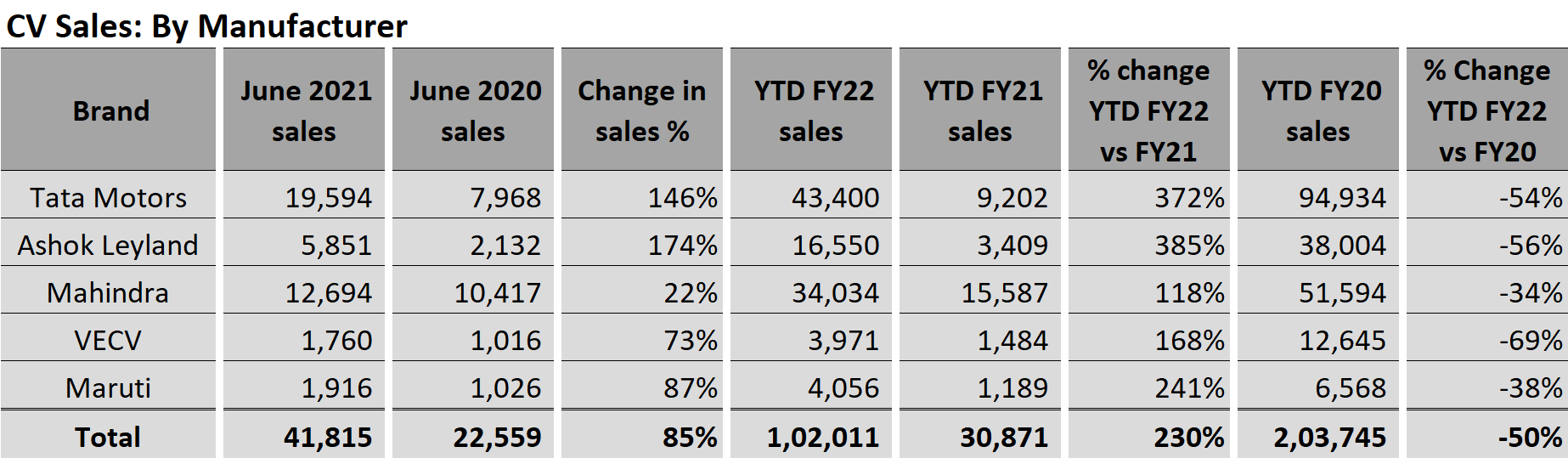

Commercial vehicle industry returned to growth track in June 2021 with 85% increase in sales (vs. June ’20). The market trends indicate that the industry is seeing some green shoots of recovery. They stem from factors like better truck utilisation, rising freight rates, improved sales-mix, increasing EMI collections, and the demand for trucks running on alternative fuels like CNG. They indicate the potential for steady growth from Q2 FY22.

The Q1 FY22 (vs. Q1 FY21) growth was also an impressive 230%. All major CV manufacturers posted impressive growth led by Ashok Leyland and Tata Motors, which grew by over 350%.

The CV customers continue to grapple with EMI payments, rising input costs, including diesel prices, and low freight rates~

However, the impact of Covid-19 wave 2 continues to be severe on the CV industry. The CV customers continue to grapple with EMI payments, rising input costs, including diesel prices, and low freight rates.

The industry is still far away from normalcy. This will be clear from a comparison of the present with the performance in FY20. Though FY20 is a low base year for CVs, the industry volumes are down by over 50% in Q1 FY22 vs. Q1 FY20. This clearly indicates that while lockdown 2.0 was better than lockdown 1.0, CV volumes continue to lag behind.

Mahindra and Maruti have dropped volumes by over 34% while other manufacturers are down over 54% in the same period. While buses fell over 87% in Q1 FY22 over Q1 FY20, the SCV segment performed the best with a drop of only 37% in the same timeframe.

An analysis of the following leading indicators from June ’21 corroborates the optimism of a steady recovery in the CV segment starting Q2 FY22.

Improved truck utilisation

Growth in sales of products in the FMCG, e-commerce, industrial goods and the construction material segment among others has improved the utilisation of trucks in June ’21. This is evident in the growth of E-way bills in June which have grown by 38% vs. May ’21 to a daily average of 1.83 million. This was nearly equal to the 12-month average daily E-way bill generated at 1.87 million. This bodes well for a strong Q2 FY22 in utilisation which in turn will reignite the demand for CVs.

