The economic impact of the COVID-19 pandemic on India has been very damaging. The Reserve Bank of India revised India’s gross domestic product (GDP) projections from 10.5% to 9.5% in FY22. The automotive industry, including the aftermarket, lost revenue worth billions.

The overall Indian aftermarket was estimated to be worth about INR 72,552 crore in FY20 (maintenance parts), and it was estimated to surpass INR 75,000 crore by FY21. However, as a result of the global pandemic, the market declined by about 25% to INR 54,414 crores in FY21. The aftermarket is expected to revive in FY22 and grow by about 15% to INR 62,576 crore. With the growing used car market, vehicle parc, increasing vehicle ownership in semi-urban and rural markets, and growing safety norms and regulations, the overall aftermarket is expected to grow by about INR 100,000 crore by FY30.

As a result of the global pandemic, the market declined by about 25% to INR 54,414 crores in FY21. The aftermarket is expected to revive in FY22 and grow by about 15% to INR 62,576 crore~

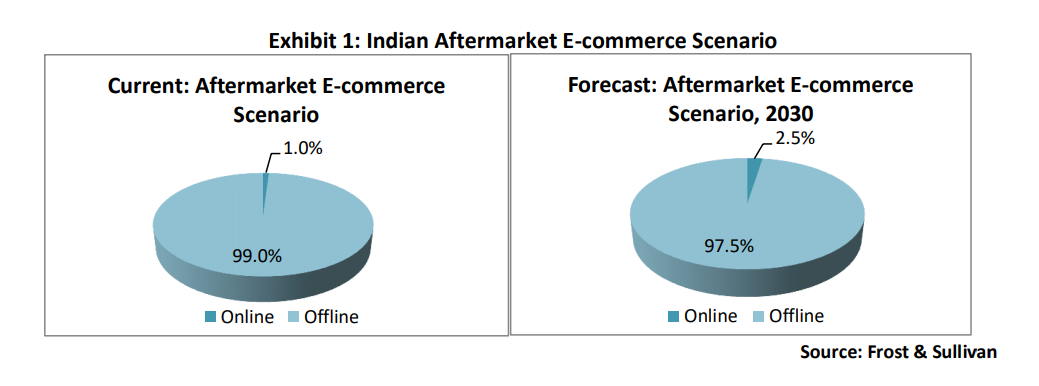

As a new trend, the industry participants of the Indian automobile aftermarket are focusing more on e-commerce platforms. The e-commerce automotive aftermarket in India is at a nascent stage. It is estimated to be at about INR 540 crore, less than 1% of the overall aftermarket in FY21. But with the growing preference for digitization by industry participants, it is expected to grow to INR 2500 crore by capturing 2.5% of the total aftermarket by FY30.

E-commerce platforms are expected to witness a surge in demand. The focus would be on Tier II and Tier III cities, technological innovations, and improved online purchase models.

Evolution of E-commerce

The evolution of E-commerce is expected to offer opportunities for all industry participants including the OEMs, OESs, workshops and garages, distributors, the end-customers, non-auto stakeholders, and mobility startups.

OEMs: As most of the original equipment manufacturers (OEMs) have limited penetration in the aftermarket, with e-commerce platforms, they have an opportunity to adopt an Omni-channel approach and multiple customer touchpoints, resulting in better business opportunities.

OES: Original equipment suppliers (OESs) have an opportunity to use online platforms to optimise their parts distribution efficiency and enlarge distribution coverage in the untapped or weakly tapped markets. They could obtain first-hand information on the market demand, streamline new product developments and optimise inventory management. Suppliers could ensure faster response to buyers/market demands and also have product promotion on additional sales channels other than the existing offline channels.

Workshops/garages: With the availability of genuine parts from catalogues, independently organised workshops could provide high service levels to the end-customers and gain increased confidence/trust. Through innovative e-commerce channels, the workshops could use and analyse their internal database to help streamline the parts searching and matching process. Competitive pricing is another benefit of the evolution of e-commerce. As more players enter this space, workshops could expect highly competitive prices and transparency in the supply chain.

Distributors: Distributors would have the opportunity to expand their product portfolios and broaden coverage beyond their local reach. They could also aim to establish regional distributor alliances and partnerships.

End-customer: With an efficient e-commerce automotive aftermarket industry in place, the ultimate beneficiary would be the end customers, who would have more power in their buying, repair, and installation decisions by being more informed about the correct parts and having more confidence in their transactions.

Non-automotive stakeholders: E-commerce comes with distinctive and nuanced risks, such as cyber attacks, product liability issues, professional liability concerns, etc. Even if an e-commerce platform is selling the products and services created by others, such issues can negatively affect the business. This provides excellent opportunities for insurance companies, which could strengthen the e-commerce businesses by offering supplier insurance, cyber insurance, commercial crime insurance, product liability insurance, cargo insurance, etc. Similarly, the financing organisation would play a major role in advancing initial capital to the e-commerce platforms. Financing models can be offered to the buyers, both in B2C and B2B segments, thus providing vigorous stimulus to the buyers.

Distributors would have the opportunity to expand their product portfolios and broaden coverage beyond their local reach~

Mobility startups: The advent of e-commerce businesses in the aftermarket opens doors for mobility startups to use the new technologies and provide more accurate insights on the predictive maintenance for their mobility solutions. Remote diagnostic services provided by mobility businesses can benefit from the e-commerce platforms and empower their end-customers and fleet operators to select the correct parts. The data analytics models can be exploited to make product selection, availability, and price optimization easier for their end customers.

E-commerce business models

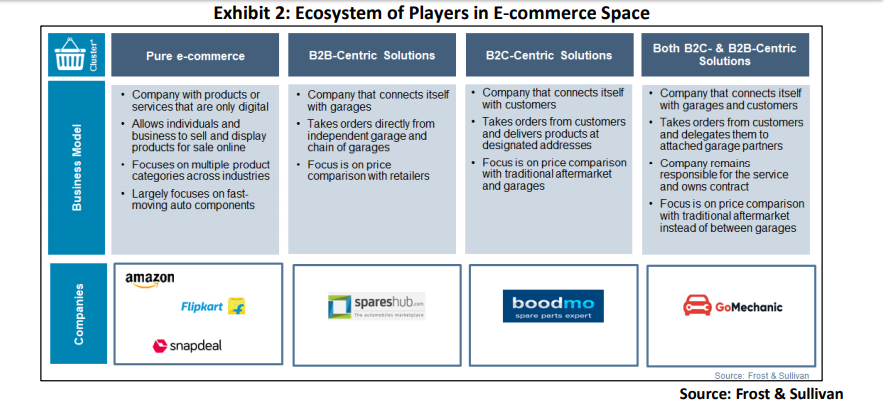

Now there are only limited players in automotive aftermarket e-commerce sales. The existing players like Boodmo, GoMechanic, Spareshub, Amazon, and others operate completely digitally, with exclusive B2C or B2B focus. A few of them operate with both.

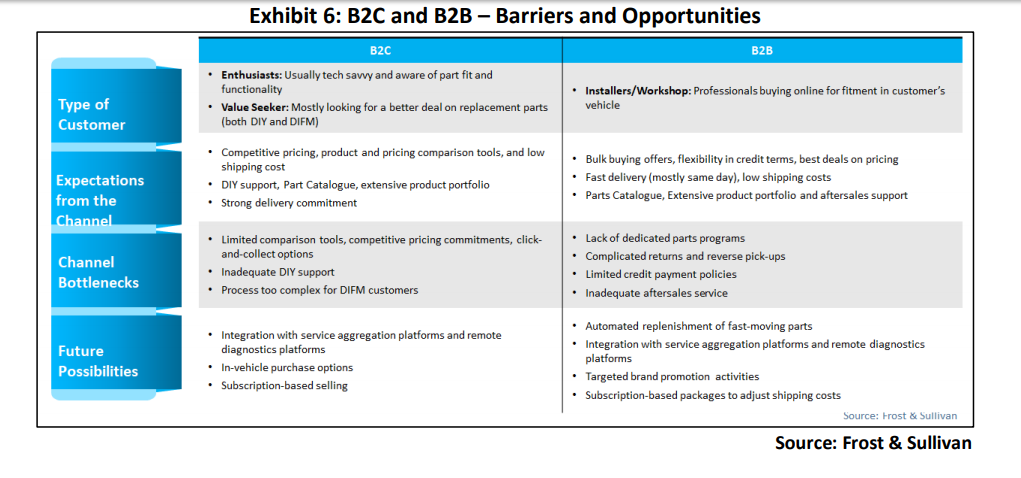

In both B2B and B2C segments in India, improvement is required for online purchasing, with the ultimate goal of increasing customer awareness and confidence in buying parts online. This requires a lot of effort to be put into online and offline elements.

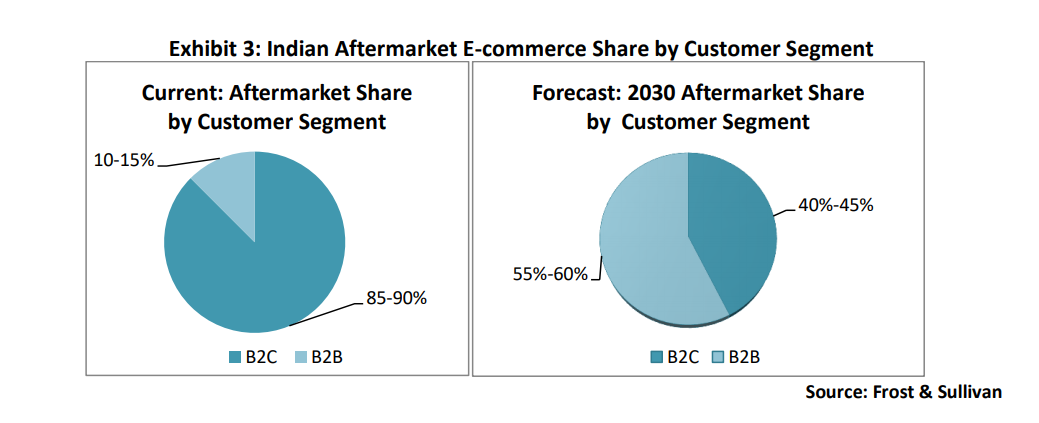

At present, around 85%-90% of the e-commerce market is dominated by the B2C segment, and the remaining 10%-15% is captured by the B2B segment. By 2030, we expect the B2B segment to evolve and capture close to 55%-60% of the total e-commerce market and the B2C segment to hold the remaining 40%-45%.

In order to understand the opportunities and challenges within the aftermarket in the e-commerce space, there is need to look at some of the trends observed within the B2C and B2B segments.

B2C segment

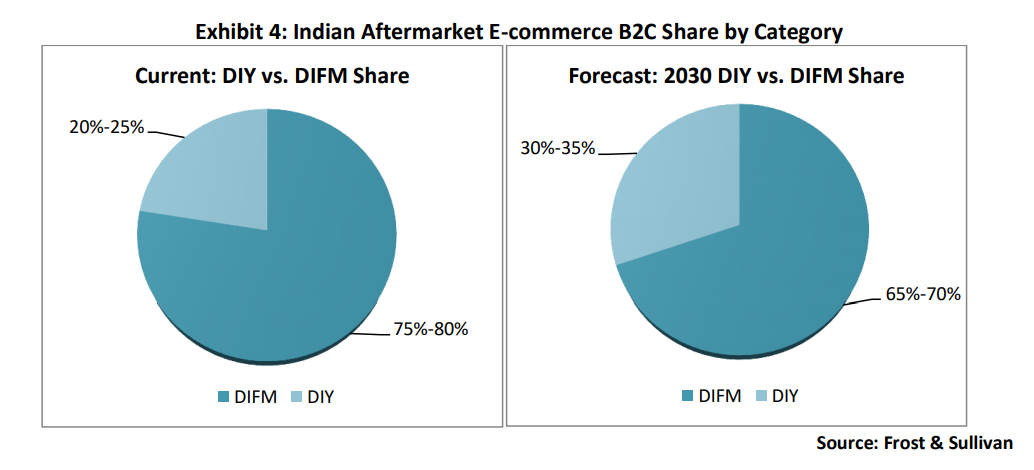

At present, the B2C segment contributes to the majority of the purchases made on e-commerce platforms. Its further bifurcation reveals that the do-it-for-me (DIFM) category accounts for almost 75%-80% of the total online sales, and due to the low labour cost the do-it-yourself (DIY) category accounts for the remaining 20%-25%.

By 2030 we expect the DIY category to grow and capture close to 30%-35% of the total sales and DIFM to account for the major share at 65%-70%. The market has increasingly shown an affinity for DIFM replacement part categories as sellers adopt smarter fulfilment models for the end-customers.

