As the Covid-19 lockdown-2 is petering out and a third wave is gathering strength, CRISIL Ratings has recast the growth projections for two-wheelers in 2021-22 by almost half, to 10%-12%. (Ref. ETAuto July 17, 2021). This comes immediately after a sales graph surge in June following a huge dip in May due to the lockdown.

I shall hold up two specific charts here from the report and one quotation as they have a bearing on what I deliberate on today –the way forward for the ‘scooter’ in India.

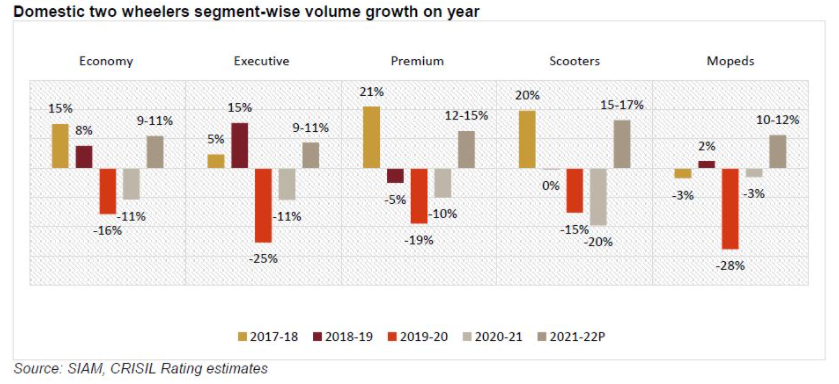

The projections show a high growth rate for scooters this year, though on a base that has significantly eroded over the past two years.

CRISIL Ratings says, “The scooters segment is expected to stage a good recovery this fiscal, registering volume growth of 15%-17%, albeit on a relatively low base, supported by faster recovery in urban incomes, continuing preference for personal mobility, and the graded opening up of offices and educational institutes, as vaccination drive gathers pace.”

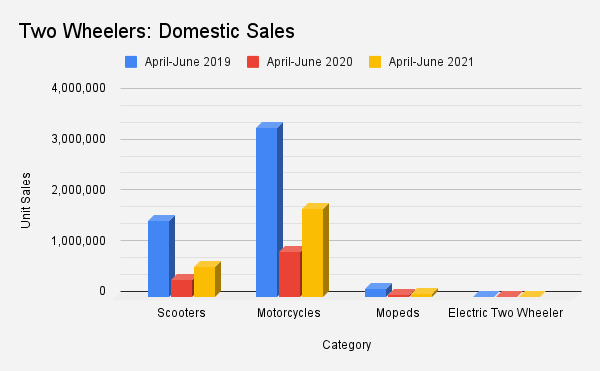

I juxtapose the above with the data chart below, to understand the task ahead for scooters as a category in the projected recovery of two-wheeler sales this fiscal.

The CRISIL report is perfectly timed for this story which I have been working on for over ten days. It all started with a casual chat with a friend who bought his son a new motorcycle as he is entering college. Why not a scooter, I asked. His son did not want a scooter as it was boring! What about his friends, I probed. Seems quite a few thought the same, irrespective of whether they were boys or girls. This was quite different from what I had heard directly from college students when I researched them four years ago in cities like Pune, Bengaluru, and Chandigarh.

So, I decided to do three things to dig out some clear insights, if there were any. [1] I chatted with twenty-seven youngsters, from college students to first-time employees to a few micro entrepreneurs. [2] I reached out to some automotive experts who have been associated with the two-wheeler industry in one way or another. And [3] I studied relevant data from SIAM and FADA to find empirical evidence to back the insights.

The core inference I draw from what I heard, learnt, and analysed is that the scooter as a product needs a complete makeover if it is to maintain its relevance in the years to come. In its present form of offering, it is inadequate and under-prepared to cater to the new generation customer, commonly called ‘Gen-Z’.

One needs to study the way the category has been performing to realise that it does not stand on steady ground despite big names like Honda, Hero, TVS and Suzuki playing in it.

