By Anant Jain

The dynamic and diversified Indian automotive industry has been able to withstand the adverse impact of COVID-19 on its manufacturing. This resilience is recognised globally. On the global platform the Indian automotive industry is ranked fifth according to the Indian Automotive Industry Report by IBEF.

The ascent to this position by both the passenger and the commercial vehicle categories has been from the seventh position in 2019. Though it is creditable a feat, its fallout is not that commendable from the environmental impact perspective. The increase in vehicle production acts as a double-edged sword: while it meets the increasing demand, it also causes excessive air pollution.

The environmental issues

India is in the midst of a grave air pollution crisis. The number of cars and two-wheelers has increased multifold in the last couple of decades. Along with the surge in fuel-operated vehicles’ air pollution also rose to damaging heights.

The perceived solution, shift to green alternatives, has been in discussion for many years. But only recently it has gathered momentum and caught the attention of the stakeholders and decision-makers. The government, the judiciary, public agencies, social and environmental organisations and consumers have raised alarms and awareness about the indispensable need for alternative fuel vehicles on Indian roads. This change would revolutionise the automotive industry in India.

The GfK Automotive Syndicate Monitor Study 2020 was undertaken to understand the road ahead for the automotive market in India and the emerging trends like consumer purchase patterns, their interest in alternative fuel cars, new in-vehicle technology, and autonomous cars.

