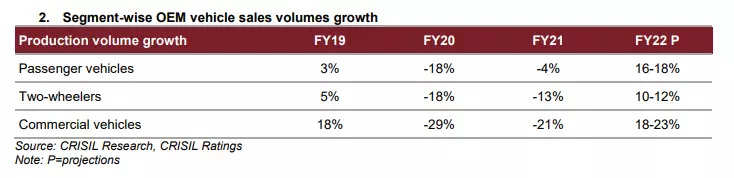

New Delhi: Passenger vehicles (PV) dealers are expected to lead a recovery among all automobile dealers’ sub segments with 20%-22% revenue growth this fiscal to the pre-pandemic revenue levels of 2020, new estimates by Crisil Ratings say.

Comparatively, due to slower recovery, two-wheeler (2W) dealers will take a year or so longer to reach the pre-pandemic sale levels. Revenues for commercial vehicle (CV) dealers will remain below pre-pandemic levels this fiscal despite higher revenue growth due to a low base created by sharp fall in the last two fiscals, the rating agency said.

The pace of recovery could have been swifter, but for the second wave of Covid-19 infections, which led to partial shutdown of dealer showrooms in the first quarter of fiscal 2021.

A study of 191 automobile dealers rated by CRISIL Ratings indicates that their overall revenues may continue to grow at 20% on a low base, supported by 4%-6% price hikes across vehicle segments. Cash flows are expected to recover gradually. Controlled channel inventory and limited increase in debt will lend stability to credit profiles this fiscal.

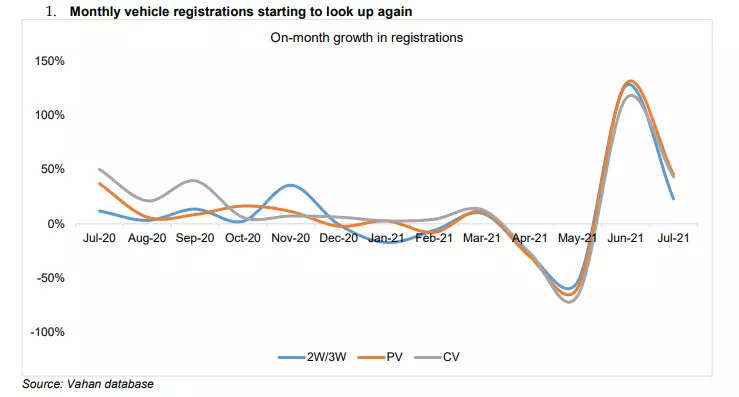

Automotive retail registrations plunged in April and May due to localised lockdowns and temporary dealer showroom closures amid the intense second wave. June saw a sharp recovery, on a low base and with easing of curbs, the recovery continued in July. The restrictions were mostly in Maharashtra, Uttar Pradesh, Tamil Nadu, Karnataka and Rajasthan, which account for 43%-45% of the total automotive retail sales in India.

From mid-June onwards, the reduction in active Covid-19 cases and the increased pace of vaccination will drive recovery in automobile demand this fiscal year.

Anuj Sethi, senior director, CRISIL Ratings, said, “PV dealers seem to be recovering faster than those in other segments, riding on higher pent-up demand and preference for personal mobility, especially in urban and semi-urban areas. Slower demand from the pandemic-hit hinterland, increased spends on health, and price hikes are likely to impact the pace of recovery of the two-wheeler (2Ws) dealers. The PV dealers’ revenues will grow at 20%-22%, well over the 15%-16% of the 2W dealers. CV dealers will see healthy revenue growth of 28%-30% this fiscal on a low base, but will remain below the pre-pandemic levels given the sharp fall in the previous two fiscals.”

Gautam Shahi, director, CRISIL Ratings, said, “Controlled inventory levels at auto dealers’ end due to lower dispatches from OEMs, and recovery in margin will ensure limited increase in short-term debt this fiscal. However, slower demand recovery for 2W and CV dealers to pre-pandemic levels will result in relatively gradual improvement in debt metrics for them compared to the PV dealers. Overall for auto dealers, key debt metrics such as interest coverage and gearing are seen improving to 2.2-2.4 times and 1.4 times in fiscal 2022, compared to 1.9 times and ~1.5 times, respectively, for the last fiscal.”

According to Crisil, the intermittent lockdowns during the first quarter of this fiscal are likely to result in only ~50 basis points recovery in operating profitability to 2.5%-3% this fiscal, which is still below the pre-pandemic level of 3%-4%. This is because service and spare sales (10%-12% of revenues but 25% of operating profits of automotive dealers) are also witnessing muted recovery.

While the business performance was severely dented last fiscal, dealers availed of moratorium and emergency credit facilities offered by banks and support from captive finance arms of original equipment manufacturers (OEMs) as well as OEMs themselves through inventory funding limits and higher credit period, respectively, to tide over liquidity pressures. This year too, similar support is expected to continue for dealers from OEMs or their captive finance arms until sales recover completely, the ratings agency said.

Sustenance of recovery in demand across segments, and normal monsoon will remain monitorables, it added.

Also Read: