The automotive OEMs are looking at more frequent model changes, facelifts and introduction of more variants and trims to meet the ever-evolving consumer demand for novelty and variety in vehicle choices, and the stiff competition from the incumbents and the new entrants in the market.

The platform-based product development partially facilitates the need for introducing variety in model offerings. However, as the consumer demands evolve, there is an increasing need for a modular product development approach to increase the speed of customisation in product offerings in a short span of time. The added advantages of scale with use of modular architectures are further catalysing this shift.

Modularity is defined as the degree to which a system is made of independent but interlocking parts. Modularity is a concept engaged in a wide range of applications where there are complex and interconnecting systems. However, a modular system is different from an integral system.

A modular system is made up of independent part clusters called modules and these modules are connected using standard interfaces. But an integral system is made up of independent parts linked together. In the automobile industry, modularity was introduced with the idea of catering to the maximum number of customer solutions while gaining maximum synergies across both the product lines and the product variants.

Various facets of modularity

This highly useful concept of modularity is not just limited to design of products; it fits well in production as well as inter-firm systems. In production, the main production lines are divided into sub-lines that can be interconnected to create multiple line variants possible. It helps in using the same set of sub-lines to produce a variety of products while keeping the material movement in check through cohesive modules.

Similarly, modularity finds its applications in inter-firm systems where the sub-lines can be made modular and moved outside the firm to take advantage of lower cost by suppliers or to gain from their specialised expertise.

The transition from an integral to modular architecture requires enablers in the form of modifications in organization structure and processes. A well-defined rule set allows the organization to keep control over the changes made in the modules as it will affect the entire product family.

Tools like standardized templates for analysing inter-component interaction and design flow analysis, IT systems and clearly defined processes enable structured flow of information. An effective inter-plant information network also needs to be established so that learnings from one plant are passed on to other plants of the organization.

From the platform based to modular production

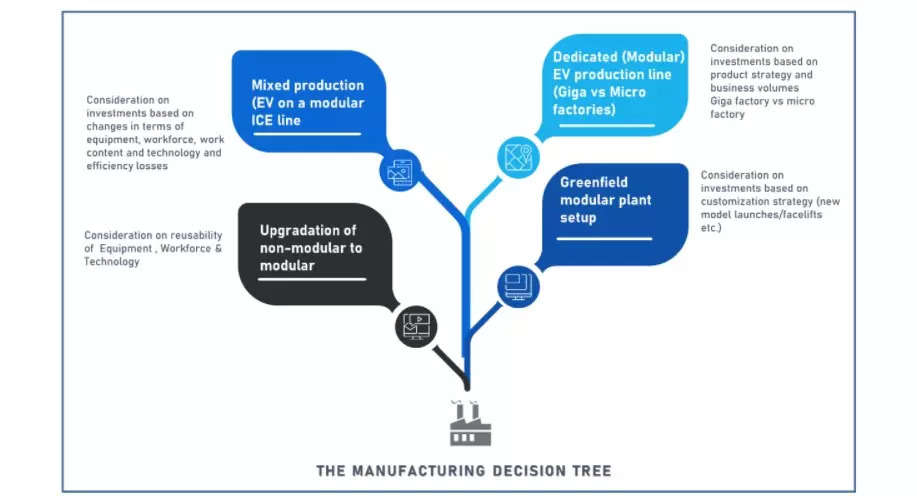

The decision to embrace modularity in the production environment by an OEM comes with a host of aspects to be considered. One of the most critical aspects is the decision to invest in a greenfield modular production facility or upgrade the existing production setup to a modular one. The business case around the decision would hinge on aspects like reusability of the existing equipment and infrastructure, workforce efficiency and re-skilling considerations, and technology upgradation among many others.

Equipment: When looking for upgradation, most of the infrastructure/equipment like the presses in the press shop or the overhead cranes in the BIW/weld shops and ~90% equipment of the paint shop can be reused. However, significant investments would go for changing the moulds/dies and tools in the Press Shop. Also, the BIW, Powertrain assembly and Final Assembly(TCF) lines will undergo significant changes with regards to the floor design, car mounting fixtures and programming of robots.

Workforce: The work content doesn’t change significantly when upgrading from a non-modular production setup to a modular one. However, there may be some efficiency losses in handling of new jigs, fixtures, tools, dies and programming of equipment

Technology: While there may not be significant changes required in technology from upgrading from a non-modular production setup to a modular one, the major investment areas would be installation of new hangers, trolleys and rolling kits in the paint shop and higher degree of automation and robots across all the shops.

Our estimates suggest that the upgradation of a non-modular plant to suit modular production would need an investment to the tune of USD 500 million while setting up a new modular plant would be significantly higher than this.

From a modular to dedicated xEV line

While the OEMs seemed busy solving the puzzle of shift from a non-modular to modular production setup, the world view outside keeps changing. The dominant megatrend of xEV and the uncertainty around business volumes introduce another complexity in the already complex puzzle. The OEMs now have to decide whether to invest in a dedicated (modular) EV production facility. The complexities with producing an EV involve changes with respect to the Make vs Buy decisions (decisions to outsource or keep the manufacturing of some of the EV specific components like battery, traction and power electronics units).

The decision to Make vs. Buy for the OEMs will depend on the strategic direction the OEMs want to take. Each have their own pros and cons, but we are likely to see more involvement of the OEMs in the battery & power electronics technology to maintain the strategic advantage that they had for the ICE components.

The decision to outsource or manufacture will influence the work content of the OEMs significantly. Also, capability planning with regards to special skills like high voltage handling vs the reduced work content on account of reduced number of moving parts will have to be factored in.

There are two strategic options for the OEMs to work on – to invest in a dedicated EV production facility (e.g. the Anting MEB plant by VW) or continue to produce EVs in a line meant for ICE vehicle production. Since the global xEV adoption is currently low, the volumes to justify the business case for a dedicated (modular) line setup might become a key constraint. However the mixed production model also brings in certain inefficiencies and significant changes in the existing setup especially in the powertrain and final assembly lines.

The final choice that an OEM makes will ultimately hinge on its xEV strategy and the investments needed. It is, however, important to thoroughly assess the pros and cons related to both the options before deciding to commit to one of them.

Strategic Option 1-Dedicated (modular) xEV line: This option suits the OEMs who have a future focus on EVs as part of their product strategies. As per estimates, the threshold volume for deciding to invest in a dedicated xEV set up is 50-100K vehicles/annum. However, this will also depend on the projected volume growth for EV production. If the volumes are relatively flat and hovering around 50K/annum for the next few years, it is prudent to produce on an ICE line with some modifications and upgradations to adjust to EV production. Our estimates suggest that setting up a new dedicated line for EV will require investments to the tune of USD 2 billion to 2.5 billion.

Another sub-option which can be considered is the micro factories, as opposed to the “giga-factories” like that of Tesla, propagated by a UK- based EV startup called Arrival. The concept harps on a distributed production network, with small, low-cost micro factories scaled to supply either 1,000 buses or 10,000 delivery vans annually to customers nearby. Unlike the traditional auto-assembly plants with high upfront costs and time, the micro factories cost significantly less (~ USD 50 million) and can be ready to start production in a few months.

The concept offers a lot of promise for companies that are not very committed to the EV bandwagon and would like to follow a “Wait and watch” strategy. However, the criticism about the concept lies around its inability to create jobs on a massive scale (~ 200 jobs per 200,000 sq feet) and hence hitting roadblocks in terms of policy incentives across countries. Also, with the recent supply chain disruptions, the complexity of fulfillment of and from these micro factories to the demand points remains a major point to consider.

Strategic Option 2-Mixed production: In terms of the changes required to adjust the existing ICE line to produce EVs, major investment areas are the battery and the electric motor area. The lines and equipment used are the same with additional stations mainly for battery and traction unit assembly and dropping in the final assembly line. For the powertrain assembly shop, significant amount of change will be needed as most of the existing equipment will not be suitable for electric motor production and new equipment e.g. for power electronics assembly will be needed. There is also a need for re-skilling and training for handling new manufacturing processes like winding.

For the battery, the incumbent powertrain workforce can’t be directly shifted to battery manufacturing and would need significant re-skilling to handle High Voltage components. When production is done on the same line (mixed production), there will be variations in assembly time as ICE vehicles require the same assembly time, however for EV, non-matching parts are taken out of the line and pre-assembled leading to the variations. Inefficiencies also arise due to limited knowledge of operators in assembly line with regards to fine-tuning operations in paint and body shops. As a result, there are more chances of defects in products at the start of mixed production during manufacturing and also during procurement as suppliers might take time to provide plants with the required quality of materials.

Conclusion

With the ever-evolving external environment on account on changing consumer needs, evolving technology and powertrain options, the manufacturing strategy and decision making is bound to become extremely complex. It, therefore, is vital to conduct a thorough assessment of one’s manufacturing strategy keeping in mind the production volume, product strategy and investment considerations as well as the scenarios that may play out for each of these factors.

Disclaimer: Ashim Sharma is Partner and Group Head at NRI Consulting & Solutions India. Aashutosh Sinha, Senior Manager, and Kalyani More Senior Consultant, contributed to the study. Views are personal.