Source: GSTIN, Leaptrucks

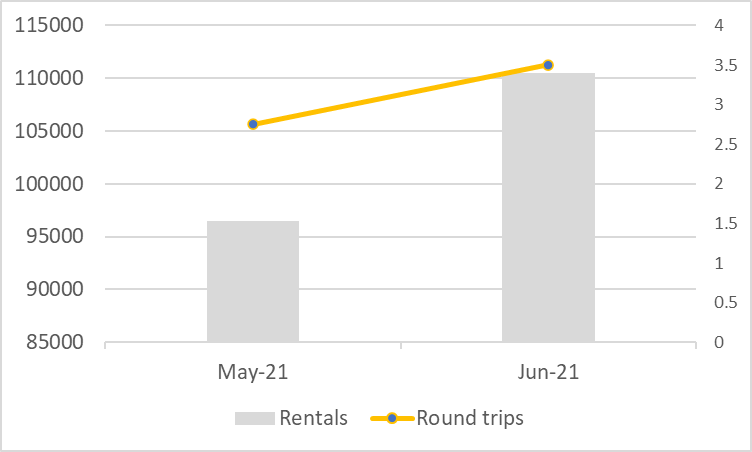

Increasing freight rates and trips / truck

Both the number of trips and the freight rates in key trunk routes have also grown strongly as per the data from ITFRT for June 2021. In the Delhi – Mumbai -Delhi route, ITFRT estimates that the average number of trips has increased from 2.75 to 3.5. At the same time, freight rates for a round trip for the multi axle trucks have also increased by over 15% from INR 96,500 to INR 1,10,000.

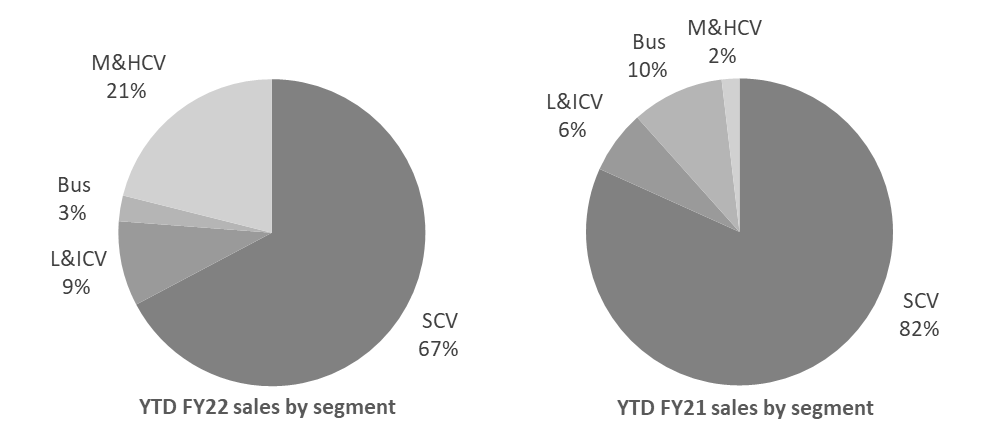

Growth in sales-mix across segments

The mix of CVs sold by segment has significantly changed between Q1 FY22 and Q1 FY21. Last Year, only the SCV segment had gained some momentum at the end of the quarter (see the chart below). However, this year, we clearly see positive momentum across 3 segments vs. just 1 last year. Both the HCV segment (21% vs. 2% Last Year) and the LCV segment (9% vs. 6% Last Year) have also got off to a better start than last year along with the SCV segment. This bodes well for growth across segments in the CV industry starting with Q2 FY22.

Rise in collections of CV financiers

CV financiers were impacted by both the restrictions in travel for documentation and the challenges in collection which had fallen to between 50% and 75% for most banks and NBFCs. By the end of June ’21, travel restrictions had eased significantly and collections had improved from May ’21. In June ’21, only a handful of financiers were actively financing new truck purchases for customers. As most challenges faced in accessing vehicle financing have now eased, customers should be able to see more options for financing starting July ’21.

As most challenges faced in accessing vehicle financing have now eased, customers should be able to see more options for financing starting July ’21~

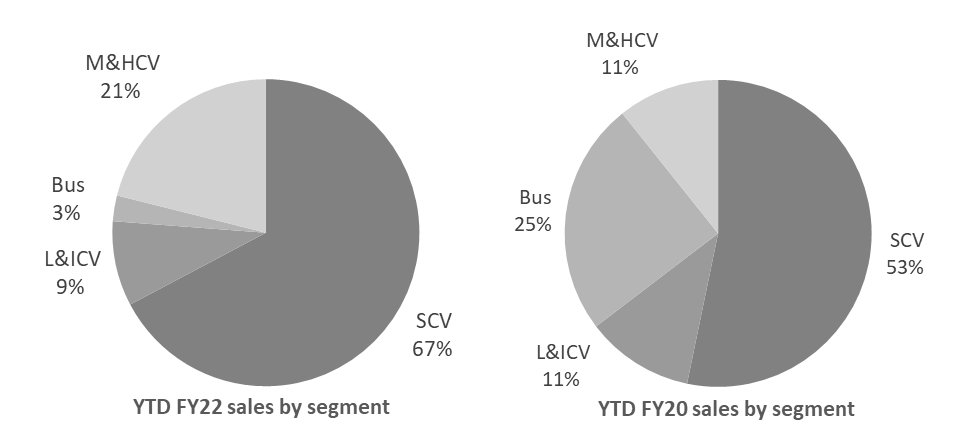

Bus segment continues to struggle

The bus segment, which made up over 25% of the CV volume in Q1 FY’20 has fallen to 3% in the same time this year. Schools continuing to be closed and many offices continuing to operate from home have significantly impacted sales of buses. Similarly, tourist buses have not started operating. Route buses have also been impacted by social distancing norms and significantly lower collection. Opening up of schools and colleges will signal a reversal in fortune in this segment which may start as early as Q3 FY22 in the absence of a Wave 3.

Demand for trucks operating on alternative fuels

As diesel prices continue to increase, the demand for electric and CNG vehicles appears to be increasing. Most of the last-mile delivery players and e-commerce companies have been expanding or encouraging the addition of electric 3-wheelers in their operator fleet. We also see a large opportunity in the mini SCV segment to provide electric vehicles for the last mile transportation.

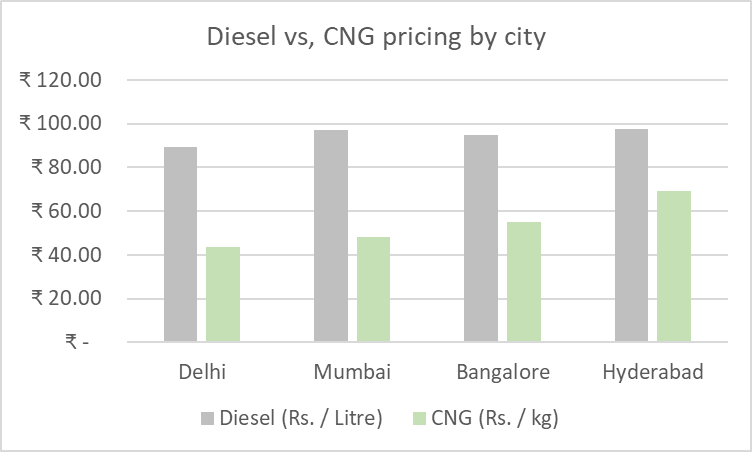

At the same time, CNG vehicle sales are also rising in the SCV and L&ICV space. Manufacturers who have been successful in the Delhi NCR market are seeing strong demand for this offering across India. CNG prices range from INR 43 to INR 68 kg across India vs. current diesel prices of over INR 100 / litre. Operators can save between 29% and 51% on CNG trucks depending on prices in their city of operation.The only challenge to higher penetration in the market is the CNG infrastructure, especially on highways, which is also catching up quickly pan India.

Way forward

In summary, many leading indicators point to a steady recovery in the CV segment. With growing demand for movement of goods across multiple sectors, truck utilisation will continue to grow in Q2 FY22. This also bodes well for further increase in freight rates which will help truck operators become profitable despite rising input costs.

At the same time, in June ’21, collection efficiency improved significantly across CV financiers. This will help improve access to loans for operators which will in turn make it easier for them to access funds to buy new trucks. The attractiveness of CNG vehicles which have a lower cost of operation along with being greener will also drive replacement demand. While challenges will continue to impact the industry, especially if there is a significant Wave 3, we are optimistic about a strong recovery in the CV industry.

Note: Kaushik Narayan is the CEO of Leaptrucks

(DISCLAIMER: The views expressed are solely of the author and ETAuto.com does not necessarily subscribe to it. ETAuto.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.)