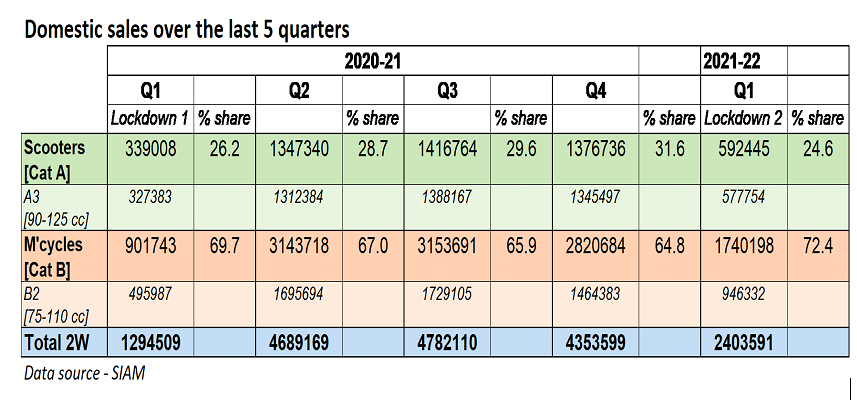

Except for Q4 of 2020-21, scooters as a category have never breached the 30% share in total two-wheeler sales. This is worrisome as it is a typical symbol of urbanisation and should have a higher share with urban India having roughly 35% of the country’s population and growing at 4% over the last decade. In fact from a high share of 31.6% in the last quarter of 2020-21, the first quarter of 2021-22 has seen its share drop to 24.6%!

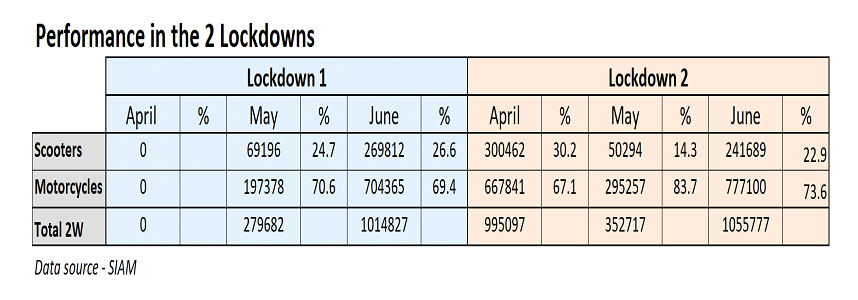

Let us have a closer look at how it performed over the two Covid lockdowns that we have endured.

A careful study of the numbers exhibits the strength of the scooter as well as exposes its weakness. Starting 2020-21 with a share of 24.7% in May [April was “0” for the entire industry], as urban India rebounded over the next few months, its share in total two-wheeler sales kept growing, maintaining momentum right up to April 2021. As Wave 2 and Lockdown 2 hit urban India, its share plummeted to 14.3%. With the gradual opening up in June the share went up to 23%!

Its clear alignment with the urban customer is both its opportunity as well as chink in the armour!

Prashanth Doreswamy, Country Head – Continental India, and MD of Continental Automotive, explains, “Scooter sales have taken the biggest hit in the pandemic mainly due to the urban buying pattern and the impact of lock down. Universities / educational institutes / IT offices are closed for longer duration and usually girls / female employees were buying scooters at a relatively large percentage. The first time buyers have postponed their decision due to ‘WFH’ and a big population of employees are in their hometowns. This has temporarily slowed down the urban buying.”

Celebrated product and UX designer and founder of IndiDesign, Sudhir Sharma, gives an insight. “I think sales have been down because of the genderization of the scooter. Most schools are still not open; women have had to be confined to the home and are also considered second earners, so their priorities take a back seat. Scooter is still considered a vehicle for women (sales-wise).”

India’s 2-wheeler industry structure is oligopolistic. It is more so for scooters, with Honda (which produces every second scooter in the country), and Hero being the only large playersVinay Piparsania, Ex-MD of Ford India and currently CEO of IIT Delhi EMF

Ex-MD of Ford India and currently CEO of IIT Delhi Endowment Management Foundation, Vinay Piparsania, adds another perspective when he says, “India’s 2-wheeler industry structure is oligopolistic. It is more so for scooters, with Honda (which produces every second scooter in the country), and Hero being the only large players. With their manufacturing having been disrupted, or possibly being restructured for a post-Covid scenario, overall scooter availability has been hit. Sales numbers in India are a wholesale number – from the factory to dealers, so it’s the shipments and supply that are down. To get a real picture we need to understand backorders and retails.”

