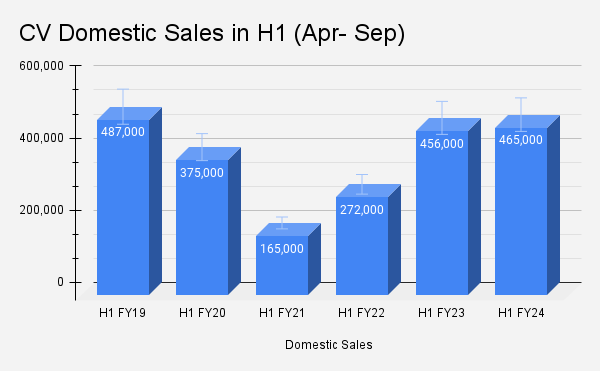

New Delhi: After a robust 40% year-on-year (YoY) growth in the first half of FY 2022-23, which was a result of the post-pandemic recovery, the commercial vehicle (CV) industry in India reported a 2% growth in H1 FY 2023-24, showing its resilience amid economic expansion.

Vinod Aggarwal, President, Society of Indian Automobile Manufacturers (SIAM), said, “The growth in CVs can be attributed to the all-round economic growth of the country, which is also enabled through the conducive government policies.”

| Domestic Sales (in units) | H1 FY24 | H1 FY23 | % change |

| Commercial Vehicles | 4,65,063 | 4,56,479 | 1.8 |

Source: SIAM

However, according to the data by the industry body, domestic sales during April-September 2023 were still below the corresponding sales of FY 2018-19. The compound annual growth rate (CAGR) is at negative 0.9%.

It may be noted that the SIAM data does not include sales data of Daimler, JBM and Scania.

Going forward, Aggarwal is optimistic about the CV sector growth and said that getting into the festival season, the segment is optimistic and looks towards posting good numbers in Q3, Aggarwal said.

Industry experts suggest that the CV industry, which is often referred to as the backbone of the national economy, is expected to record the peak sales in FY24.

Saket Mehra, Partner, Grant Thornton Bharat, said that the YoY marginal growth in H1 FY24 can be attributed to strong sales and high base during the previous fiscal year.

Overall, the growth in the CV industry is supported by growth in the manufacturing and infrastructure sector. This can be highlighted by the strong Index of Industrial Production (IIP), especially in manufacturing, which has been consistently increasing month by month. In August 2023, the overall IIP reached 145.1 (compared to 131.3 in August 2022), and the manufacturing sector reached 143.5 (up from 131 in August 2022), he said.

| CV Domestic Sales | H1 FY24 | H1 FY23 | % change |

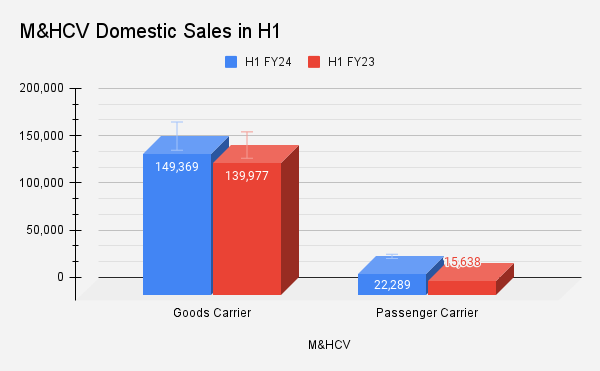

| M&HCV | 1,71,658 | 1,55,615 | 10 |

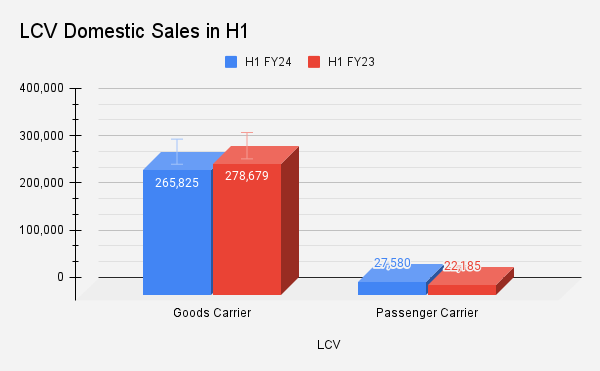

| LCV | 2,93,405 | 3,00,864 | -2.4 |

According to Mehra, the M&HCV category (made up of 23% by sales in the CV segment as of FY23), is expected to witness sales growth, with no foreseeable challenges in the short term.

“The overall LCV sales (made up of 11% by sales in the CV segment as of FY23) are expected to be spurred by an increased focus on last mile connectivity- expected to be largely driven by electric fleet. As fleet operators transition to EVs, key challenges may include raising awareness among their delivery and service partners and persuading them to adopt electric fleets. This can be complex due to sustained challenges for EV financing,” he said.

While the M&HCV segment reported a YoY growth of 10% in the April to September 2023 period, LCVs witnessed a 2.4% decline.

Experts suggest factors such as growth in e-commerce (to aid last-mile delivery), urbanization (increased need for delivery and logistics services) and technological advancements, which make LCVs more advanced with features such as connectivity, safety and fuel efficiency- making businesses efficient and cost-effective, are expected to drive demand for LCVs in short-to-medium run.

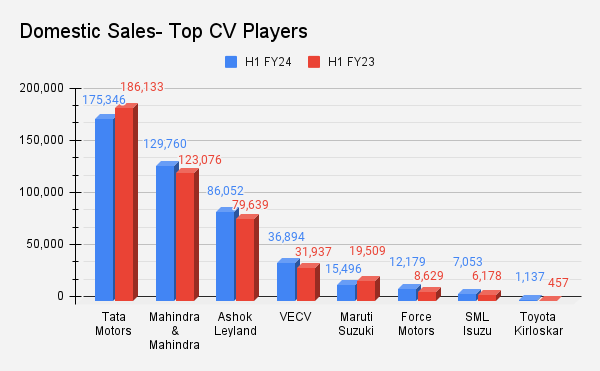

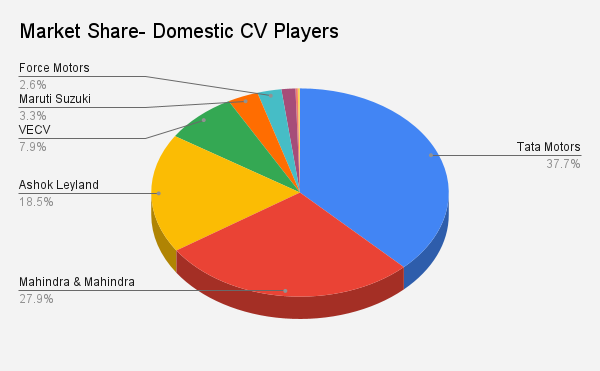

Tata, Mahindra take up 66% of domestic market

Market leader in the CV segment Tata Motors reported about 6% drop in YoY domestic sales. However, Mahindra & Mahindra witnessed about 5% growth during the period.

Tata Motors and Mahindra together take up over half of the domestic CV market, grabbing about 38% and 28% share respectively. This is followed by Ashok Leyland taking up 18.5% share of the pie.

Girish Wagh, Executive Director, Tata Motors, said the company’s upgraded BS-VI Phase-II product range continues to see good traction with customer benefits of lower total cost of ownership. M&HCV segment reported growth fuelled by continued government infrastructure push, robust replacement demand, and growth in core sectors, along with sustained growth from the e-commerce sector.

“We have scaled up our electric bus manufacturing to service orders won from various STUs under CESL’s Grand Challenge. Looking ahead, continuing infrastructure thrust by the government and improving consumption auger well for the CV industry, while rural demand remains to be a key monitorable, as monsoon has been below average,” he said.

CV sector growth

In the mid-to-long term, enhanced economic growth is one of the most pertinent factors expected to drive the CV sector.

“With India’s manufacturing sector projected to reach USD 4.5 trillion by 2047, taking its GDP share to 22% (against a base projection of USD 2.5 trillion with 17% share in GDP), the growth in CV sales may witness an unprecedented boost. An increase in investment demand in the manufacturing sector is also triggered by augmented capital expenditure by the government to reduce import dependence and enhance capacity utilization. Other trends which are expected to promote sales within the CV industry include vehicle scrappage policy and electrification,” Mehra said.

Talking about the outlook of the CV segment, he stated that the sales during H2 FY24 is expected to witness a marginal growth over the previous year, because of bullish sales in FY23, guided by recovery in economic activity, restoration of inter-state personal movement, and enhanced demand for CVs from various sectors (such as FMCG, mining, etc.).

“Thus, though the overall economic activity (aiding infrastructure and manufacturing growth) is expected to increase, overall growth in CV sales is expected to revive in FY25,” he said.

CV exports

Major export markets for CVs include Saudi Arabia, Africa and South Asia. The developing African market is one of the pertinent export destinations, backed by India’s cost-effective vehicles and technologies.

During the first half of fiscal year 2024, the dip was observed on account of the CV industry being directly linked to economic health and with a slowdown in economic growth across, CV sales were impacted. The exports of light commercial vehicles (LCV) constitute about 70-75% of the total CV exports, Pushan Sharma, Director- Research, CRISIL, said.

According to Grant Thornton, with the global growth projected to fall from an estimated 3.5% in 2022 to 3% in both 2023 and 2024, the overall macroeconomic activity remained muted for the first half of 2023, directly impacting the CV exports.

| Export | H1 FY24 | H1 FY23 | % change |

| M&HCV | 8,440 | 11,826 | -28.6 |

| LCV | 23,424 | 30,480 | -23 |

| Total | 31,864 | 42,306 | -24.6 |

Exports to South Asia (Bangladesh, Nepal, and Sri Lanka) have declined owing to muted economic activity in the region. The exports are expected to pick up as the economic activity in these regions improves. Additionally, exports to Latin American markets are expected to further grow as more FTAs get initiated.

With the latest World Economic Outlook report forecasting global inflation to decline steadily, from 8.7% in 2022 to 6.9% in 2023 and 5.8% in 2024- driven by tighter monetary policy and lower commodity prices, the overall economic activity is expected to pick up- which is likely to result in an increase in CV exports from India, Mehra said.