Funds focused on sustainability, such as Northern Arc Capital, Delta Corp Holdings and Incofin Investment Management, are buying into Indian fintech firms that specialise in electric vehicle (EV) financing to fast-track adoption of two- and three-wheelers using the electric powertrain.

Rev Fin, OTO, Mufin Finance, and Three Wheels United are among the fintech firms that have secured either equity or debt financing from the likes of Northern Arc Capital, Shell Foundation, Delta Corp Holdings, Incofin Investment Management, Matrix Partners India, Prime Venture Partners, 9Unicorns and Better Capital – global and local funds that support green initiatives. These partnerships seek to route loans for EV purchases to the un-banked and the under-banked, experts said.

Some months ago, digital e-mobility lending platform Revfin raised ₹100 crore funding in debt, led by Northern Arc, Liquiloans and Shell Foundation, a UK-registered charity. This will help Revfin expand the e-rickshaw financing businesses in new states such as Assam, Madhya Pradesh, Rajasthan and Punjab, said Sameer Aggarwal, Founder and CEO, RevFin.

“The latest inflow of funds will help us overcome multiple barriers in the EV financing space in a structured manner,” said Aggarwal. “Having experienced over 5X growth in monthly disbursements, we have built partnerships with all major e-rickshaw OEMs and are also planning to bring forward our next equity raise.”

For global funds, these partnerships are also key to achieving sustainability goals.

“We are partnering with RevFin for financing electric mobility, a rapidly evolving segment that can help reduce carbon emission and lead to sustainable development,” said Bama Balakrishnan, Chief Operating Officer, Northern Arc Capital.

Similarly, Mufin Green Finance this month raised ₹45 crore in Series A funding from Incofin India Progress Fund.

Price Influences EV Purchase Decisions

The company has helped finance the purchase of ₹160 crore worth of EVs in nine States. Mufin Green Finance also finances EV charging stations and battery top-up loans besides bankrolling vehicle purchases.

Two-wheeler financier OTO raised ₹6 crore last month from venture debt firm Stride Ventures. That round of financing comes almost a year after OTO raised $6 million in Series A funding, led by Matrix Partners India. Three Wheels United (TWU) has also raised $10 million in Series A funding led by Delta Corp Holdings. The lack of affordable financing options for low-income consumers stands in the way of faster EV adoption despite some decline in vehicle costs.

“India’s EV adoption rate is moving slowly, primarily because they are not priced on a par with conventional vehicles and come at a premium,” said Rohit Mehta, Managing Director, Akasa Finance. “It influences purchase decisions.” Established non-bank lenders, meanwhile, are still cautious about lending to this segment of the automotive industry. That’s a gap the fintech firms are seeking to fill.

“We are able to fulfil financing requirements with flexible EMI options, making the purchase much easier,” said Sumit Chhazed, CEO and cofounder, OTO.

OTO has tie-ups with some of India’s biggest two- and three-wheeler companies, such as Hero MotoCorp, TVS Motor, Bajaj Auto and Suzuki. The platform offers 35% lower EMIs compared with other banks.

India’s EV financing market will likely be worth $50 billion (₹4.1 lakh crore) by 2030, when 30% of private cars, 70% of commercial vehicles and 80% of two- and three-wheelers are expected to use the electric powertrain.

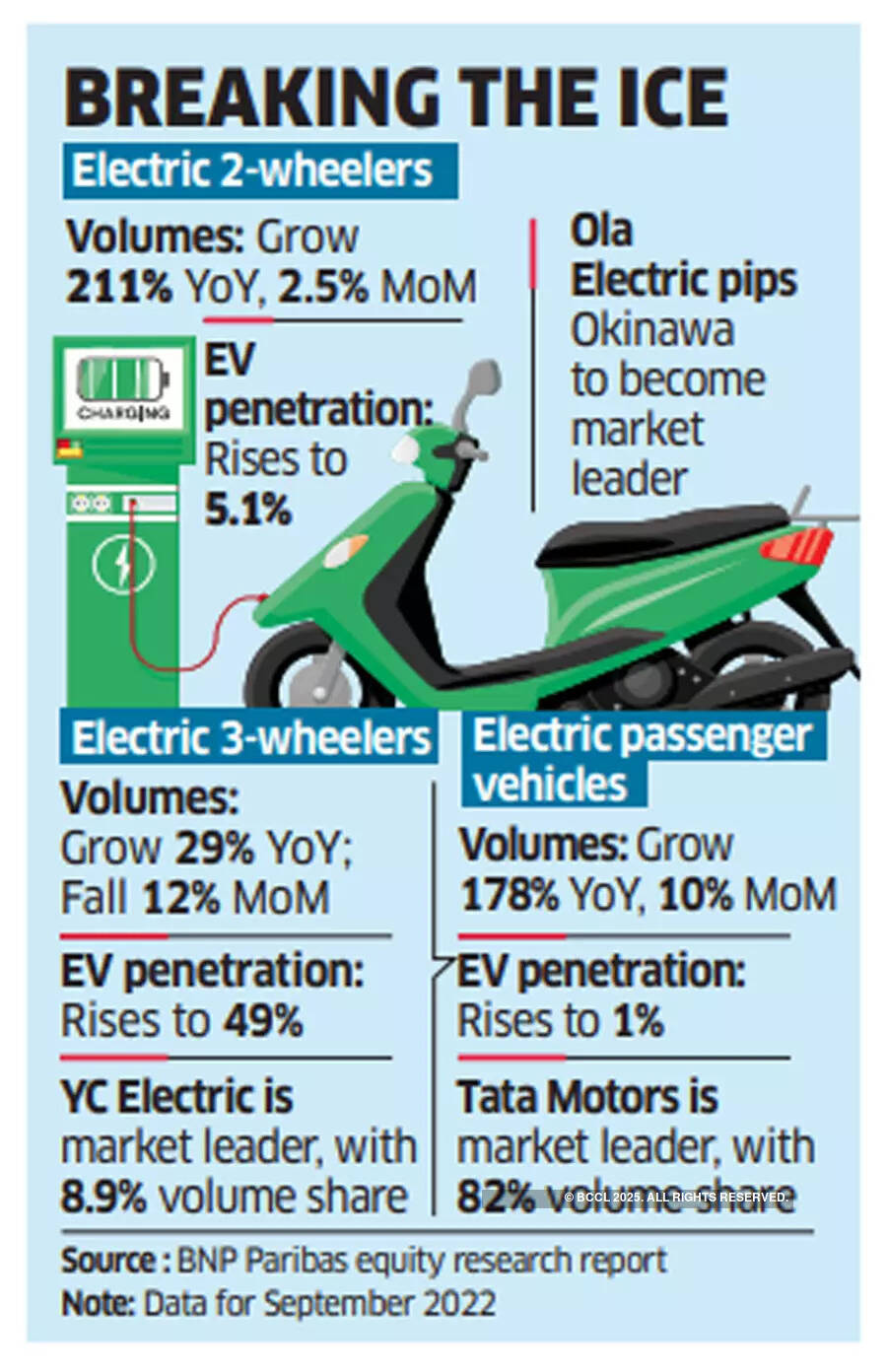

Venture capital fund Blume said that sales of electric two-wheelers are expected to expand 24 times their current volumes in India by 2030 to touch 17.69 million units, up from a projected volume of 0.75 million this year.