When asked why the share of scooters is gradually sliding, one of India’s most celebrated automotive chroniclers and uber-expert on two-wheelers, Adil Jal Darukhanawala, brings a key insight, “The first aspect is that scooters have a long shelf life with customers. In most cases, a scooter is the only vehicle in the family and it is used with utmost care. With not so much happening in everyday life, as was the case 18-20 months ago, this section of Indians who are frugal want to keep that frugality ethos intact. And one of the visible aspects of this ethos is reflected in not many scooter sales.”

In parallel, my chats with the youngsters gave me a clearer picture of what makes the scooter tick, or why is it ticked off!

What works for the scooter?

- It is nimble and very easy to operate, especially in the lanes and by-lanes of our cities.

- It is flexible in use in the sense that any family member can use it, right from the grand parent to the visiting relative – in fact, this is an oft seen phenomenon with the scooter in smaller cities and towns.

- It is capable of multiple roles, from taking one to office to dropping one off at the bus depot and returning home via the sweet shop.

- It is frugal in terms of both running and maintenance costs.

And what does not work?

- Its biggest strength, the flexibility of usage, makes it merely functional with little ‘aspiration’ attached to its purchase; one respondent nicely put it, “I love my scooter as much as I love my washing machine and microwave oven…I cannot do without any…”

- It is seen as a stepping-stone to something better or bigger, either a motorcycle or a car.

- Being frugal also makes it fragile in terms of dents and damages.

- The nimbleness of the 12-inch wheels also constrains it when it comes to operating on any kind of terrain.

- There are too few scooters to choose from; motorcycles offer a much wider range.

- It carries a resale value much lower than a motorcycle considering its sticker price.

- Finally, it is not ‘masculine’ enough; the motorcycle, with the engine throbbing under you and fuel tank between the thighs is, in Freud’s terms, a phallic symbol and experience which a scooter clearly cannot replicate; this feedback came equally from boys and girls.

Given his decade-long experience with two-wheeled machines, Adil asserts, “One has to always realise that dynamically the scooter can’t match a motorcycle and so it will never be able to deliver the joys of motorcycling as the performance-minded strive to get. The motorcycle cannot also do the task of being a unisex-friendly machine for the masses.”

So, a scooter is a left-brain purchase, led by mostly functional and rational reasons. Factors like reliability and cost of ownership score much higher than styling and appeal. This could be the reason why the Yamaha Fascino and the Vespa could never build traction in the Indian market.

One does not typically buy a scooter to show off. And if one is reminded of the days when our fathers cleaned their Bajaj Chetaks, it was to justify the patience of the waiting period and not necessarily the pride of ownership [just like the black Bakelite MTNL telephone].

Is the fascination with the scooter wearing off the urban Indian?