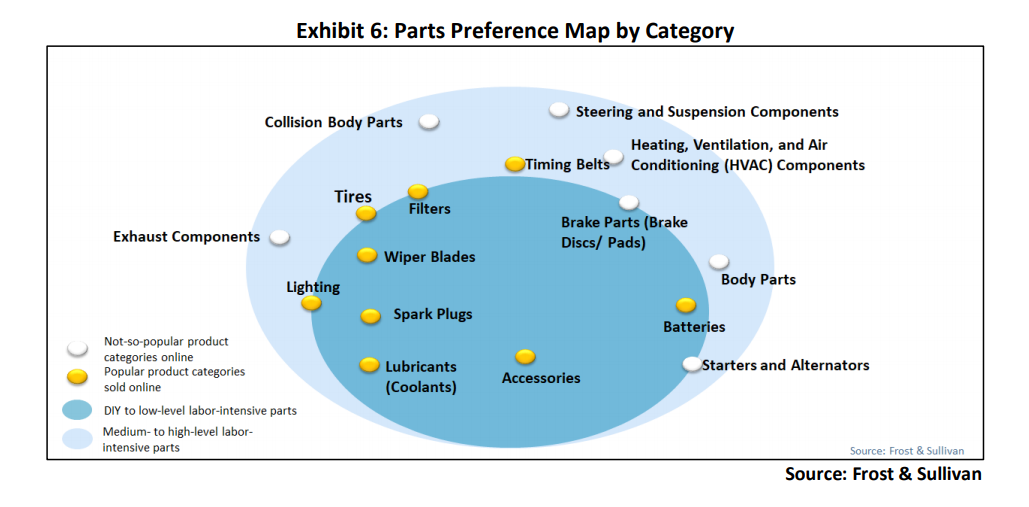

Within the DIFM category, most sales are counted for high-margin parts such as tyres, filters, timing belts, brake pads, brake discs, etc. This is attributed to the increasing complexity in the repair requirements and the use of specialised electronic components in advanced vehicles, which vehicle owners usually do not possess. They have to rely on professionals to replace and install the bought parts.

E-commerce sales within the DIY category illustrate that parts requiring fewer installation efforts, such as batteries, lubricants (coolants), spark plugs, and accessories, are the most preferred products.

The majority of the DIY customers are from the two-wheeler segment, followed by the PV (taxi and cab drivers) segment. Major drivers for these preferences are competitive pricing, easy and quick installations, higher product knowledge, and lower risk involvement.

The existing e-commerce business models in India, from purchase to parts installation, involve a mix of online and offline elements. In the B2C segment, information about the product is important for the e-commerce platform and the end-customer. In the case of DIFM with B2C sales, there are high chances of conflicts over the actual part purchases and installation methods used by the independent workshops, which could vary and, in some cases, lead to rejection of the parts.

B2B Segment

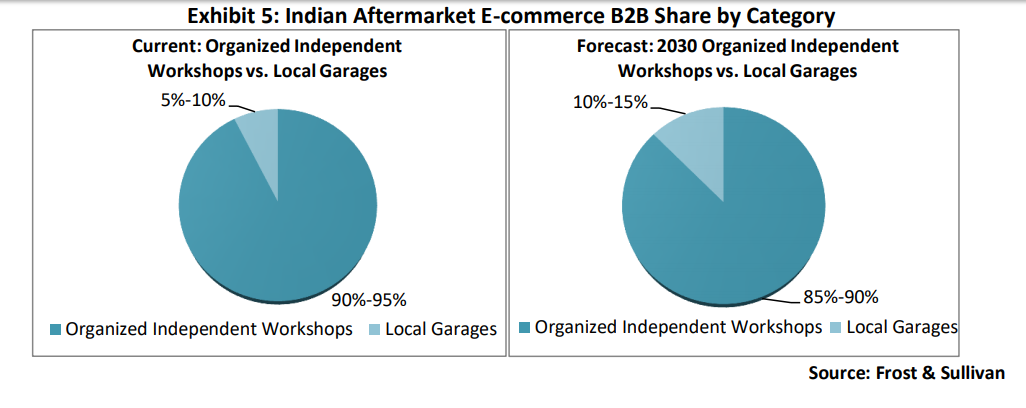

In the B2B segment, close to 90%-95% of the total sales are by organised independent workshops, while local garages/roadside mechanics account for approximately 5%-10% due to their low exposure to e-commerce platforms. By 2030, we expect the organised independent workshops continue to dominate the B2B segment, accounting for close to 85%-90% of the total e-commerce sales. Local garages/roadside mechanics with access to easy-to-use e-commerce platforms (apps, websites) would account for the remaining 10%-15%.

There are limited B2B e-commerce players in automotive aftermarket sales in India with a conventional B2B business model. In this case, most of the information remains with either the e-commerce platform or the workshops that buy from them. The end- customer thus has to remain dependent on the workshops for parts availability and performance.

