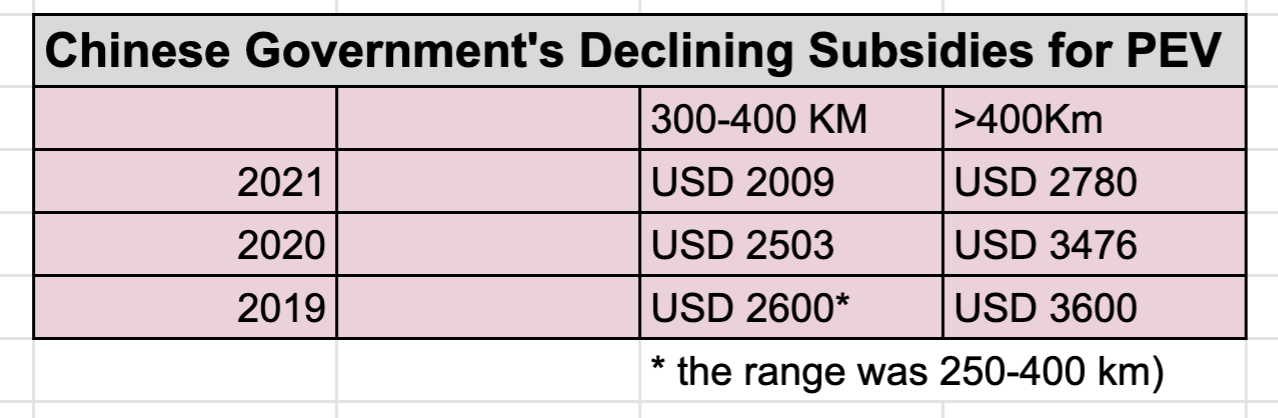

Contrary to this China has been lowering its subsidies for electric vehicles (EVs) since 2019. The Chinese government announced the new EV subsidy policy for 2021 on December 31, 2020, which included a 20% year on year reduction in subsidies as planned.

This reduction in the EV subsidy follows the government’s plan announced in late March 2020 to extend the EV purchase subsidy by a further two years to 2022 beyond the original expiry date of December 31, 2020, and to slow the rate of reduction to 10% in 2020, 20% in 2021 and 30% in 2022.

Growth Momentum to Continue

In the near-term in the first quarter of the calendar year 2021, global electric car sales rose by around 140% compared to the same period in 2020, driven by sales in China of around 500 000 vehicles and in Europe of around 450 000. US sales more than doubled relative to the first quarter of 2020, albeit from a much lower base.

EV markets could be significantly larger if governments accelerate efforts to reach climate goals.IEA Report

According to the IEA report, globally, electric cars’ strong momentum will continue. “Existing policies around the world suggest healthy growth over this decade: in the Stated Policies Scenario, the EV stock across all modes (except two/three-wheelers) reaches 145 million in 2030, accounting for 7% of the road vehicle fleet,” the report stated.

It further asserts that EV markets could be significantly larger if governments accelerate efforts to reach climate goals. In the Sustainable Development Scenario, the global EV fleet reaches 230 million vehicles in 2030 (excluding two/three-wheelers), a stock share of 12%.

The reports talking about the well to wheel greenhouse gas emission says in 2030, in the Stated Policies Scenario, the global EV fleet reduces GHG emissions by more than one-third compared to an equivalent ICE vehicle fleet; in the Sustainable Development Scenario, the level rises to two-thirds.

Manufacturers Expand Product Line Up

The years also witnessed a massive increase in the models on offer and saw new initiatives for critical battery technology.

Consumer spending on electric car purchases increased to USD 120 billion in 2020. In parallel, governments across the world spent USD 14 billion to support electric car sales, up 25% from 2019, mostly from stronger incentives in Europe. Nonetheless, the share of government incentives in total spending on electric cars has decreased over the past five years, suggesting that EVs are becoming increasingly attractive to consumers.

The demand and push for EV adoption have also increased to bring about sharp reductions in emissions of air pollutants, and meet global climate goals in line with the Paris Agreement.

The sustainable demand scenario (SDS) reaches net-zero emissions by 2070 and the global temperature rise stays below 1.7-1.8 °C with a 66% probability, in line with the higher end of temperature ambition of the Paris Agreement.

To achieve this goal, the scenario requires a rapid reduction of the carbon intensity of electricity generation, changes in driving behaviour and utilisation of public transport or non-motorised modes (resulting in reduced annual vehicle kilometres travelled and vehicle stock).

According to IEA, the SDS assumes that all EV-related targets and ambitions are met, even if current policy measures are not deemed sufficient to stimulate such adoption rates.

“In this scenario, the collective target of the EV30@30 signatories to achieve 30% sales share in 2030 for light-duty vehicles, buses and trucks is surpassed at the global level (reaching almost 35%), which reflects increasing ambitions for widespread EV deployment,” IEA reports.

Significant fiscal incentives spurred the initial uptake of electric light-duty vehicles (LDVs) and underpinned the scale-up in EV manufacturing and battery industries.

The measures – primarily purchase subsidies, and/or vehicle purchase and registration tax rebates – were designed to reduce the price gap with conventional vehicles. Such measures were implemented as early as the 1990s in Norway, in the United States in 2008 and in China in 2014.

Gradual tightening of fuel economy and tailpipe CO2 standards has augmented the role of EVs to meet the standards.

Today, over 85% of car sales worldwide are subject to such standards. CO2 emissions standards in the European Union played a significant role in promoting electric car sales, which in 2020 had the largest annual increase to reach 2.1 million. Some jurisdictions are employing mandatory targets for EV sales, for example for decades in California2 and in China since 2017.