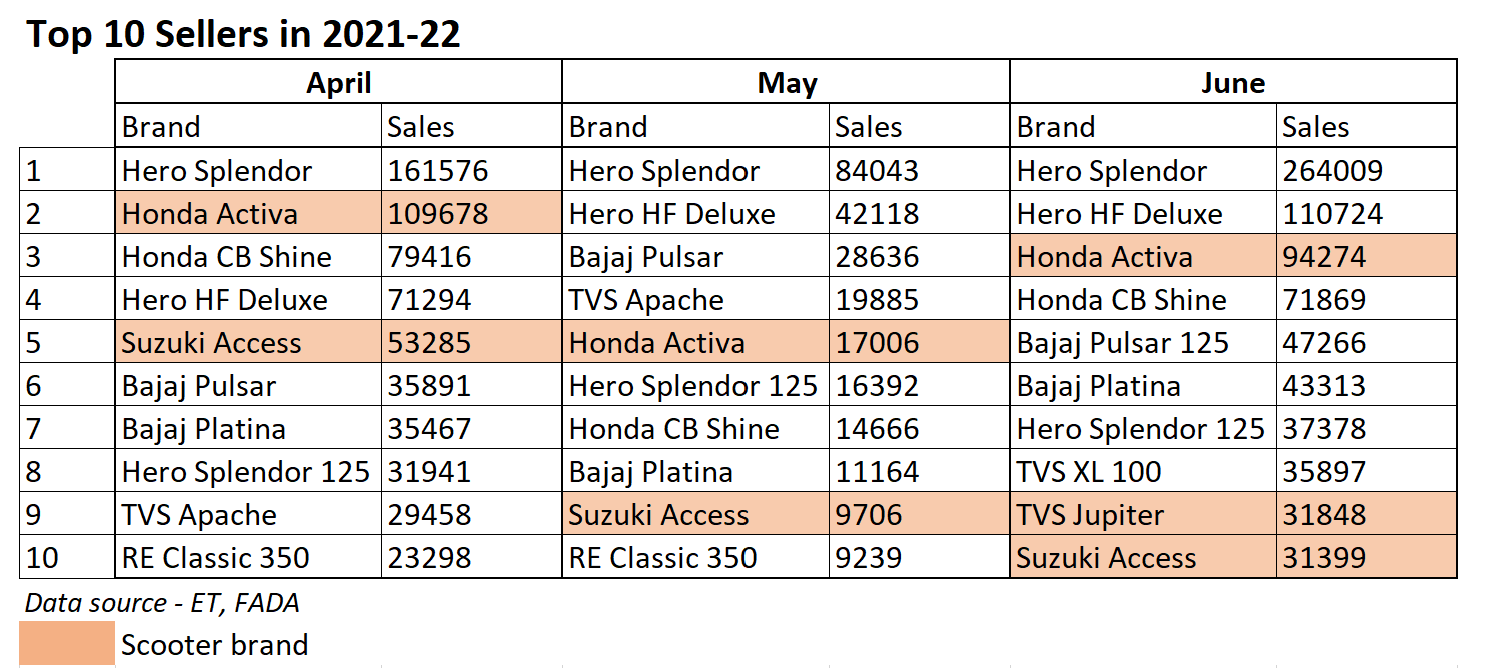

Is the future tribe of rationalists a gradually declining one? Let us look at some numbers again, this time of the top 10 brands sold in Q1 2021-22.

The scooter brands offered are highlighted in the data chart above. The Honda Activa is the only one in the top 3 most months, except for May 2021 when it slipped to the fifth position. Apart from the Activa, there are only a couple more that feature in the top 10 from time to time.

The Activa too has decided to play a distant second to the likes of Splendor whom it had beaten a few months in 2018 and 2019. It is as if it has given up the fierce battle for the top slot. Other offerings like Pleasure and Jupiter are ‘mundane’ offerings. Brands like Cliq, NTorq and Wegodid break moulds but needed more conviction of the badges in creating more ‘pull’.

The scooter as a product offering needs fresh thinking in terms of application and appeal if it is to control this gradual erosion and turn its fortunes for the decade ahead.

Prashanth shares his building blocks when he says, “The future scooter would be electric, connected and user-friendly. The latest offerings from Ather / Ola accelerate lots of new technology. Since the selling strategy would be to impress on the consumer the new tech is inevitable. When the market is switching to electric / connected and last mile connectivity, India could play a leading role. The content / value offering will be much more than the current scenario.”

Manufacturers need to be more adventurous and look at more modular designs, making it relevant to the functionality stack of a growing economy. Potential is of course there… but our manufacturers are too used to making profits by volumesSudhir Sharma, product and UX designer and founder of IndiDesign

The product designer in Sudhir comes to the fore when he states, “There should be disruptions, but I don’t think any organized large OEM is shaking or working on shaking anything. The newer brands have too little trust and are asking for larger costs. I really don’t see this working. It needs to go the other way… utility / cheaper way. Electric looks natural on a scooter. Because of its uses and sizes, new connected tech will also work better on scooters. Scooters do give more options for industrial design as well. Manufacturers need to be more adventurous and look at more modular designs, making it relevant to the functionality stack of a growing economy. Potential is of course there… but our manufacturers are too used to making profits by volumes!”

Vinay puts on his business hat and opines, “India can aspire to be the supplier to the world. But will need to scale up and improve quality, the overall designing, battery chemistry, conforming to international standards of safety, voltage, and frequencies. OEMs should design and scale-up scooter manufacturing primarily targeted at exports, and provide the same consistent standards to Indian consumers, even if it means over-designing.”

