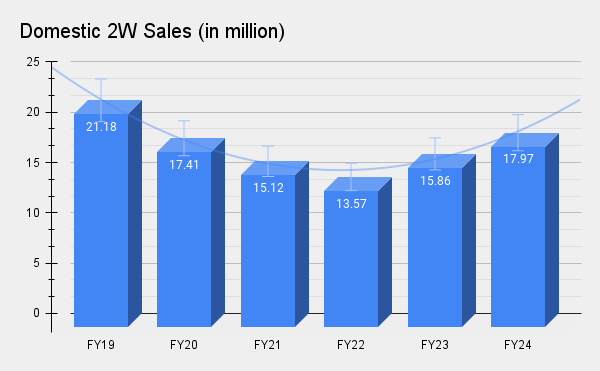

New Delhi: Despite the two wheeler industry growing higher than expected this year, it could still take about 3-4 years to touch peak sales, according to an official of the two wheeler maker Honda Motorcycle & Scooter India (HMSI). The segment recorded its best-ever year with peak sales of 21 million units in FY19.

“It should take around three to four years,” Yogesh Mathur, Director- Sales and Marketing, HMSI, told the reporters on the sidelines of the 64th SIAM Annual Session.

According to Mathur, one of the reasons is an anticipated hit on sales due to implementation of OBD (Onboard Diagnostics) Stage-2B from April 1, 2025. “The two-wheeler sales so far this year have grown by 16%, against the initial forecast of 10-12%. But the industry has to start adjusting production later this fiscal year due to implementation of OBD Stage-IIB norms.”

Earlier, the advanced OBD-IIA was made mandatory on all two wheelers sold in India as part of the BS-VI Phase-II emission norms that kicked in from April 1, 2023.

The OBD system monitors the vehicle’s emission levels in real time, regulates a standardized access to the electronic control units (ECUs) for inspection and in case needed, informs the driver via the malfunction indicator light (MIL) on the dashboard.

Mathur suggested that the upward price revision with the new norms could put pressure on consumer demand for motorcycles and scooters. When asked about the quantum of increase in cost, he said it is expected to be “substantial”.

Earlier, ETAuto reported that despite 17% growth the two wheeler segment was at a 9-year low in FY23.

Outlook for FY25

The two wheeler maker expects the industry to clock about 17.5 million units during the ongoing fiscal year. Talking about the sales expectations for the festive season, he said it could be one of the best years for the two-wheeler industry. However, this October “will be crucial to decide upon the overall direction of the two wheeler market.”

HMSI also confirmed its entry in the electric vehicle (EV) segment in FY25. “We will soon be coming in with our first electric vehicle. We are the only OEM left (to launch an electric two-wheeler) and it will be launched later this fiscal.”

The maker of Activa scooters looks to mark a double-digit growth for the year. Last month, ETAuto reported that during the April-July 2024 period, it overtook Hero MotoCorp in domestic dispatches.

On close competition with the market leader, Mathur said, “We are not aiming to become No 1 or No 2, it is just a result of growing year-on-year. Last year, we had supply chain challenges for four to five months. This year onwards, we have tweaked our entire supply chain, and a range of products launched in the second half of last year is exciting the customers.”

HMSI offers nine motorcycles and four scooters in its portfolio. Currently, motorcycles account for about 40% of its total sales as against 60% share of scooters. “Motorcycles have a growth rate of about 13%, while scooters are growing faster at 24%.”

According to him, rural market for the two-wheeler segment has not grown as expected in the country during the first half of this year. However, better demand is expected in the second half of 2024. “Normally, the first quarter of every fiscal year is a marriage season, especially in the rural area. But this time, it was not there. The long tenure of the elections and delayed monsoons also impacted. When the monsoon started, incessant rains caused flash floods, which impacted the sales.”

The company, which has an installed production capacity of 6.2 million units per year, said its plants are currently running at full capacity. Meanwhile, it is “studying the options” for a greenfield manufacturing facility. “So all those options are also in pipeline”.