The festive season may have ended but festivities are continuing for electric vehicle (EV) makers with November sales likely to match the record set last month amid Navratri and Diwali seasons.

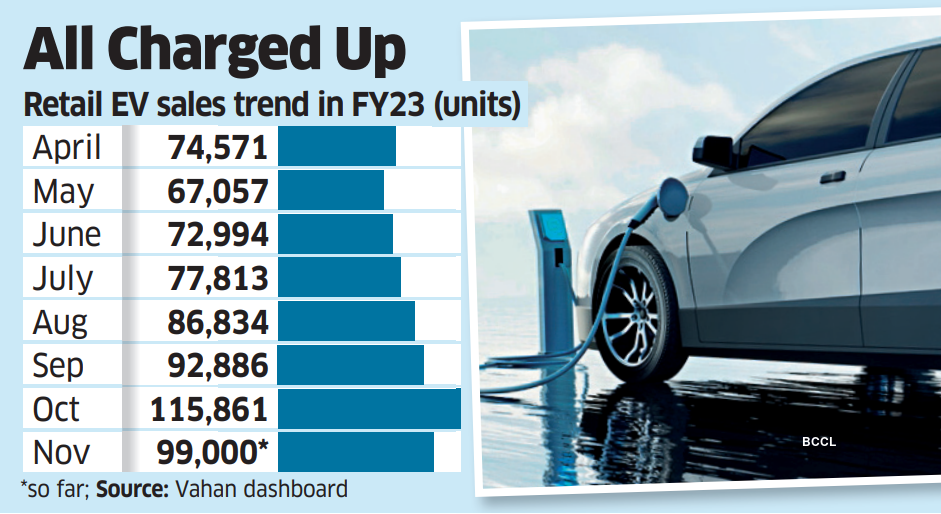

If October set a monthly record of 115,861 EV sales, the numbers this month have already crossed 99,000 units, as per data from government website Vahan that tracks vehicle registrations.

This, as backlog bookings continue to be retailed and awareness of EVs continues to grow among the strata of vehicle owners, industry officials said.

“EVs are at an inflexion point across multiple vehicle categories – the total cost of ownership is already favourable for two-wheelers and is near par for three-wheelers,” said Sohinder Gill, CEO of electric bike and scooter maker Hero Electric and director-general of Society of Electric Vehicle Manufacturers (SMEV).

In the next two years, there would be more electric two-wheeler product launches at competitive price points, which would help boost their adoption, Gill said.

While the EV ecosystem is still developing in the country, adoption is driven by two- and three-wheelers as the masses increasingly use them for last-mile connectivity, buoyed by low cost of operations.

If the past seven months are an indicator, EV sales will cross a million units in 2022-23, up 84% from last fiscal year.

Sales of electric two-wheelers are poised to grow 117% year on year at 750,000 units this fiscal year, while three-wheelers are expected to grow 12% to 200,000 units, according to SMEV.

While the electric car sales volume is still low, considering its higher pricing, their sales zoomed 268% year on year in the first six months of the ongoing fiscal year at 18,142 units. In October, electric cars sales stood at 4,935 units, according to the Vahan dashboard.

The industry expects the market to grow rapidly as the operational cost of EVs is much lower than that of vehicles powered by petrol and diesel.

“At Rs 1.1 per km of running cost (for an electric car), the monthly expense is a fraction of what is incurred driving a petrol/diesel car, making it simply unbeatable,” said Vivek Srivatsa, head, sales, marketing and service strategy, at Tata Passenger Electric Mobility, which dominated the EV passenger vehicle market with a share of about 85% and has the largest electric car portfolio.

As the EV demand goes up and supply bottlenecks ease, original equipment makers (OEMs) have been ramping up production. “The waiting period has reduced as production goes up in multiples. Now electric OEMs are able to deliver vehicles faster,” said Hemal Thakkar, director at credit rating firm Crisil.

With traditional automotive players also getting into the EV space, it has boosted the confidence of financiers and consumers alike. Dealers say the transition to EVs continues unabated after festival season.

“The affordability and running cost, specifically in two- and three-wheelers, have drastically improved, making it a viable choice for consumers,” said Nikunj Sanghi, an automotive dealer based out of Alwar.

While it will take some more time for EVs to become mainstream, the pace of EV adoption is steady.

Experts said the hinterlands are seeing faster adoption of low-speed scooters, amid a rise in fuel prices and consumers choosing cleaner and greener mobility.

After a dip in FY21, EV sales jumped more than 200% in FY22, accounting for nearly 3% of the overall vehicle sales in India.

Electric two-wheeler sales have been going up in the last 8-12 months after the government revised upwards incentives under the Fame 2 scheme.

The Narendra Modi-led government has set a goal for EVs to make up 30% of private cars, 70% of commercial vehicles, and 80% of two- and three-wheelers by 2030.

The government has been working with Fame, or Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India, and PLI, or Production-linked Incentive, schemes to push EV adoption in the country.

As per a report by venture capital firm Blume, sales of electric two-wheelers in India are expected to grow by 24 times from their current level to touch 17.69 million units by 2030.