Adil is convinced that, “Scooters will remain an urban application for 99% of the time and here with the shift to electro-mobility they lend themselves to this more than a motorcycle or such. The new age battery protocols determining the standardised sizes and power density of batteries are being shared around; every OEM in this space will create a new eco-system that will transcend the existing fossil fuel one. Scooters are the best placed and packaged to benefit from this. New areas for innovation are being configured for utilities and service providers. But by and large it will be a necessity to be the mother of invention, and innovation if I may add.”

There is a lot happening around us but very little in India. The electric offerings by Ather, Ampere, Hero and now Ola are still based on the old-world way of conceptualising the very product. They incorporate bells and whistles but all that is built around a core shape created in a conventional manner. We are still very “boxed-in”!

1.Left + Right brain approach

This is the first fundamental shift in mindset of the scooter being not just functional but also drool-worthy without burning your pocket in a post-pandemic world. You are going to cater to the Gen-Z customer, so better get into the act right now of reading his / her mind better when it comes to issues like styling, functionality, and sustainability.

2.Look beyond 12” wheels

Why do you not look beyond 12-inch wheels? It is a self-imposed constraint. I am sure the wheel size can go up to 13” or 14” to add that bit of multi-terrain capability to the conventional city vehicle. It need not ape a motorcycle or a moped but certainly can add to its role.

3.Expand user-base into rentals

The two-wheeler rental market is projected by analysts like Markets & Markets to grow at a CAGR of 18.9% to USD 10 billion by 2027. This is a segment yet to happen in India. We too need our versions of Lime, Jump, Ofo or Grow. The scooter is best poised to both create and lead this new urban user segment. This will allow people to experience it across metros, cities and towns as the ‘cool’ mode of moving around without having to own one!

4.E-commerce application

Sudhir talked about modularity, and I fully endorse this suggestion. Just like modular micro CVs have taken over a large part of last mile commercial applications, so can the scooter. Its basic structural design lends itself to the same. Just take a look at the Honda concept scooter picture I have shared and you can imagine multiple attachments as per application, weather, time of day / night and terrain. All two-wheelers available in India are the traditional 2-seater ones. Designers will have to dump the existing toolbox and create a new one to work with.

5.Lead electrification

All the four experts talked about the scooter being most capable of electrification. The pioneers in Hero, Ampere and Ather have demonstrated the same. I remember a brand called Lectrix from the SAR group that happened way back in 2008, along with Ampere. I vividly remember the Hero electric scooters on display at Auto Expo 2012 in Pragati maidan, New Delhi. The hype generated for the just announced Ola electric scooter also brings good tidings to the segment.

6.Bring in the ‘maxi’ scooter

The image the market has about a product segment is led by the kind of products on offer and the communication around them. In the SIAM classification for two-wheelers, there are 12 sub-segments for motorcycles, right from 90 cc to above 1600 cc. The premium and luxury motorcycles allow a significant image rub-off over all the others. For scooters there are only 5 sub-segments, from below 75 cc up to 200 cc. Nothing above a measly 200 cc! Nothing premium that creates a halo effect around the entire category. This is required to create the ‘appeal’ for a scooter well beyond just functional reasons. Over 80% of sales might still come from the mass sub-segments and applications. But it sure does good to have a Suzuki Burgman650 or a Peugeot Metropolis gliding along to get the eyeballs!

7.Emerging market penetrator

The electric scooter is the best product to make the Indian brand global. The scooter should be exported to all emerging markets right across Central and South America, Africa and South and Southeast Asia. In fact, vehicle penetration in many countries can be improved through the “Made in India” electric scooter. India can surely lead the world in scooters in tomorrow’s world and not just in volumes.

Adil asserts, “I think the resounding answer is YES but for that our OEMs will have to think not just India but globally from the outset when setting out their future EV strategy. Having ridden many electric scooters – make that two-wheeler, over the last 4-5 years globally, I do think that Ather is probably the finest and best example of what a world-beating EV from India should be.” As a man who crossed the Sahara Desert on a Kinetic Honda gearless scooter decades ago, he should know more than most of us.

I rest my case here!

(The author is co-creator of Expereal India. Also, he is former head of marketing, product planning and PR at Volkswagen India.)

DISCLAIMER: The views expressed are solely of the author and ETAuto.com does not necessarily subscribe to it. ETAuto.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.)