New Delhi: As the awareness around vehicle safety and technology is increasing, customers are looking for ease of operations and automakers are focusing on bringing newer Advanced Driver Assistance Systems (ADAS) features in their latest offerings. Several carmakers including Hyundai, Tata Motors, Mahindra, Honda, and MG Motor are offering a variety of these features in their new vehicles.

ADAS offers features across different levels to let the vehicle drive itself autonomously. For Level-0 to Level-4, the driver must hold their hands on the the steering wheel at all the times. In the highest Level-5, vehicles are fully autonomous and do not require any human supervision.

Globally, the market growth is driven by L2 and L3 vehicles with automakers working on making L3 solutions commercially available. Driverless L4 and L5 vehicles are being piloted in some markets.

A recent Mckinsey report suggests that steep up-front costs for developing L3 and L4 driving systems suggest that auto companies’ efforts to commercialize more advanced autonomous driving systems may first be limited to premium-vehicle segments.

“Additional hardware- and software-licensing costs per vehicle for L3 and L4 systems could reach USD 5,000 or more during the early rollout phase, with development and validation costs likely exceeding more than USD 1 billion. Because the sticker price on these vehicles is likely to be high, there might be greater commercial potential in offering L2+ systems. These autonomous systems somewhat blur the lines between standard ADAS and automated driving, allowing drivers to take their hands off the wheel for certain periods in areas permitted by law,” it said.

In India, the adoption of ADAS features is still at an early stage. Interestingly, an AI startup Minus Zero has recently unveiled what it claims is India’s first autonomous vehicle based on a camera-sensor suite. The concept vehicle is named zPod. However, several works are going on at the prototype level on such concepts and it is yet to be seen if the product becomes commercially viable.

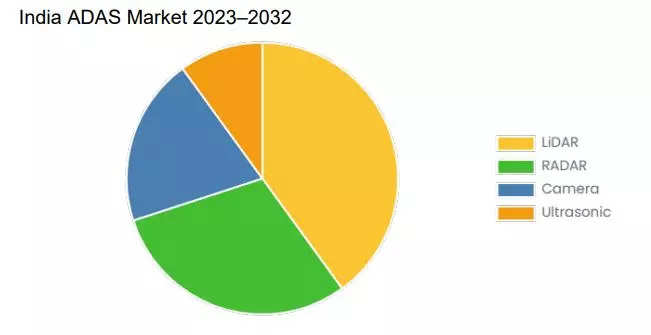

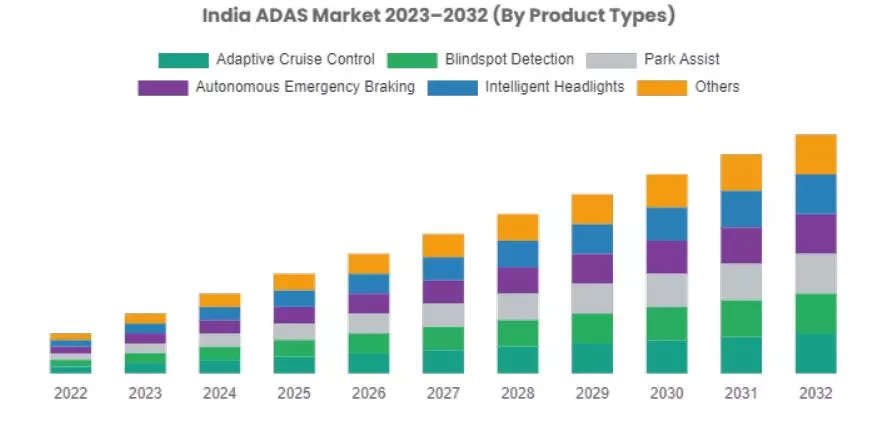

According to a recent market research conducted by CMI Market Research Team, the global India ADAS market is expected to record a CAGR of 18.80% from 2023 to 2032. In 2022, the market size is projected to reach a valuation of USD 1.24 billion. By 2032, the valuation is anticipated to reach USD 9.98 billion.

As the needs of the industry are developing towards safety and technology, so are the suppliers in adapting to the market preferences. Tech giant Continental is working on cost-efficient ADAS technology for the Indian carmakers.

Prashanth Doreswamy, President & CEO, Continental India, says ADAS technology can be split into assisted, automated and autonomous. “While the assisted functions are required for safety, the automated and autonomous are more for convenience- it takes the work from you to complete it on its own,” he said.

Hyundai is also observing a significant change in customer behaviour in terms of buying high-end cars, along with the evolving preference for aspiration over functionality and features over price.

“The good thing is that it is continuing despite the headwinds. The customer still wants connected cars, high trims and modern technology. On one side, the pent up demand may be tapering off, but on the other hand, the behavior of the customer in terms of the newfound freedom and a penchant for fine things continues. The fresh demand that is coming in is for higher trims of SUVs with ADAS,” Tarun Garg, Hyundai Motor India, said.

He said that in the overall sales of Tucson, about 85% volumes comes from models with ADAS features and for Verna this stands at 36%.

Honda Cars, which recently launched the Elevate SUV also features its ADAS technology, called the Honda Sensing. Collision Mitigation Braking System (CMBS), Adaptive Cruise Control, Road Departure Mitigation (RDM), Lane Keeping Assist System (LKAS), Lead Car Departure Notification system and Auto High-Beam are the signature features of ADAS here.

Takuya Tsumura, CEO & President, Honda Cars India, said that about 90% of Honda City sales volumes come from models with ADAS features.

The company’s City petrol sedan also comes with Honda Sensing now. Additionally, the City hybrid gets a ‘Low-Speed Follow’ in Adaptive Cruise Control function feature. Another feature ‘Lead Car Departure Notification System’ has been added in Honda Sensing suite in both City petrol and hybrid, that informs the driver with visual and audible alerts when the preceding vehicle starts moving in situations like traffic lights junctions.

In 2021, MG Motor India launched the Astor, with a personal AI assistant and segment-first autonomous (Level 2) technology. It offered AI technology, six radars, and five cameras to manage 14 advanced Autonomous L2 features. MG collaborated with Bosch on ADAS. Now, its model portfolio including the Hector and Gloster come with ADAS features.

Tata Motors entered the ADAS space with its Harrier and Safari launched this year.

India Potential And Challenges

KPIT Technologies believes that working with specialist teams across the globe, India can bring deep expertise and scale to ADAS and autonomous driving software development as it has in other software domains. “It is an opportunity waiting to be seized,” the company said.

Software development for ADAS requires deep math and engineering capabilities, along with world-class training and upskilling programmes. Set to produce over 8 lakh engineers in computer science alone every year, India has the largest talent pool in place for advanced software development.

Doreswamy of continental said, “We see significant changes for software integration in the coming years. That coupled with some Artificial Intelligence (AI) driven technologies will become even more prevalent. This will have a huge potential to make vehicles more safer, efficient, and convenient.”

However, experts also suggest that there are several challenges in adoption and deployment of ADAS features in vehicles. A part of the road infrastructure is not fully equipped to support the widespread adoption of ADAS technologies in India. The steep up-front cost for development of these features may also limit its adoption amongst the cost-sensitive consumers.