New Delhi: The Indian tractor industry has been in the spotlight since ten months as a prime symbol of the rural juggernaut. Buoyed by a good monsoon, pent-up demand from rural and semi-urban areas, robust Rabi harvest, and better farm income, the industry had impressive sales despite the widespread impact of COVID-19.

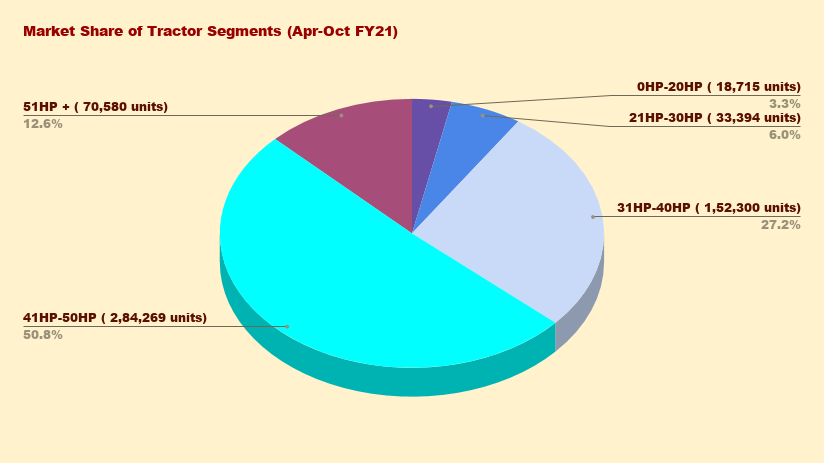

Meanwhile, the industry trend of gravitating towards higher horsepower tractors also continued unabated thanks to its superior performance in hard soil regions and versatile use in both farm and non-farm applications. The market share of 41HP-50HP tractors in the overall domestic volumes grew to about 50.8% between April and October FY21, compared to about 49.3% in the same period in FY19, though there was a paltry dip in volumes.

“Up to 50 HP segment, the contribution of higher HP tractors is expected to rise due to increasing mechanisation levels. States like Punjab, Haryana, Andhra Pradesh, Haryana, Telangana, Tamil Nadu, Madhya Pradesh and Uttar Pradesh are the biggest markets for high-HP tractors, due to higher levels of mechanisation,” Hemant Sikka, president – Farm Equipment Sector, M&M, told ETAuto.

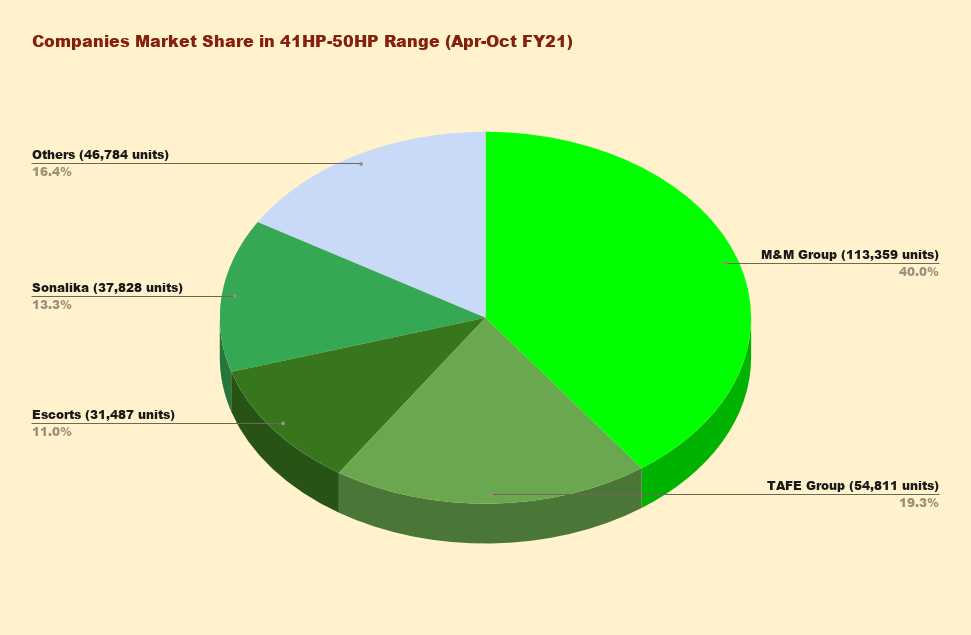

M&M has one of the most comprehensive tractor portfolios, including products on the company’s next-generation tractor platforms – the Novo, Yuvo and Jivo. At present, M&M is the market leader in 41HP-50HP tractors and holds above 40% market share in this category, he said.

Tractor makers are bringing out an ever-greater variety of products within this range. They are eager to capitalise on the rising demand for the above-40 HP tractors, which are a high-margin product range.

“Our product-mix has shifted more towards higher HP tractors. The 40 HP and above proportion of our company has improved to 51% in FY20 against 47% in FY19,” Bharat Madan, Escorts Limited – group CFO and corporate head, said in an analyst call in June. Within this range, the company has launched the Farmtrac Powermaxx series which starts at 47 HP and goes up to 55 HP.

According to TR Kesavan, president, Tractor Manufacturers Association (TMA), farmers are choosing what is optimum. Therefore this industry trend will continue in the medium to long term due to higher fuel efficiency and increased use of implements along with tractors.

“In the current scenario, the implements and equipment that are being used on farms are almost tuned to higher HP tractors. Farmers consider this 41HP-50HP as a prime range because they can use 70% of farm implements with this category to carry out various mechanisation work,” he said.

Experts say that with the convergence of emission norms, the share of higher HP segment will further expand due to the likely increase in the cost of premium segment tractors (above 50 HP) by INR 1.5lakh to INR2 lakh.

“We have to look at the landscape in India where most of the farmers are marginal, and the tractor is the biggest purchase a farmer makes in his life. He may not see any additional benefit in a 20% -25% increase in the cost of that machinery,” Raunak Varma, country manager, India and SAARC, CNH Industrial, said at the ET Auto virtual seminar.

He said that farmers will tend to shift towards comparatively lower HP tractors so that they do not have to pay the increased price, which will further shrink the market of premium segment tractors. At present tractors above 50 HP, where new emission norms are applicable, accounts for only 8% of industry sales (in unit terms).

Additionally, tractor demand for use in agriculture, which accounts for two-thirds of total demand, is expected to significantly outpace commercial-usage demand, which is linked to economic activity, according to rating agency CRISIL. “This is expected to materially improve the volume share of 41-50 horsepower tractors to about 52% this fiscal from 49% last fiscal that could tantamount to 200 basis points (bps) fillip in the average realisation of tractor makers,” it noted.

Month-wise 41-50 HP tractor sales

| Companies | April | May | June | July | August | Sptember | October |

| M&M Group | 2,678 | 13,758 | 19,506 | 13,759 | 14,117 | 24,626 | 24,915 |

| TAFE Group | 1,839 | 7,000 | 10,302 | 6,731 | 6,656 | 11,683 | 10,600 |

| Escorts | 476 | 3,948 | 5,834 | 2,898 | 3,980 | 7,007 | 7,007 |

| Sonalika | 454 | 4,,373 | 7,204 | 4,391 | 4,653 | 8,787 | 7,966 |

| Others | 1,336 | 4,421 | 7,018 | 6,307 | 7,053 | 9,155 | 11,494 |

| Total | 6,783 | 33,500 | 49,864 | 34,086 | 36,459 | 61,258 | 62,319 |

Source: Industry Data