Preferred Parts on E-commerce

The majority of parts purchases online are either vehicle accessories or parts for which the decision-making is easy. This is ultimately a result of the knowledge availability, criticality of the component, installation requirements, and awareness about the brand and warranty. The higher the criticality, the more the end-customer is likely to shift to the OEM authorised workshops rather than the e-commerce platforms or independently organised workshops, as observed in the present scenario.

Challenges and opportunities from the B2C and B2B perspectives

As the Indian automotive aftermarket is expected to witness increased sales through online platforms, the opportunity to build an e-commerce platform that bridges the gap of quality and trust among primary vehicle owners needs to be tapped. Let us categorise the challenges and opportunities from B2B and B2C perspectives.

The existing credit facility in the traditional offline sales channels, unavailability of parts catalogue, lack of extensive product portfolio and training modules, uncertainty on the lead time, and lack of multilingual platforms are the major challenges faced in the current e-commerce market

B2B perspective

- The Indian primary vehicle owners have been highly dependent on the OEM authorised workshops and have shown high reluctance toward the organised independent workshops for repair and maintenance. This is the case while the warranty is valid, after which they gradually become comfortable with more economic, nearby independent workshops. Independent workshops in the Indian market are not highly acknowledged compared to the European or American automobile aftermarkets, mostly due to trust and quality issues.

- Most independent workshops use the conventional supply chains for buying the parts from OES or OEM authorised distributors. These transactions are usually backed up by mutual trust and credit payment terms. E-commerce platforms have to find a way to bridge this gap because none of them work on credit with their customers.

- Multi-brand repair shops would require a lot of information from e-commerce platforms, such as a parts catalogue, training modules, and technical knowhow of parts to make their buying decision easier. A strong focus is on providing surety for the correct match between the parts and the vehicle model. Other aspects related to product warranties and aftersales services should also be addressed to ensure vigorous and healthy service levels for B2B customers.

- Lead time is another challenge that e-commerce platforms have to look into when operating in a huge country like India. This would require a more resilient supply chain and faster deliveries.

- Returns and reverse logistics are still a hurdle, reducing the confidence of workshops in shifting their interests from conventional distributors or OES to e-commerce platforms.

- The e-commerce platforms could also bridge the gap between the primary vehicle owners and independent workshops by extending support for real-time visibility of available parts at the nearest independent workshops and giving interactive services to the end customers.

- As social distancing and hygiene concerns will continue in the coming years, along with contactless service booking and doorstep deliveries, the e-commerce platforms should bring virtual reality concepts and 3D models to provide more knowledge about spare parts and services to the independent repair shops.

B2C perspective

- The COVID-19 pandemic and strict lockdowns in India made the workshops shut down for months and pushed many Indians to try to repair/replace the basic components of their vehicles by themselves. This has increased online spare parts purchases and DIY concepts among primary car owners. This isl most likely to continue even after COVID, at least for the basic car components like batteries and filters. Therefore, e-commerce platforms should use this opportunity to create a DIY market for the end customers by providing accurate information for their needs.

- Many end-customers would likely continue to use the contactless services and prefer the mechanic to come to them with the right tools to repair/service their cars at their doorstep. E-commerce platforms could bridge this gap of providing doorstep service deliveries by partnering with the local independent repair shops and mechanics to facilitate easy booking and payment options.

- Language barriers still exist in India when it comes to online buying. Purchases related to critical auto components without proper understanding of the language used on e-commerce platforms still keep many customers away. In a multilingual country like India, platforms must be launched in some of the key regional languages, and aftersales services also should be available in the regional languages. By doing this, customers will have more confidence in e-commerce platforms.

Conclusion

The future of automotive aftermarket e-commerce is very promising and all the channel partners, be it the parts manufacturer, the distributor, or end customer (Workshops/Garages/DIY and DIFM customers), have already started working toward it by engaging with the current e-commerce platforms. By addressing the key challenges such as a shift from credit to cash mentality, integration of a large number of workshops with e-commerce platform, lead time, and unavailability of a multilingual platform, the participation of all channel partners would increase and thus, boost the growth of overall automotive aftermarket e-commerce market.

Note: Mradula Sharma is Senior Consultant, Mobility Practice, Frost & Sullivan.

(DISCLAIMER: The views expressed are solely of the author and ETAuto.com does not necessarily subscribe to it. ETAuto.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.)