By Dev Ashish Aneja and Abhishek Bansal

Electric vehicles (EVs) are expected to play a crucial role in reaching the sustainable development goals. In India, the adoption of EV is likely to grow significantly with the increasing demand for the clean energy-based mobility solutions. The Union Government has plans to hit a target of 30% electric vehicle adoption by 2030 powered primarily by electrification of two-wheelers, three-wheelers, and commercial vehicles.

The annual battery demand is forecasted to be 70-80 GWh by 2028, of which two-third will be for electric mobility-related applications. The rest will be for stationary applications. This demand is going to increase exponentially in the coming years owing to the increase in population, industrialization, and urbanization in the country. A lot of industries such as data centers, telecom and renewable energy use these batteries as a backup source for their power requirement.

Ten bids with a cumulative capacity of ~ 130 Gwh have been received under the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) battery storage. This scheme has received an encouraging response from domestic as well as global investors as bids received are 2.6 times of the tender size of 50 Gwh.

Global battery raw material price trends

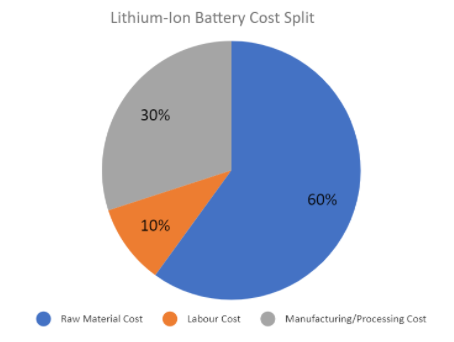

About 60% of the cost of lithium-ion battery production is raw materials. Labour, processing and manufacturing costs account for 10% and 30%, respectively. Of this, 60% upstream raw material cost – cathode materials such as mixed metal oxides of lithium, nickel, manganese and cobalt (NMC), Lithium Nickel-Cobalt-Aluminum Oxide (NCA), Lithium-ion manganese oxide (LMO) and lithium ferrophosphate (LFP) account for a relatively high proportion of about 40%. Thus, any rise in raw material prices has the potential to increase the overall battery cost considerably. This can be a dampener to the otherwise bullish EV penetration projections.

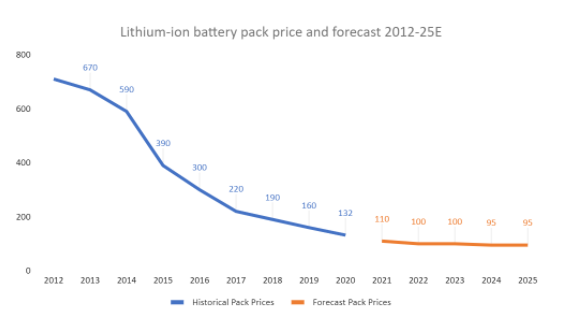

According to a BloombergNEF (BNEF) Survey, we have seen battery prices come down from USD1,000 to USD132 in the past one decade. This trend of a consistent fall in the battery prices has been one of the major growth drivers in the EV industry. Until recently, there was an industry-wide assumption that this trend may continue. However, prices of spodumene concentrate have risen nearly six times over the past 14 months (later part of 2020 & 2021).

Lithium isn’t the only raw material price that has increased. Nickel, cobalt, and manganese prices are all up. But it’s certainly the principal raw material “lithium” that’s seen the most significant rise. Towards the last quarter of 2021, battery producers globally started passing on these price increases to their customers. Most of the battery makers started writing to their customers for new pricing structures in lieu of rise in cathode and anode raw material price increases. Last year (2021) witnessed consistent price increases and this trend is continuing into 2022 as well.

The Chinese battery-grade lithium carbonate prices rose by 21% in the first two weeks of January 2022, adding further cost pressures on battery makers who are moving to secure their own supplies of the key raw material. China’s battery-grade lithium carbonate hit a record high average of USD 47,500 a ton, according to Benchmark’s Lithium Price Assessment, bringing prices up by 495.9% compared to the end of January 2021.

Need for recycling and global best practices

The broad explanation for this is the large-scale under-investment in the upstream sectors which is leading to a shortage of key battery raw materials. Demand for battery grade minerals is by far exceeding the supply. On an average, it takes 5-7 years for a mine to get operational from the time deposits are discovered. Lithium processing facilities to convert this ore into battery grade chemicals such as carbonates and hydroxides takes 2-3 years to set up.

Commissioning of a typical cathode manufacturing plant or even a cell manufacturing plant takes about 2-3 years. Thus, the longest lead time or the bottleneck in the entire supply chain is the upstream element which takes the most time to set up. Unfortunately, this has been getting the least investor interest in the past. One of the possible solutions to this bottleneck is cost efficient and sustainable recycling facilities which can ensure quality raw material supplies to cathode makers and cell makers.

Europe and North America have started to explore this route of battery recycling. These regions are looking to reduce their reliance on Chinese suppliers for battery grade materials. One of the sustainable ways of doing this while managing raw material cost escalations is the usage of recycled materials in the production of battery cells. Europe as a region has been one of the pioneers in developing the right ecosystem and policies for recycling companies to thrive. For example, by July1, 2024, EV batteries in Europe will require carbon footprint declaration, and by January 1, 2027 the declaration of the content of recycled lithium, cobalt and nickel.

While startups dominate the headlines for recycling, automakers and battery manufacturers have announced plans to establish their own recycling facilities. Vertical integration of manufacturing and recycling helps OEMs ensure a supply of increasingly expensive battery commodities. OEMs are also well-suited to accept their own end of life battery packs as they know their exact composition and dismantling procedure. Volkswagen and Tesla, for instance, are building their own recycling capabilities. Also, Northolt has started its recycling programme named Revolt. In November 2021, Northvolt produced its first battery cell with 100% recycled nickel, manganese and cobalt. Electrochemical testing of these cells made from recycled materials demonstrated performance at par with the cells produced from freshly mined metals.

Battery recycling opportunity in India

It’s the right time for global recycling companies to enter the Indian market especially with PLI ACC getting an incredible response. Most of these cell makers who kick start production in the next 18-24 months will have a sizable volume of pre-production battery waste which will be raw material / feedstock to these recycling companies. These cell makers can be potential JV partners for these global recycling companies.

Also, with the central government working on a battery swapping policy, major battery swapping players such as (Reliance & BP), Sun Mobility, (Hero Moto Corp & Gogoro) along with Honda can be prospective JV partners for global recycling companies because swappable batteries are the most utilized and the first ones to be recycled owing to their usage in the fleet / B2B space.

We are already seeing a good amount of traction from global recycling companies who are keenly observing the Indian market and the PLI-ACC activities. We are bullish on this industry and expect some major announcements on this front this year.

(Disclaimer: Dev Ashish Aneja – AVP & Sector Lead and Abhishek Bansal, Investment Specialist are a part of Automobile and Electric Mobility Sector of Invest India, the National Investment Promotion and Facilitation Agency of Government of India. Views expressed are personal.)

Also Read: