By Saket Mehra

The game is changing for the Indian auto industry. Original Equipment Manufacturers (OEMs) and dealers are exploring new business models and reinventing strategies to stay relevant in the market. New alternatives of vehicle ownership, such as vehicle subscription and leasing are taking hold.

In India, traditionally driven by corporate fleet management, the penetration of the new models is only less than 1%. However, these models are being seen as a viable solution in the pandemic scenario, where purchasing a vehicle may not be feasible and crowded public transportation is deemed unsafe. These drive the switch from ‘ownership’ to ‘usership’.

From ‘owning’ to ‘experiencing’

A vehicle subscription is a service in which the customer pays a monthly charge in return for the use of one or more vehicles and is based on the concept of temporary ownership. There are currently three types of players in India’s vehicle subscription market: traditional leasing firms like Avis, Orix, and Myles; mobility companies such as Revv and Zoomcar; and major OEMs such as Maruti Suzuki, Mahindra, Hyundai, Tata Motors, Volkswagen, Toyota, and MG Motor. OEMs offer vehicle leasing and long-term vehicle subscriptions through partnerships with mobility service providers (MSPs) or tie-ups with third parties.

| Segment | Average Total cost of ownership (in figures) | Average Total cost of experience (in figures)/per annum | Variation (in figures) | So, which is a better choice? (Owning or subscription ) |

| Luxury | 4,140,000 | 7,729,396 | (3,589,396) | Owning |

| Small mid-size | 639,051 | 167,508 | 471,543 | Subscription |

Other Subscription offerings:

| Maruti | Expanded its subscription-based model to larger number of cities and have plans to reach all Indian states over the next few years. |

| Mahindra & Mahindra | In October-December 2020, M&M sold more vehicles through the subscription-based model than it did in the entire FY 2020. |

| Revv | The model accounts for 50% of Revv’s business with 8000 subscribers (75% obtained at times of nationwide lockdown) |

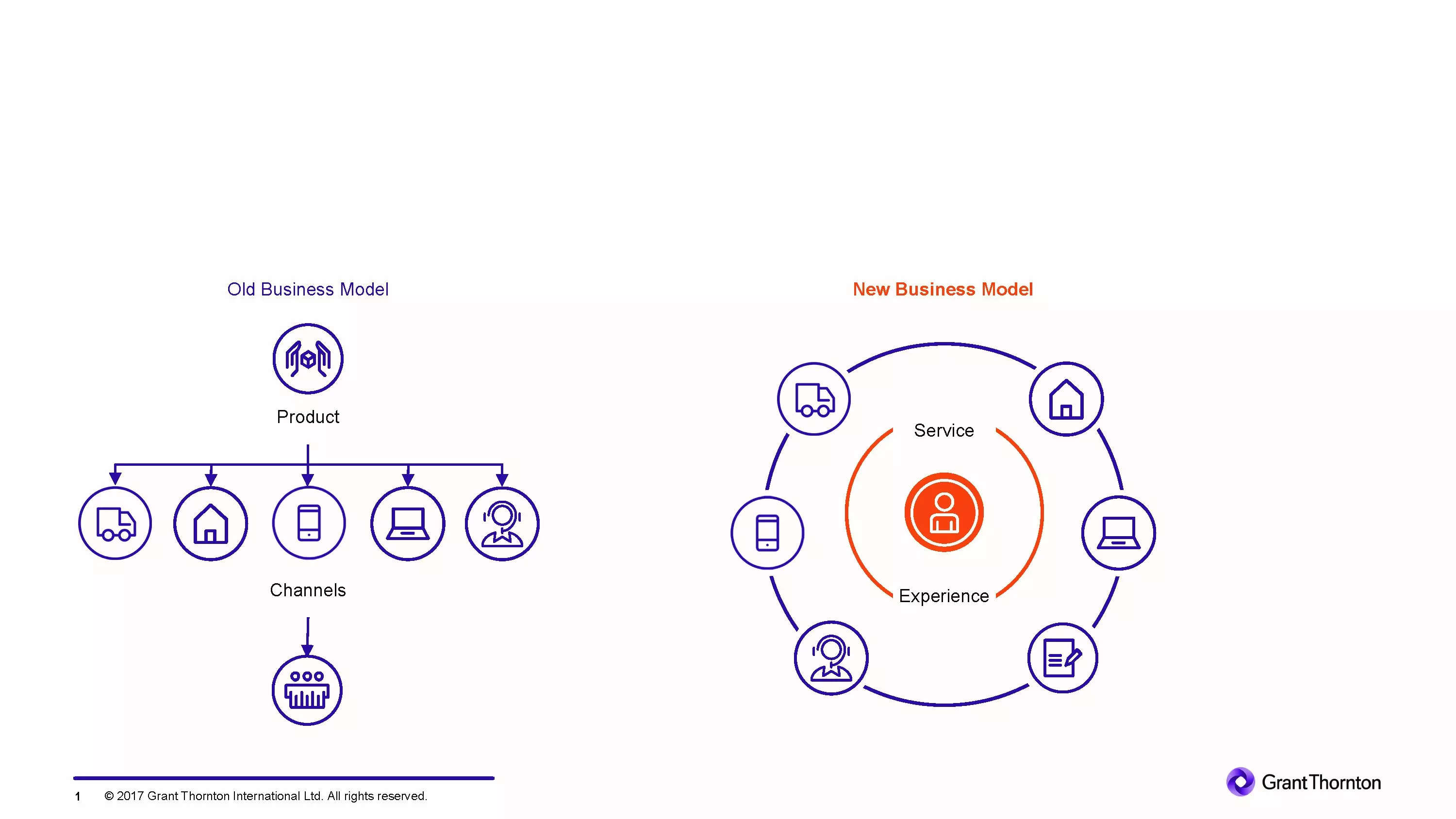

Old vs New: The switch to subscription model for OEMs and dealerships

Global perspective

In existence for over a decade, the global car subscription industry generated USD 3.55 billion in 2019 and is expected to generate USD 12.09 billion by 2027, with a CAGR of 23.1% from 2020 to 2027, according to the Global Opportunity Analysis and Industry Forecast report.

The key players operating in the global vehicle subscription market include Fair Financial Corp, Clutch Technology, CarNext, FlexDrive, Cluno GmbH, DriveMyCar Rentals Pty Ltd.

Asia-Pacific leads the vehicle subscription market because of the rise in population, rapid urbanisation and industrialisation and development in living standards of the people. The region is projected to grow at the highest rate of 27.1% between 2020 and 2027, while Europe is expected to account for more than 20% of the automotive subscription services market by 2026 due to the growing popularity of flexible mobility services in the region.

Changing consumer dynamics

Traditionally in India owning a personal vehicle brought with it a sense of pride and accomplishment. But the subscription model provides ease and flexibility, which is increasingly attractive to many customer segments. From young professionals looking to avoid large outflows and long-term financial commitments, to senior citizens who want to avoid the hassles of automotive ownership, such as maintenance and insurance, prefer the new model.

A 2020 survey conducted by Grant Thornton in India, in partnership with Society of Indian Automobile Manufacturers (SIAM), found that 15% of respondents chose subscription model as a preferred mode of owning vehicles and 66% favoured pay-as-you-go (PAYG) options. The survey indicated that service-based models, including lease rentals, could see an uptake from Indian consumers.

Customers are becoming more aware of the innovative models offered by the industry and with smartphone connectivity, consumers have embraced digital and online sales channels with open arms. Technology is playing a key role in fuelling the growth of subscription model and in the future subscription services may be as simple as picking a model online, selecting a plan, and then heading to the dealership to pick up the vehicle, without the need for loans, negotiations, registration, or insurance.

The number of enquiries for vehicles under the subscription-based model is rising drastically, indicating increased demand for this mobility option both for OEMs and dealers. However, to scale up the vehicle subscription model and make it sustainable, an integrated ecosystem needs to be created. OEMs and dealerships must come together with both banks and insurance companies to make vehicle subscription a viable model. In India, where about 85% of vehicles are financed, a unique business model such as vehicle subscription has significant potential.

| OEM offering Vehicle Subscription services in market | OEM Tie up with Vehicle Subscription Brand | Vehicle Subscription Price/INR month | Vehicle Financing Price/INR month | Down Payment – INR | So which is a better choice? (Owning or subscription ) |

| Maruti – Swift | Orix Automation | 13,959 | 12,162 | 64,000 | Subscription – (As it does not include payment of any prior down payment) |

| Hyundai – Santro | Revv | 20,099 | 10,083 | 53,000 | |

| Mahindra – Scorpio | Revv | 34,699 | 28,907 | 1,52,000 | |

| MG motors – ZS EV | Zoomcar and Orix Automation | 49,999 | 41,916 | 2,20,000 | |

| Toyota – Glanza – G – MT | Myles | 23,322 | 15,746 | 83,000 | |

| Ford – Ecosport | Zoomcar | 21,499 | 21,830 | 1,64,000 | |

| Merc – CLA 200 Sport | – | 98,000 | 68,028 | 3,60,000 | |

| BMW – 3 series sports 320d | – | 60,783 | 96,510 | 5,07,000 |

As an innovative business model, subscribing to a vehicle could be a smarter choice than vehicle purchasing for customers who do not feel like locking their finances for close to five years. So, vehicle subscription is one such model which is certainly a trend whose time has come.

(Disclaimer: The author is Partner and Auto Sector Leader at Grant Thornton Bharat. Views expressed are personal.)