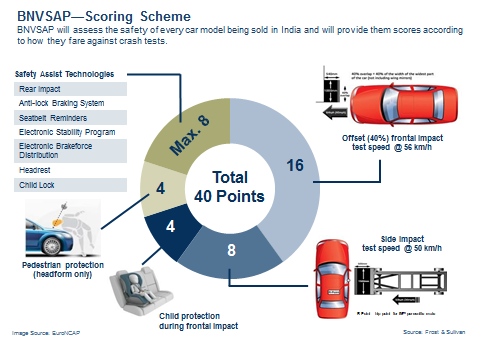

The Bharat New Vehicle Safety Assessment Programme (BNVSAP) will change the Indian automotive market dynamics by mandating time-bound passive and active safety systems in new and existing vehicles.

Passive safety systems: From July 2019, driver-side airbags have been a standard fitment in vehicles sold in India, with front passenger airbags mandated for all new models from April 2021 and from September 2021 for all existing models. Prior to this mandate, airbags were offered mainly on medium and high-end variants and targeted consumers willing to pay a premium for safety features.

Driver and co-driver seatbelt reminder alarms are mandatory and need to be active until the driver and the front passenger are belted.

Since 2019, speed warning systems have been required for every new vehicle. BNVSAP mandates speed alerts at two levels: above 80 kmph and above 120 kmph. According to new stipulations, the system cannot be overridden or turned off.

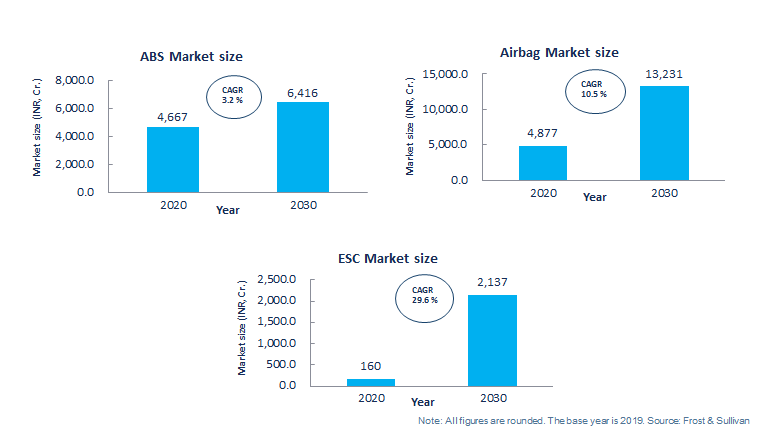

Active safety systems: Although an anti-lock braking system (ABS) is a critical safety function, it has been mandated for all new vehicles sold only after April 2018. Since April 2019, the mandate has been extended to all models offered by OEMs in the Indian market.

Rear parking sensors have been a requirement for vehicles manufactured since 2019.

Regulation to energize passive safety systems

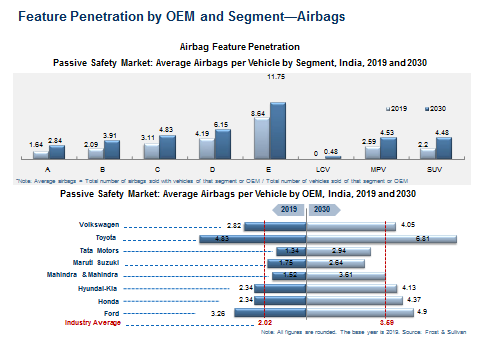

Growth in airbag unit sales will be driven by BNVSAP-mandated fitments of both driver and passenger airbags and by safety-conscious consumers. Currently, some OEMs are offering up to eight airbags in their vehicles. For instance, Skoda’s Superb comes equipped with eight airbags, and the previous version of the Skoda Kodiaq had nine.

The top-end variants of several models now come with six airbags.

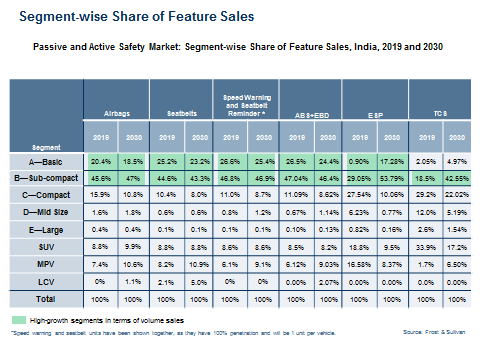

Frost & Sullivan projects the airbag segment to register a compound annual growth rate (CAGR) of 11.9% to expand from 7.9 million to 27.5 million units during 2019-2030.

In India, long-standing regulations mandating the use of seatbelts for drivers and co-drivers have been undermined by poor enforcement and the general lack of driving self-discipline. Nevertheless, Frost & Sullivan expects this product segment to grow at a CAGR of 6.3% over 2019-2030 to reach an estimated 38.3 million units.

Both seatbelt reminder and speed warning functions are the newly mandated additions from 2019. Our research reveals that deployments of seatbelt reminders and speed warning features will collectively increase from 3.9 million units to 7.6 million units over 2019-2030.

Changes in active safety systems

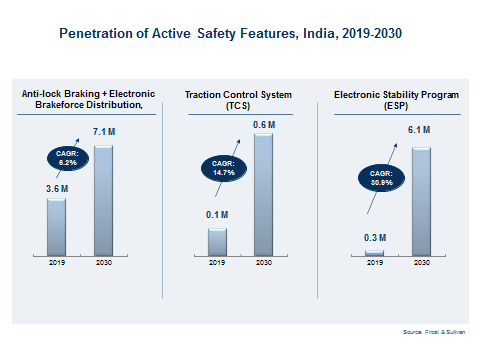

In India, active safety features have been offered in mid-to higher-end trims. However, with new mandates, this is likely to change. Electronic Stability Programme will lead the change in active safety systems

ABS and electronic brakeforce distribution (EBD) are projected to expand from 3.6 million units to 7.1 million units. We expect A, B, and MPV segments to be the highest growing in terms of sales volumes.

Traction control systems (TCS) remain an optional feature, offered as a voluntary fitment and mainly available in higher trims. Frost & Sullivan

estimates a robust CAGR of 14.7% over 2019-2030 for TCS. As the focus on safety percolates to A and B segments, the B segment is likely to account for a majority of the sales by 2030.

Similar to TCS, electronic stability programmes (ESP) are currently offered as an optional feature. After 2025, most OEMs producing passenger vehicles will begin offering the feature as a voluntary fitment, catalyzing a CAGR of 30.9% during 2019-2030.

BNVSAP mandate for rear parking sensors for vehicles manufactured from 2019 will result in a Level 0 autonomy standard for the Indian passenger vehicle market.

Consumer expectations

OEMs acknowledge that voluntarily offering safety features will ensure enhanced safety for vehicle occupants, mitigate accident rates, and allow for higher BNVSAP ratings. OEMs such as M&M and MG are going the extra mile by offering advanced driver assistance systems (ADAS) features such as adaptive cruise control (ACC), automatic emergency braking (AEB), lane-keeping assist (LKA) and traffic jam assist (TJA).

The leading global Tier 1 and Tier 2 suppliers active in the Indian automotive market are spurring the deployment of innovative safety features. They are partnering with OEMs to develop cost-effective ADAS specifically targeting the price-sensitive Indian consumer. Many OEMs, such as Hyundai, are plnning camera-based ADAS offerings.

OEMs to deploy safety features to comply with BNVSAP standards

In terms of the long-term prospects of the product segments, Frost & Sullivan forecast airbags, ABS, and electronic stability control (ESC) revenues to be worth INR 13,231 crores, INR 6,416 crores, and INR 2,137 crores, respectively, by 2030.

The vehicle segments where safety features will see the strongest growth are the A and B segments, which have traditionally dominated automotive sales in India. The B segment, in particular, will account for the highest deployments because it represents the highest share of sales in India’s automotive market and offers only limited safety features due to price sensitivity.

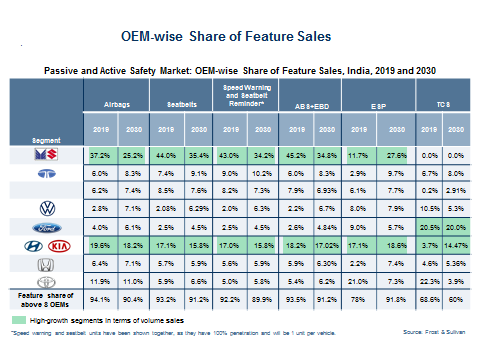

The front runners in the race to implement safety features: Frost & Sullivan research indicates that Maruti Suzuki and Hyundai-Kia are likely to take the overall lead in terms of absolute volume growth of mandated safety features. This will be a direct consequence of their high vehicle market share. However, as competition intensifies, other OEMs will make gains. In fact, OEMs such as Toyota, Ford, and Volkswagen already exhibit a higher penetration of safety features in their line-up.

