New Delhi: The Coronavirus pandemic has brought the commercial vehicle (CV) industry to its knees but the gradual reopening of economies helps the sector to get on the road to recovery. In the first quarter (Q1) of FY22, the domestic market for CVs has begun to climb back from the steep downturn seen in 2020. Unlike last year, when the pandemic first erupted, OEMs were quite operational in April this year and saw only marginal decline in volumes as compared to March.

New Delhi: The Coronavirus pandemic has brought the commercial vehicle (CV) industry to its knees but the gradual reopening of economies helps the sector to get on the road to recovery. In the first quarter (Q1) of FY22, the domestic market for CVs has begun to climb back from the steep downturn seen in 2020. Unlike last year, when the pandemic first erupted, OEMs were quite operational in April this year and saw only marginal decline in volumes as compared to March.Despite the second wave of COVID-19 infections and re-imposition of lockdowns this summer, the trucking industry, which is a leading economic indicator, was not hurt the same way as it was in the same period a year ago because markets were partially operational.

Sales of the top five CV companies which contribute to 98% of the domestic sales, jumped by 235.60% in April-June 2021 at 102,176 units compared to 30,440 units in the same period last year. Medium and Heavy Commercial Vehicles (M&HCVs) rose over six times at 25,632 units and Light Commercial Vehicles (LCVs) grew by 68,598 units over the same period last year.

While the CV sales saw a healthy increase in factory dispatches in the three months to June 2021, industry experts have cautioned that the data will not paint the full picture of the industry’s growth trajectory. They argue that the strong number is simply due to the low base from last year’s negative print and that it will be some time before the wholesales get back to the pre-Covid levels.

“Tata Motors’ CV domestic sale in Q1 FY22 at 43,400 units was about 56% lower than the previous quarter (Q4 FY21) as the momentum of strong sequential demand recovery, evident in the H2‐FY21, was disrupted by the surge in Covid second wave. With decentralized restrictions and focus on micro containment zones this year, the sale in Q1 FY22 was 4.7 times of Q1 last year which was under complete lockdown,” Girish Wagh, ED and president, CV business unit, Tata Motors, said.

While trucking conditions are improving, the sector continues to see short-term challenges such as delayed replacement cycle and long-term issues such as supply chain disruptions and a shortage of computer chips.

Another industry expert, who didn’t want to be identified, said only those that are confident the economy is improving are ordering what they would have earlier, but orders are still running below replacement demand. “Medium-sized and small fleets that probably aren’t as profitable have delayed replacements, and this trend will continue throughout 2021. There’s still too much uncertainty,” the person mentioned above said.

Weathering the unstable economic environment, the M&HCV segment climbed a growth of 25% at 25,632 units in Q1 FY22 as compared to 15% in the same quarter year, largely due to strong demand for tipper trucks from the infrastructure and mining sector.

During the quarter under review the LCV (truck) segment has been facing headwinds from the macroeconomic and consumption slowdown due to sporadic lockdown that restricted intercity transport. Coupled with subdued demand from rural and allied sectors, wholesale market share of LCVs (trucks) contracted to 68% during April-June 2021 from 83% in the same period year ago.

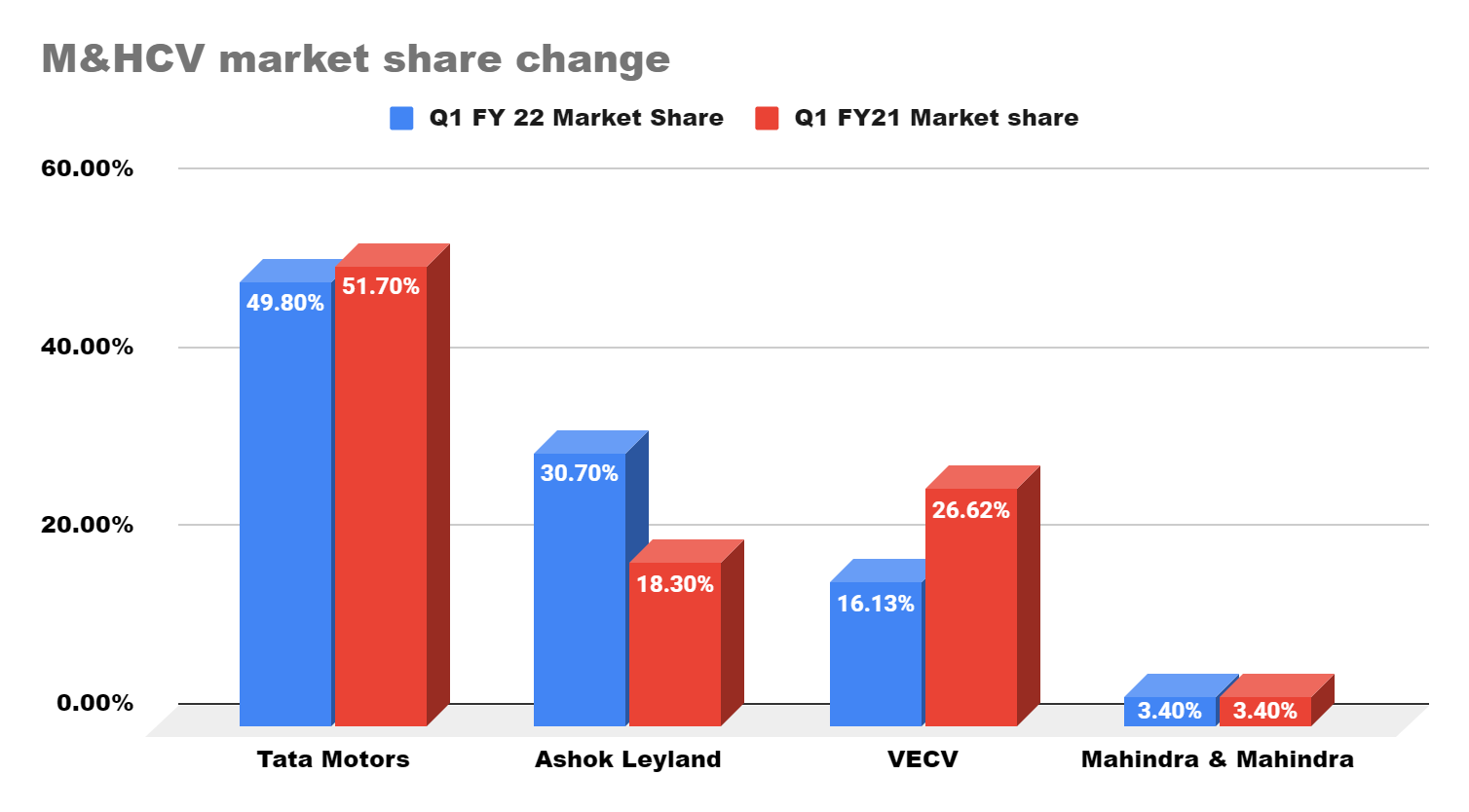

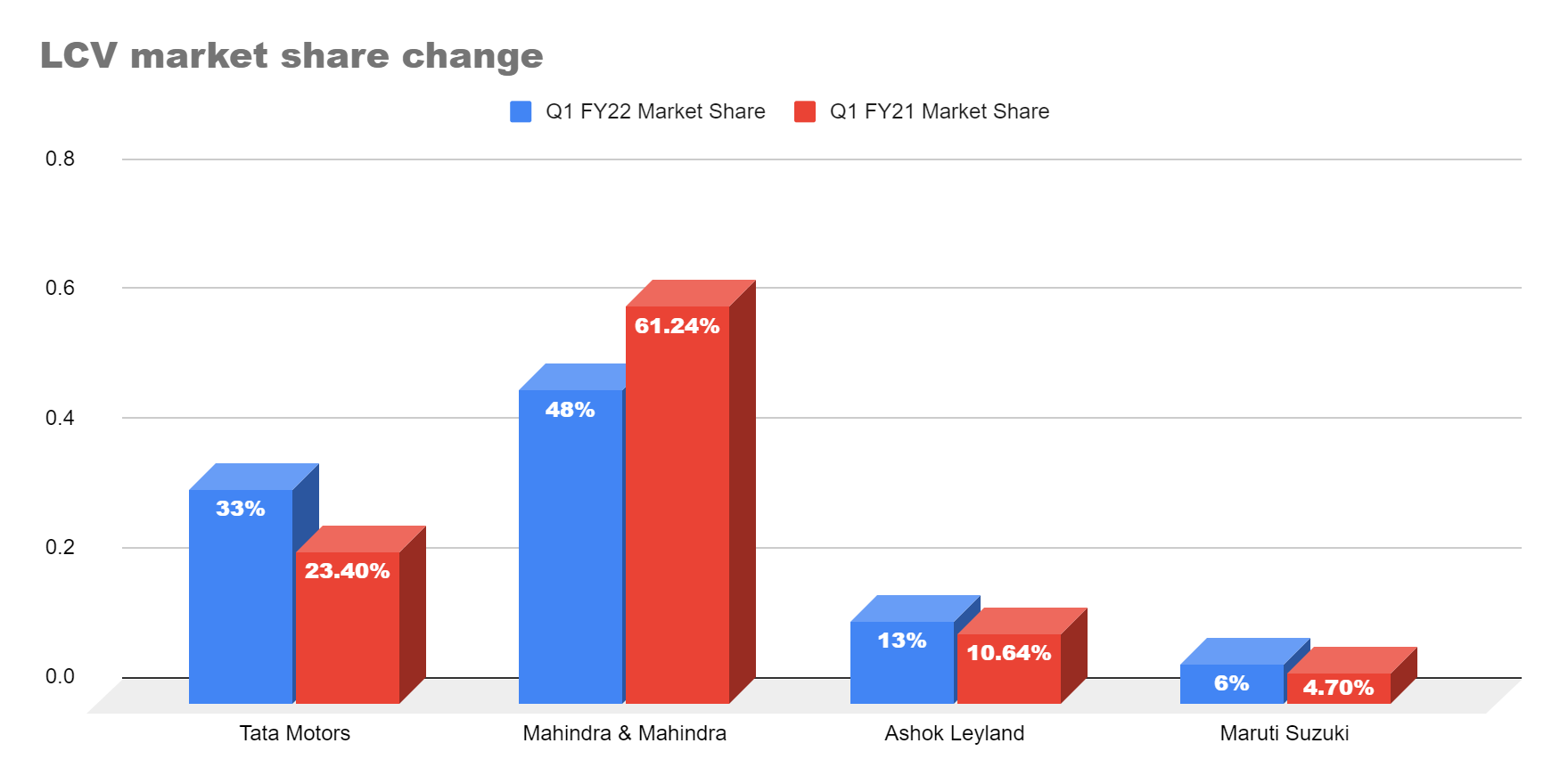

While Tata Motors, the country’s largest CV maker, lost 2% market share in M&HCV segment, its LCV share jumped almost 10% in Q1 FY22 on the back of its product launch of Ultra T. series range of advanced LCV designed specifically for urban transportation.

In comparison, M&M’s market share in the LCV segment reduced to 48.34% in Q1 FY22 which is a decline of 13% in the market share. This is also the highest fall of market share by any manufacturer last fiscal year.

Among the key players, Ashok Leyland emerged as the sole OEM which has witnessed market share gain in both the sub-segments driven by introduction of new products. In the last one year the company has launched Bada Dost truck in the LCV segment and modular truck range AVTR in M&HCV which raised its share to 12.67% and 30.7% in both verticals respectively.