Consumer preference for electric vehicles

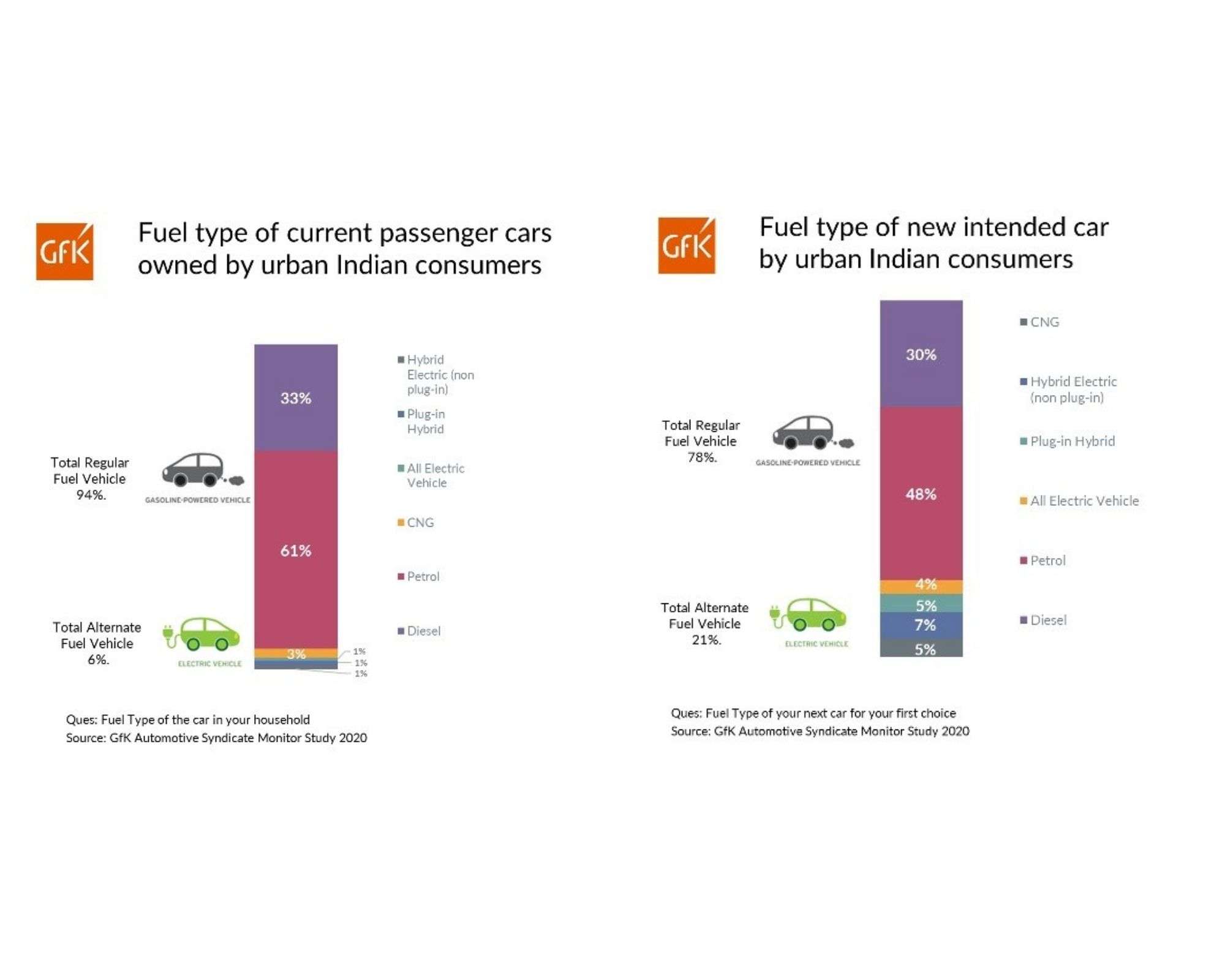

The Indian consumer is increasingly leaning towards alternative fuel cars that include both hybrid and electric vehicles. The study reveals that currently, 6% of passenger cars owned by Indian consumers are alternative fuel-driven. However, the number rises sharply to 21% when you factor in consumers intending to buy such a car. This intention is driven by the awareness about being socially responsible and environmentally friendly. The increasing cost of fuel in India is another reason. Most of those who intent to shift to an alternative fuel-driven vehicle prefer to buy hybrid electric (non-plug-in) type vehicles.

Interestingly, there has been significant growth in the intrigue factor for all forms of alternative fuel vehicles among consumers. Today a car user is interested in knowing about all forms of alternative fuel engines. The GfK Automotive Syndicate Monitor Study 2020 captures a rather encouraging trend both for consumers and car manufacturers. Let’s decode the entire equation.

The major forms of alternative fuel vehicles are as follows:

1. All-Electric vehicles

2. Plug-in hybrid electric vehicles

3. Non-plug-in hybrid electric vehicles

4. Fuel cell electric vehicles

5. Hydrogen fuel cell electric vehicles

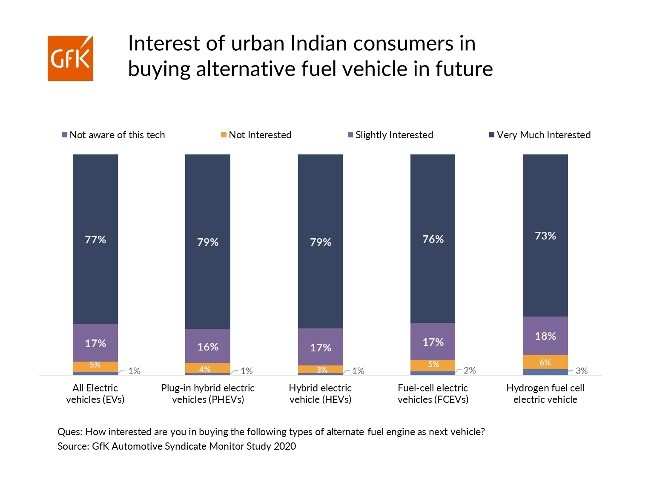

A cognizant consumer can easily differentiate between the above alternatives and the GfK Automotive Syndicate Monitor Study 2020 reveals an upward sloping trend in consumer interest in the alternative vehicle categories. On an average, 76.8% of consumers are extremely interested in buying an alternative fuel vehicle in the future. The graph on the right shows that 77% of the respondents are extremely interested in buying an all-electric vehicle while 79% are inclined to buy a plug-in hybrid electric vehicle. This trajectory is positively skewed towards socially aware and responsible behaviour in the hands of a consumer who is envisioning a more organised and harmonised future.

Challenges in the adoption of EVs in India

While there is increased awareness among conscious consumers about the adoption of electric vehicles, there is still room for improvement. The challenge is those consumers who are not interested in buying an alternative fuel vehicle. Some of the observations were rather thought-provoking and should pave the way for improvements in the infrastructure.

“Failing to plan is planning to fail”, to quote Benjamin Franklin, would be most appropriate here. It is imperative to make plans that are executable and not just visionary. Every plan should support and justify its objectives. The vision of a smooth transitioning process towards adopting a global technology ought to be well structured and planned. The primary factor that would lead to Indian consumers trusting the alternative fuel vehicles is setting up a well-grounded infrastructure that would support the smooth functioning of such vehicles.

Some of the barriers to the adoption of alternative fuel vehicles in India are high prices and lack of electric vehicle charging infrastructure followed by the time required to charge one and the reliability/durability factor. High pricing of an alternative fuel car reduces the consideration by 46% for an average Indian consumer. The lack of charging infrastructure is another.

India’s focus on alternative fuel vehicles will improve the situation immensely in the future. However, as we progress towards hybridizing India’s automotive sector, it must be ensured that a cost-effective, energy-efficient, and scalable ecosystem is put in place to support the growth.

E-mobility in India is an ambitious scheme fuelled by the tremendous contributions of think-tanks and industry players. The potential is huge and would drive the growth of alternative fuel vehicles in India which should be a priority now. The transition is taking place at a much faster rate and the future looks bright for alternative fuel-driven cars in India.

(Disclaimer: Anant Jain is Head of Market Intelligence – India, GfK. Views expressed are his own.)