OEMs will Leverage safety features as a competitive differentiator

Maruti Suzuki’s range of voluntary safety offerings will be limited as it primarily caters to the price-sensitive A and B segments. Although Hyundai Kia caters mainly to A, B, and C segments, its feature-loaded vehicles will act as competitive differentiators.

Apart from the mandated basic safety features, the high growth rate of ESP offerings in Tata Motors’ vehicles will highlight the company’s focus on safety as a value proposition. We expect higher offerings of TCS and ESP from Mahindra & Mahindra as its portfolio mainly comprises vehicles in the SUV segment.

Honda’s mid-to-high-end vehicle offerings will showcase the higher penetration of safety features since its customers are willing to bear the add-on costs. Toyota caters to a similar customer demographic, with 42% of its sales coming from MPV (Innova) and S segments (Fortuner). New launches in the B segment will reduce the overall deployments of TCS across Toyota vehicles in the next 10 years.

In spite of low market share, Ford’s vehicles exhibit a higher penetration of safety features. For instance, they come with 3.2 airbags on average, with 29% of vehicles sold in 2019 equipped with ESP. Volkswagen’s vehicles have a higher penetration of safety features than many other OEM groups, with an average of 2.8 airbags per vehicle and 31% of its vehicles sold in 2019 equipped with ESP.

The challenges

Cost, enforcement, and infrastructure are the challenges that persist. Vehicle economics, particularly in terms of fuel efficiency, are a critical purchase consideration for the Indian consumer. The significant cost addition associated with ADAS might hamper uptake in the mass market vehicle segment.

The emphasis to some extent remains on convenience and comfort, with safety features perceived as “nice-to-have” rather than “must-have.” However, the urban consumers are placing increasing emphasis on safety features and are willing to pay a premium for them.

Ineffective enforcement is a major hurdle. This is likely to restrain OEM and supplier investment plans, ADAS innovation, and market growth.

While BNVSAP promotes the adoption of safety features, the lack of technology readiness and weak road infrastructure will act as a dampener and most likely cause the short-term focus to be limited to parking and warning features.

Strategic recommendations

While emission-related regulations have brought India at par with Europe, Japan and the US, there needs to be a stronger push for safety-related standards. BNVSAP focuses on features such as dual front airbags, ABS with EBD, rigid crash structure, seatbelt warning, seatbelt pretensioners, and force limiter seat belts.

However, regulations need to be much more comprehensive and include AEB, blind spot detection (BSD), lane departure warning (LDW)/LKA, forward collision warning (FCW), and alcohol interlock to improve safety. For example, even though LKA is not currently mandated in the EU, Euro NCAP grants additional points to vehicles that offer this feature. Promisingly, India’s Ministry of Road Transport and Highways (MoRTH) is considering making tyre pressure monitoring systems (TPMS) and ESC mandatory in the country.

Indian OEMs have led the way for safety. Tata and M&M have fared well consistently, with most of their recently-launched models scoring a minimum 4-star NCAP safety rating.

Against this backdrop, it must be noted that the export-spec cars are built to a different standard than India-spec cars. Many export-spec cars have fared well in GNCAP. Several OEMs in India manufacture cars with ADAS features for export markets. This could easily be replicated for the Indian market, with the additional benefit of no significant investments in retooling the assembly line.

ADAS will be an important competitive differentiator and a revenue generator for OEMs in India’s automotive space. To increase penetration rates, OEMs need to devise out-of-the-box customer approaches that encourage feature adoption. This can be done through digital promotions or by allowing customers to test safety functions in a simulated environment before a vehicle purchase.

While vehicle safety is a concern, so is cost. Accordingly, OEMs should offer optional ADAS features that address both safety and price considerations. The key will be for OEMs and suppliers to prioritize the performance-to-cost ratio of safety systems.

Incumbent OEMs need to adjust their operating model and collaborate more closely with non-traditional and tech companies in the value chain. Current and prospective updates to vehicle safety mandates in BNVSAP underline the importance of OEMs partnering with Tier I suppliers like Bosch, Continental, and ZF-TRW to develop cost-effective solutions and drive the deployment of ADAS features.

All trends show that the Indian market is gradually moving toward Level 2 safety features. We expect many more models with camera-based ADAS systems to be launched in the near future, with such systems set for explosive growth from 2025.

(Disclaimer: Kamalesh Mohanarangam is Research Manager, Mobility Practice, Frost & Sullivan. Views expressed are personal)

Also Read: