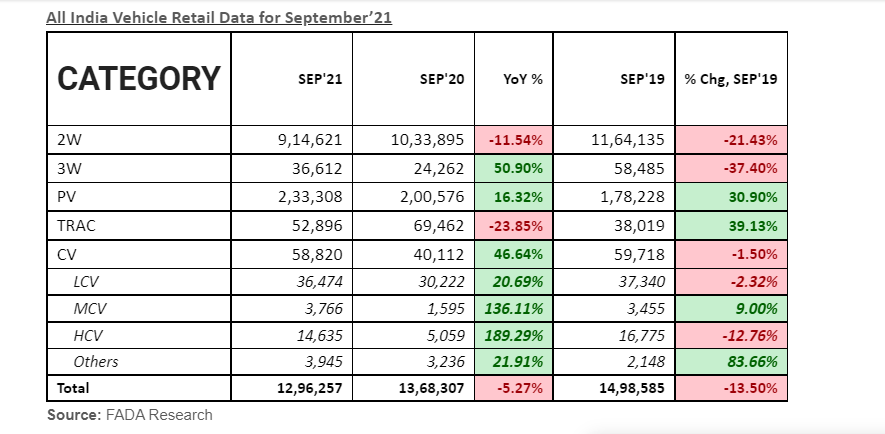

New Delhi: Auto OEMs have reported mixed retail numbers for September 2021. The Federation of Automobile Dealers Associations (FADA), on Thursday said retail sales of passenger vehicles (PV) in September increased by 16.32% year-on-year to 233,308 units.

According to FADA, PV sales stood at 200,576 units in September 2020. Experts point out that festival stocking is likely to be affected by chip shortage.

“Auto retail in the month of September has taken a pause as overall sales were down by 5%. During the first half of this financial year, while the overall retails were up by 35%, the same was down by 29% when compared to 2019, a pre-Covid year. On a long term basis, except tractors which grew by 19% and PV which has almost reached pre-Covid levels, all the other segments were in the red,” Vinkesh Gulati, FADA President said.

Two-wheeler sales, however, slipped 11.54% to 914,621 units last month, compared to 10,33,895 units in the year-ago period.

“The semiconductor shortage has intensified with the lockdown in Malaysia from June 2021, resulting in a severe crunch in its supply to the Indian automotive industry. This could potentially hurt demand for PVs, premium two-wheelers, and LCVs during the upcoming festive season. The impact was the highest for PVs, followed by premium motorcycles and LCVs,” Motillal Oswal said in a latest report on the Auto sector.

Commercial vehicle sales surged 46.64% to 58,820 units last month against 40,112 units in September last year. Volume growth was strong in this segment on the back of pickup in demand from infrastructure and construction sectors, coupled with improving freight utilization levels

Three-wheeler sales saw a rise of 50.90% to 36,612 units last month from 24,262 units in the year-ago period. Domestic sales of Bajaj Auto, M&M, TVS and Atul Auto improved in this category majorly due to the gradual easing of lockdown restrictions.

“The three-wheeler segment is showing clear signs of a tactical shift from ICE to EVs as the ratio has hit a 60:40 split. With offices and educational institutions slowly opening up, electrification of 3Ws will gather a greater momentum in months to come,” Gulati added.

The total sales across categories decreased by 5.27% to 12,96,257 units in September as against 13,68,307 units in the same month last year.

“The prices for core commodities have seen some stabilization since Q1FY22 and 20%-50% reduction in the precious metals basket. We expect some lag impact to reflect in Q2 FY22 and then stabilize thereafter. Supply-side issues for PVs and premium 2Ws, weaker 2W demand, and slower recovery in CVs would lead to another round of earnings cut for our FY22 estimates,” the brokerage firm added.

Outlook

According to FADA, the chip shortage looks less likely to ease within the next two quarters. As a result, the industry body added PV sales is likely to stagnate going ahead even though OEMs are coming ahead with new launches to keep the customer excited. “With the skyrocketing fuel prices and a drop in purchasing power, entry level customers in rural India are keeping themselves away from fulfilling their mobility needs,” FADA said.

It further added, “India’s vaccination drive has reached a remarkable momentum. This coupled with a less likelihood of a third wave in the near future and offices and educational institutions opening up in a phased manner, we anticipate a marginal recovery process to begin in the 2W space. FADA hence requests all 2W OEMs to roll out special promotion schemes so that it can springboard 2W retails for a faster recovery.”

Also Read: