Fundraising is a ceaseless process for most of the EV startups. Its momentum continued unabated throughout 2021 when it touched a new high, in spite of the supply-chain imbalances and market choppiness due to the second wave of COVID-19 and rising concern of its new variety, Omicron.

“In the past two years, there has been an unexpected surge in technology investments. This accompanied massive changes in the EV industry that saw an influx of more money from PE-VC funds in the past six months than we have seen in the last ten years. The spike in interest comes on the back of supportive government policies, increasing awareness and demand for zero-emission products, and rising petrol prices,” Kaushik Madhavan, Vice President, Mobility Practice, Frost & Sullivan, said.

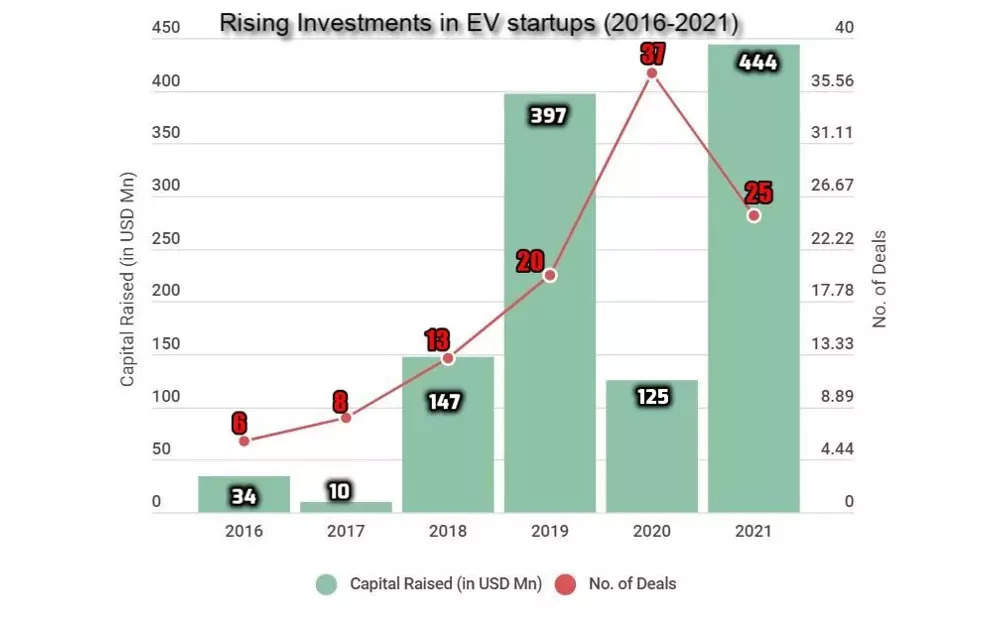

ETAuto Research shows that funding to Indian EV tech startups hit an all-time high in 2021, nearly reaching USD 444 million (INR 3,307 crore) across more than 25 deals, despite the pandemic worry, which is 255% higher than that of funds raised in 2020. Moreover, that’s even 12% higher than the pre-pandemic year 2019 when EV startups raised about USD 397 million.

In the first half, EV startups had raised just USD 78.2 million (INR 582.22 crore) from about 10 deals due to local lockdown-like restrictions, and reduced economic activities. Majority of the largest funding rounds was announced in the second half when market conditions stabilised and Indian startups witnessed a substantial rebound.

Startups that attracted maximum funding in the just-ended year include Ola Electric (USD 253 million), Blusmart (USD 25 million), Simple Energy (USD 21 million), Revolt (USD 20 million) and Detel (USD 20 million).

Among other major investments in the EV space are TVS Motor Company and Zoho Corporation’s USD 15 million investment in Ultraviolette Automotive in December 2021, and Amara Raja Batteries and Petronas Ventures’ USD 10.5 in electric battery maker Log9 Materials in two tranches.

The intense rise in increasing bets can be attributed to the public-market enthusiasm which is helping drive outsized private investment into domestic EV startups. Undoubtedly, the rise of EVs has created new patterns of consumption across space and time.

Domains like grid works, manufacturing, battery tech, installation and maintenance of new public charging stations are attracting investors who are eager to gain grounds in this growing field.Saket Mehra, Partner and Auto Sector Leader, Grant Thornton Bharat

Also, with the Indian government firing cylinders for electrifying the domestic automobile sector, investors can’t keep their hands off from the newage companies even remotely related to this area.

Emerging trends

While taking a look at where investors are directing their dollars, our analysis revealed that as revolutionary electrification technologies move closer to mass commercialization, investors are becoming more selective, often funneling investment dollars to startups with track records of success.

The overall fundraising scenario indicates that the investors are encouraging the whole ecosystem of EV and focusing on attractively priced higher value-add areas like charging solutions, throughout the value-chain, where there is typically more pricing power.

Besides, some enterprising innovators willing to take a risk on new technologies and unproven business models seem to be trying to cement their role. And therefore, the electric mobility industry is graduating from its scrappy entrepreneurial phase to infrastructure investment.

Another approach that continues to attract funding is battery technologies. Despite significant advances, the limited driving range of batteries remains a top concern for car buyers. That might explain investors’ bullishness on entrepreneurs seeking to cram more energy into new battery chemistries while reducing space, costs and charge times.

“EVs have no longer remained an only-vehicle story; rather they have now transformed into a tech story where every chapter holds a strategic importance. Ultimately, all the investments that are coming in are focusing on EV product development as well as the related value chain. Domains like grid works, manufacturing, battery tech, installation and maintenance of new public charging stations are attracting investors who are eager to gain grounds in this growing field, ” Saket Mehra, Partner and Auto Sector Leader, Grant Thornton Bharat.

Currently about 13-14 have approved and notified dedicated EV policies. Some are on the verge of finalizing. Such moves are enough to create buzz and catch the eye balls of investors with massive cash piles.Kaushik Madhavan, Vice President, Mobility Practice, Frost & Sullivan

Overall the four prominent areas that guided investment in 2021 are Battery tech (Log 9 Materials, Lohum Cleantech), EV charging (Magenta EV Solutions, Exponent Energy, goEgoNetwork), Vehicle makers (Ola Electric, Detel, Simple Energy) and Mobility-as-a-service (MaaS) (Blusmart, 3EV Industries).

Deal size getting larger

Rather than a sharp jump in the number of startup opportunities available, the dramatic expansion reflects how much the size of the average deal has swelled up since 2016. Our analysis revealed that average deal sizes have gone up substantially and rounds are closing in record time. It almost quadrupled to USD 18 million in 2021 from USD 4.8 million in 2016, our data show. And this happened because the early entrants who figured out how to build successful bussiness model now need far more capital to enact their surging ambitions.

According to Madhavan, increase in deal size has a direct correlation with positive market sentiments. “Currently about 13-14 have approved and notified dedicated EV policies. Some are on the verge of finalizing. Such moves are enough to create buzz and catch the eye balls of investors with massive cash piles. Secondly, as the EV sector is getting mature and more competitive, the amount of capital the PE and VC offer tend to increase,” he added.

Outlook

The variety of planned EVs is broad and so the pull-ahead in startups is real and they are doubling up the speed of product development. One of the major challenges that emerged in the post-pandemic period for private equity players as well as startups is the confusion in the supply chain. But still, the EV space will remain desirable for investors due to the higher returns they get than from other industries.

While many think that startups represent a challenge to legacy automakers, industry experts believe that they are also crucial to the automotive industry as they represent a bridge to the next generation of mobility. As a result, there are lear chances that some key automakers will join the league of Hero MotoCorp and TVS Motor in purchasing direct stakes in EV startups in the coming years.

Fund Raised by EV startups in 2021

| Months in 2021 | Startups | What They Do | Fundraising in (INR Cr) | Investors |

| October | Ola Electric | EV manufacturer | 1898 | Temasek, Falcon Edge, SoftBank Group and others |

| September | Blusmart | EV ride-hailing | 186 | BP Ventures |

| November | Simple Energy | EV manufacturer | 156 | UiPath, Sattva Group, Athiyas Group |

| March | Revolt Motors | EV manufacturer | 150 | RattanIndia Enterprises |

| March | Detel | Electric moped manufacturer | 150 | Undisclosed |

| December | Ultraviolette Automotive | Electric bike manufacturer | 130 | Zoho Corporation |

| May | Magenta EV Solutions | EV charging solutions provider | 120 | Dr Kiran C Patel, JITO Angel Network |

| March | Euler Motors | EV developer | 94 | Inventus Capital India, Jetty Ventures,Emergent Ventures,Blume Ventures,Ev2 Ventures, ADB |

| October | Log 9 Materials | EV battery manufacturer | 74.7 | Amara Raja Batteries, Petronas Ventures |

| July | Lohum Cleantech | Battery manufacturer | 52 | Baring Private Equity Partners India, Talbros Automotive and others |

| December | MoEVing | Electric mobility technology platform | 40 | D.S. Brar, Anshuman Maheshwary, Srihari Raju Kalidindi, D.N. Reddy and others |

| December | Exponent Energy | Rapid charging startup | 37.7 | YourNest VC, 3one4 Capital, AdvantEdge VC, Motherson Group |

| September | Revos | EV infra startup | 30.15 | Union Square Ventures & Prime Venture Partners |

| October | RevFin | EV digital lending platform | 30.15 | Redcliffe Life Solutions, Knam Marketing, Let’s Venture Angel Fund, CarDekho |

| July | Ati Motors | Electric autonomous industrial vehicle maker | 26.12 | Blume Ventures and Exfinity Venture Partners and others |

| April | Oye! Rickshaw | Electric rickshaw hailing service | 24 | Alteria Capital |

| November | ElectricPe | EV charging platform | 22.6 | Blume Ventures & Micelio Fund |

| August | goEgoNetwork | EV charging solutions | 15 | Rishi Bagla, Olivier Guillaumond, Jay Shah |

| November | 3EV Industries | Transportation & logistics focussed EV startup | 15 | Family offices |

| June | Cell Propulsion | Electric commercial vehicle manufacturer | 14.87 | GrowX Ventures, Micelio, Endiya Partners |

| December | Oben EV | EV manufacturer | 11.3 | We Founder Circle and others |

| February | eBikeGo | Online platform offering electric-two wheeler subscription platform | 11.14 | Startup Buddy, Real Time MCS, Boudhik Ventures, Fluid Ventures |

| March | BLive | EV retail marketplace | 7.5 | DNA Entertainment Networks, Mumbai Angels,CreditWise Capital, LetsVenture |

| June | Kazam | EV charging solutions | 7 | Inflection Point Ventures |

| May | Cellestial | Electric tractor manufacturer | 3.71 | Ashik Karim – Founder of UpCapital Investments |

| Total | 3,307 |